Arundel Federal Savings Bank is a local bank that provides a plethora of account options. To find out if Arundel Federal Savings Bank is right for you, continue reading the review below.

This bank is unique in its many savings account options offer relationship accounts for senior citizens and even a “Goal Maker Savings” account for sports fanatic!

All their accounts are also really easy to open and don’t require too much.

Checking Account Options

Arundel Federal Savings Bank has a good selection of checking accounts with low minimum requirements.

This checking account requires a $50 minimum opening deposit and comes with a bunch of benefits such as, access to all kinds of online, mobile and phone banking and unlimited check writing.

There is no monthly fee nor minimum balance requirements either.

You can even avoid overdraft fees if you sign up for “Worry Free” savings transfers.

With a $250 minimum opening deposit, this checking account can earn variable interest rates.

You will also need to maintain a daily balance of $250 to continue earning interest and to waive the $5 monthly fee.

This basic checking account is for those who are 55+ and will require a $50 minimum deposit.

You can earn interest on it without having to worry about a monthly fee nor minimum balance requirements as well.

However, you can only open this account at a physical branch.

This is a checking account that earns money market interest rates so you will need a minimum opening deposit of $1,000.

The interest is compounded daily and you have to maintain a daily balance of $1,000 also in order to avoid the $5 monthly fee.

This account comes with everything all other checking accounts provide.

Compare Checking Accounts

Savings Account Options

Arundel Federal Savings Bank has several savings accounts that are unique from other banks, and the minimum requirements are too hard to maintain either.

You will need $50 to open this account and you can earn variable interest rates.

There is a small monthly fee of $5, but you can waive it if you keep a daily balance of $50.

This account is designed for sports fans who often keep up with the latest sporting events.

You only need a minimum deposit of $5 and then you can start earning variable interest rates.

To earn interest however, you will need to keep a daily minimum balance of $2,500.

The monthly fee is also $5 so if you keep a daily balance of $5 or above you won’t lose anything.

This account corresponds with the Senior Rewards Checking 55+ so it can become a relationship account.

You can open it with $50 and continue to earn interest as long as you have a daily balance of $250.

This is similar to a holiday savings account except it’s specifically designed for you to store money in for vacation purposes.

You will only need a $10 minimum opening deposit and you can earn variable interest rates.

There is a $5 quarterly fee, but you can waive it with a daily balance of $10.

You also get one FREE withdrawal per club term, and a check for your entire balance will be mailed to you at the end of the term.

You can only open this account at a physical branch.

Just like the Money Market Checking account, there is a savings one too. You can open this account with $1,000 and start earning interest.

If you keep a daily balance of $1,000, you can waive the $5 monthly fee.

A savings account specifically designed for annual holidays. You only need an opening deposit of $10 and you can earn interest towards your holiday spending.

As long as you keep a daily balance of $10, the $5 quarterly fee will be waived.

Compare Savings Accounts

CD Account Options

Arundel Federal Savings Bank offers CDs with competitive rates. You can open each CD with $1,000. These terms range from 6 to 84 months.

To learn more about their CDs, click here.

They also offer 48 to 84 month CDs, but they can only be open in branches.

The CDs will automatically renew upon maturity.

Compare CD Accounts

• Available nationwide online, Discover® offers CDs with some of the highest & most competitive rates! with select terms as short as 3 months up to 120 months • Rates ranging from 2.00% APY up to 4.05% APY. • Opening a Discover Bank Certificate of Deposit is extremely quick and easy. • Funds on deposit are FDIC-insured up to the maximum allowed by law. • Get started and open a Discover CD in 3 easy steps. |

Reasons to Bank with Arundel Federal Savings Bank

- They offer a great variety of both checking and savings account options.

- Lower than average monthly fees.

- They offer really unique savings account such as Goal Maker and Christmas Club that offers exclusive benefits.

- They have both a Money Market checking and savings account that is relatively lower than a standard MMA.

- Provides both a senior checking and savings account that can function as a relationship account.

- Great ratio of checking to savings accounts.

- They have really low monthly fees that are also easily waiveable.

- They have a wide range of CD terms to choose from that earns decent APY.

- Conduct all your banking online or through the Arundel Federal Savings Bank mobile app.

Reasons Not to Bank with Arundel Federal Savings Bank

- They lack a student checking or savings account.

- They are only in Maryland, and there are only 7 total physical branches available.

- Some accounts such as Christmas Club and senior citizen checking and savings accounts can only be opened in branch.

- Their opening deposits aren’t consistent and they all have different amounts.

Arundel Federal Savings Bank Routing Number

The routing number for Arundel Federal Savings Bank is 252070299.

Contact Customer Service

You can reach Arundel Federal Savings Bank on their 24-hour service line at 410-768-7800.

You can also fill out a request form on Arundel Federal Savings Bank website.

How Arundel Federal Savings Bank Compares

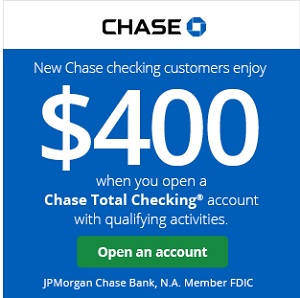

- Chase Bank: Chase is one of the biggest banks in the U.S and offers just about almost everything. Compared to its other competitors, Chase offers much more checking account options.

- deposits accounts, including accounts for teens and customers who need a second chance.

- Wells Fargo: Located throughout the US with over 5,800 branches and 13,000 ATMs. They offer a variety of deposits accounts, including accounts for teens and customers who need a second chance.

- Discover Bank: Discover Bank is also an online nationwide bank that offers bonuses for their checking and savings accounts! You can earn cash back rewards when you open a checking account and generous bonuses for opening a savings one.

Bottom Line

Overall, if you happen to live in Maryland and want to invest in a bank with a bunch of different kinds of account types and options to choose from, then consider Arundel Federal Savings Bank.

They have such unique accounts that earn pretty decent interest rates for being such a small bank. The only downside that it is only available in Marlyand and for their holiday savings accounts, you have to visit a physical branch in order to open them.

But of course, you can always head online to do your banking for all the other accounts.

However, keep in mind that when you look for a checking or savings account be sure to look into all the fees charged. Don’t focus on the interest rate alone, but on what the account will cost you overall.

If you’re interested in banking with Arundel Federal Savings Bank, then apply today! For more options from a variety of banks, see our list of the best bank promotions!

Leave a Reply