Read on to learn more about American Savings Bank promotions, bonuses and offers here.

Currently, they are offering a $250, $500, $750, $1000 bonus when you open a qualifying account and meet all the requirements.

About American Savings Bank Promotions

American Savings Bank is a financial institution created on the foundation of tradition. The mission and vision of the bank is to help their community grow and be more unified. If are interested in a new banking experience, you can see all nationwide bank bonuses for more suitable offers.

I’ll review the offers below.

American Savings Bank $1000 Savings Bonus

American Savings Bank is offering up to a $1000 bonus when you open a new savings account.

- What you’ll get: $250, $500, $750, $1000 bonus

- Account Type: Savings Account

- Availability: HI (Bank Locator)

- Credit Inquiry: Soft Pull or Hard Pull

- ChexSystems: Unknown

- Credit Card Funding: Unknown

- Direct Deposit Requirement: None

- Monthly Fee: $0-$5, can be waived, see below

- Household Limit: Not listed

- Closing Account Fee: Not listed

(Expires 11/15/2023)

| AlumniFi Credit Union Savings (4.75% APY) | SoFi Checking & Savings ($325 Bonus + 3.80% APY) |

| Upgrade Premier Savings (4.15% APY) | Discover® Bank Savings (Up to $200 Bonus + 3.70% APY) |

| CIT Bank Platinum Savings (4.00% APY) | Harborstone Credit Union Money Market (4.30% APY) |

| FVCbank Advantage Direct Savings (4.55% APY) | Live Oak Bank Savings (4.10% APY) |

How To Earn Bonus

- From October 16 – November 15, bring in new money from another financial institution and receive cash back when depositing into your ASB personal savings account:

- Deposit a minimum of $100,000 new money from another financial institution into a personal savings account to receive $1,000 cash back, or

- Deposit a minimum of $75,000 new money from another financial institution into a personal savings account to receive $750 cash back, or

- Deposit a minimum of $50,000 new money from another financial institution into a personal savings account to receive $500 cash back, or

- Deposit a minimum of $25,000 new money from another financial institution into a personal savings account to receive $250 cash back

- Offer valid from 10/16/2023 to 11/15/2023 (promotional period) when 1) you deposit funds from another financial institution into your ASB personal savings account: deposit a minimum of $100,000 to receive $1,000, or deposit a minimum of $75,000 to receive $750, or deposit a minimum of $50,000 to receive $500, or deposit a minimum of $25,000 to receive $250 (gift), 2) the minimum deposit amount to qualify for the gift posts to your ASB personal savings account within the promotional period and remains in your account until 02/15/2024, and 3) you opt-in and let us know of your intent to participate in this promotion by visiting one of our branches or by calling our Customer Banking Center. Eligible transactions are as follows: checks processed at a branch, external transfers, and wires.

- If customer is new to ASB, must not have a closed ASB personal savings account after 10/15/2021. Eligible personal savings accounts are existing or new Statement Savings, Tiered Savings, Money Market, or existing Supreme Savings and Premier Savings accounts; ASB does not currently open new Supreme Savings and Premier Savings accounts. Moneyhune Savings, Holiday Savings, and I-Plan Savings accounts are not eligible for this promotion. Minimum to open a Statement Savings, Tiered Savings or Money Market account is $20. If a new Statement Savings, Tiered Savings or Money Market account was opened for this promotion and is closed within 180 days of opening, a $100 fee will be assessed.

- ASB will deposit the applicable gift amount into your savings account by 02/23/2024. If there is a withdrawal of the eligible funds from your account before 02/15/2024, you will not qualify for the gift. Value of the gift is considered interest and may be reported to the IRS. Limit of one gift per customer and only one account per customer is eligible. Limit of one gift per customer for any 12-month period. One cannot combine this cash back offer with any other promotion. Fees could reduce the earnings on the account.

American Savings Bank $500 Business Checking Bonus (Expired)

Earn up to a $500 bonus with a new Business Checking Account.

American Savings Bank is offering up to a $500 bonus when you open a new business checking account.

- What you’ll get: $500 bonus

- Account Type: Business Checking Account

- Availability: HI (Bank Locator)

- Credit Inquiry: Soft Pull or Hard Pull

- ChexSystems: Unknown

- Credit Card Funding: Unknown

- Direct Deposit Requirement: None

- Monthly Fee: $0-$25, can be waived, see below

- Household Limit: 1

- Closing Account Fee: If the Business Checking account is closed within 180 days after the offer expires, a $100 fee will be assessed.

