Anstaff Bank has several unique account options. To find out if Anstaff Bank is right for you, continue reading the review below.

Anstaff has interesting checking and savings accounts, offering a senior checking and a kids savings account. Their savings accounts range from standard, money market, kids to holiday and health ones.

They offer a full selection of savings account and most of them earn pretty decent rates.

Checking Account Options

Anstaff Bank offers a good variety checking accounts with varying opening deposits and balance requirements.

Their checking accounts come with the standard features that most accounts have.

You need $100 to open this checking account, but there are no minimum balance requirements afterwards.

There is, however, a $6 monthly fee that seems unavoidable.

An interest bearing checking account that can be opened with $100.

There is a $8 monthly fee, but you can waive it if you keep a daily balance of $1,000.

This account also comes with unlimited transactions.

This is a senior checking account for those 55 and older and you can open it with $100.

There are no minimum balance requirements nor monthly fees to worry about and the account earns interest on all balances.

A pretty standard checking account that only requires an opening deposit of $50!

There are no minimum balance requirements nor monthly fees, but this account doesn’t earn interest.

This rewards checking account can be opened with $100 and you will earn interest on all balances.

There are no monthly fees nor minimum balance requirements either.

Compare Checking Accounts

Savings Account Options

Anstaff Bank has a pretty large variety of savings accounts that all have varying opening deposits and minimum balance requirements.

There is practically an account for everyone.

This regular savings account will require a $100 opening deposit.

The monthly fee of $2 can be waived if you keep a daily balance of $100. If you are under 18, you can also get the monthly fee waived.

There is also no minimum balance requirement to earn interest!

Since this is technically a money market account, you will need an opening deposit of $2,500.

You can also waive the $10 monthly fee if you keep a daily balance of $2,500.

This account earns tiered interest rates and can earn interest on all balances.

This is specifically a children savings account as it’s only available to those 10 or younger. You can open it with just $1.

The way this account works is that for every $10 deposited, one Penny Pig Dollar can be earned. You are allowed up 30 Penny Pig Dollars per quarter.

You can exchange your Penny Pig Dollars for prizes in the Penny Pig Prize Pen.

This account does earn interest and there are no monthly fees nor minimum balance requirements to worry about either.

A holiday savings account that only requires $1 to open and it will earn interest on all balances.

There are no monthly fees nor minimum balance requirements either so you can save for vacations or other holiday expenses, completely fee free.

A health savings account for those who have the High Deductible Health Plan.

You will need a minimum deposit of $25 to open this account, but there are no monthly fees nor minimum balance requirements.

Compare Savings Accounts

CD Account Options

Anstaff Bank offers CDs that earn really high, competitive interest rates. You can open each CD with $500.

These terms are available from 90 days to 5 years.

The CDs will also automatically renew upon maturity.

Compare CD Accounts

• Available nationwide online, Discover® offers CDs with some of the highest & most competitive rates! with select terms as short as 3 months up to 120 months • Rates ranging from 2.00% APY up to 4.05% APY. • Opening a Discover Bank Certificate of Deposit is extremely quick and easy. • Funds on deposit are FDIC-insured up to the maximum allowed by law. • Get started and open a Discover CD in 3 easy steps. |

Reasons to Bank with Anstaff Bank

- They offer a great and large variety of both checking and savings accounts.

- Some of their checking accounts don’t require monthly fees or balance requirements.

- They have two money market accounts that earn competitive interest rates.

- Has decent and not too hard to maintain monthly fees or minimum balance requirements for some of their accounts.

- Offers a senior checking account that requires no monthly fees nor minimum balance requirements.

- Has a unique kids savings account that allows them to earn interest at the young age of 10.

- Has a holiday/vacation savings account that earns interest for a low opening deposit.

- Provides a health savings account for those who have a HDHP.

- Their savings and money market accounts earn a pretty high APY.

- Their website is easily navigable and has everything laid out.

- Conduct all your banking online or with the Anstaff Bank mobile app.

Reasons Not to Bank with Anstaff Bank

- They are only located in Arkansas with a total of 12 physical branches.

- Lacking a senior savings account since they offer a checking one.

- Absence of a student or youth checking account.

- Their Privileges Checking account doesn’t have options to waive the monthly fee.

- Doesn’t have a 24-hour telephone banking line.

Anstaff Bank Routing Number

The routing number for Anstaff Bank varies based on regions or locations. To find your routing number, check the lower left hand corner of your Anstaff Bank check.

Contact Customer Service

You can reach Anstaff Bank at 870-438-5214.

To speak to a customer representative, their business hours vary based on locations.

You can check Anstaff’s website for the different times available.

How Anstaff Bank Compares

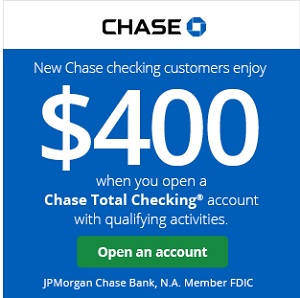

- Chase Bank: Chase is one of the biggest banks in the U.S and offers just about almost everything. Compared to its other competitors, Chase offers much more checking account options.

- Discover Bank: Discover Bank is also an online nationwide bank that offers bonuses for their checking and savings accounts! You can earn cash back rewards when you open a checking account and generous bonuses for opening a savings one.

- Wells Fargo: Located throughout the US with over 5,800 branches and 13,000 ATMs. They offer a variety of deposits accounts, including accounts for teens and customers who need a second chance.

Bottom Line

If you live in Arkansas and are looking for a variety of checking or savings account that earns high interest rates, then Anstaff Bank can be of service.

The Penny Pig Savings account is designed for kids and parents who want their children to start saving money responsibly at the ripe age of 10, before they even enter middle school. They also offers rewards to the children if they actively keep up with their account.

There is a rewards checking account for adults as well, but you may have to contact Anstaff for more information as not much is displayed on their site.

However, keep in mind that when you look for a checking or savings account be sure to look into all the fees charged. Don’t focus on the interest rate alone, but on what the account will cost you overall.

If Anstaff Bank has the variety and options you’re looking for, apply today! For more options from a variety of banks, see our list of the best bank promotions!

Leave a Reply