(Expires November 30, 2019)

| Chase Business Checking ($300 or $500 Bonus) | Bank of America Business Checking ($200 bonus offer) |

| Axos Business Premium Savings ($375 Bonus) | Axos Bank Basic Business Checking ($400 Bonus) |

| Axos Bank Business Interest Checking ($400 Bonus) | Huntington Unlimited Plus Business Checking ($1,000 Bonus) |

| Huntington Unlimited Business Checking ($400 Bonus) | Bluevine Business Checking ($300 Bonus) |

| U.S. Bank Business Checking ( $500 or $900 Bonus) | |

How To Earn $500 Business Checking Bonus

- Get $150 when you open a Biz Essentials Checking

- Get $200 when you open or upgrade to a Biz Plus Checking

- Get $500 when you open or upgrade to a Biz Deluxe Checking or Biz Analyzed Checking

- Must make at least 10 posted transactions (any credit or debit) by 11/30/19 and must be enrolled in Online Banking with eStatements.

- The cash back will be deposited into your business checking account by 12/13/19 if the criteria is met.

- If the Business Checking account is closed within 180 days after the offer expires, a $100 fee will be assessed.

- Value of the cash back is considered interest and may be reported to the IRS.

- Cannot be combined with any other promotional offer.

- To qualify for the offers, you must not have had these services within the last 12 months.

- For Business Lines, Business Loans and Merchant Services, the account is subject to underwriting guidelines and credit approval.

American Savings Bank $500 Bonus (Expired)

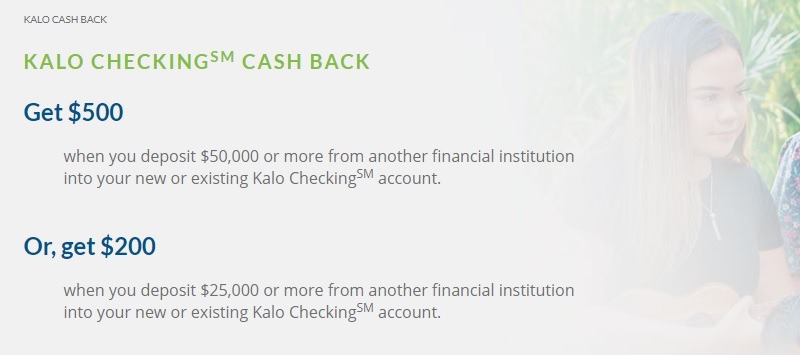

Earn up to $500 when you open a new checking account!

American Savings Bank is offering up to a $500 bonus when you open a new qualifying checking account.

- What you’ll get: $500 bonus

- Account Type: Kalo Cash Back Checking Account

- Credit Inquiry: Soft Pull or Hard Pull

- ChexSystems: Unknown

- Opening Deposit: $20

- Credit Card Funding: Unknown

- Direct Deposit Requirement: None

- Monthly Fee: $25, can be waived if you complete any of the following:

- Have $30,000 in combined personal monthly average deposit and/or outstanding loan balances

- Set up to receive $5,000 in direct deposits per statement period

- Household Limit: 1

- Closing Account Fee: $100, if closed within 180 days of account opening

(Expired)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | HSBC Premier Checking (Up to $3,000 Cash Bonus), |

How To Earn $500 Bonus

- Open a new American Savings Bank Kalo Checking account by July 31, 2019

- Complete the minimum opening deposit of $20.

- Deposit money from another institution:

- To earn $500: deposit $50,000

- To earn $200: deposit $25,000

- Visit your local branch or call their customer service line to join the promotion.

- If the eligible funds are withdrawn from your account within 90 days from the end of this promotion (10/29/2019), you will not qualify for the gift.

- Value of the gift is considered interest and may be reported to the IRS.

- Limit of one gift per customer and only one account per customer is eligible.

- Limit of one gift per customer for any 12 month period.

- Cannot be combined with any other promotional offer.

- Fees could reduce the earnings on the account.

How To Avoid Monthly Fees

- Kalo Essentials Checking: No monthly fees

- Kalo Plus Checking: $15 per month waived with $7,000 in combined personal monthly average deposits and/or outstanding loan balances OR $2,500 in direct deposits per statement period

- Kalo Deluxe Checking: $25 per month waived if $30,000 in combined personal monthly average deposits and/or outstanding loan balances OR $5,000 in direct deposits per statement period

- Statement Savings: $4.50 monthly fee waived with $300 daily balance

- Tiered Savings: $5 monthly fee waived with $500 monthly average balance

- Money Market: $10 monthly fee waived with $1,000 daily balance (or $2,500 monthly average balance)

- Holiday Savings: No monthly fees

- Moneyhune Savings: No monthly fees

|

|

Bottom Line

While the bonus at American Savings Bank sounds enticing, you need to have a lot of capital at your disposal to even qualify for the first tier. This bonus is easy if you have the money to spare, and they offer a lot of free services.

While they have a generous bonus, American Savings Bank doesn’t have great rates for CDs and Savings. You may want to check out our full list of Bank Rates and CD Rates.

Your feedback is highly appreciated and makes our site even better!

*Check back at this page for updated American Savings Bank promotions, bonuses and offers.

Leave a Reply