Check out Bank of Blue Valley promotions, bonuses, and offers here!

They are currently offering bonuses of $300 or $600 for opening a qualifying account!

About Bank of Blue Valley Promotions

Bank of Blue Valley is headquartered in Merriam, Kansas and was established in 1871. Since then they have grown to 8 locations and offer CD rates that are 84% higher than the national average. If you are not a resident with a location near you, then you should take a look at our own list of bank promotions and still earn big!

Bank of Blue Valley has decently competitive CD rates compared to traditional banks.

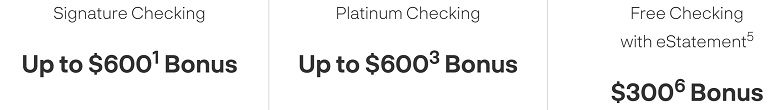

Bank of Blue Valley $600 Checking Bonus

Bank of Blue Valley is offering you an opportunity to earn up to $600 Checking Bonus when you open a checking account.

- What you’ll get: $300 or $600 bonus

- Account Type: Checking

- Availability: KS, MO (Bank Locator)

- Direct Deposit Requirement: Yes (see what works)

- Hard/Soft Pull: Soft Pull

- ChexSystem: Unknown

- Credit Card Funding: None

- Monthly Fee: $0-$12; waivable

- Early account termination fee: Bonus forfeit + $25 fee if closed within 90 days

- Household limit: None listed

(Limited time offer)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- $600 Signature Checking Bonus:

- To receive a $300.00 bonus, you must have a balance of at least $50,000.00 or more in your new checking account 180 calendar days after the account open date. If 180th calendar day falls on a weekend or holiday, the account balance on the following business day will be used to qualify for the promotion.

- To receive a $300.00 bonus, you must have two direct deposits made into this account. Each direct deposit must be at least $1,000.00 or more posted to this account within 90 calendar days of account opening.

- $600 Platinum Checking Bonus:

- To receive a $300.00 bonus, you must have a balance of at least $7,500.00 or more in your new checking account 180 calendar days after the account open date. If 180th calendar day falls on a weekend or holiday, the account balance on the following business day will be used to qualify for the promotion.

- To receive a $300.00 bonus, you must have two direct deposits made into this account. Each direct deposit must be at least $1,000.00 or more posted to this account within 90 calendar days of account opening.

- $300 Free Checking with eStatements Bonus:

- To receive a $300.00 bonus, you must have 2 direct deposits made into this account. Each direct deposit must be at least $300.00 or more posted to this account within 90 calendar days of account opening.

- Eligibility Requirements: This offer is for new consumer checking customers only. Existing customers with loans, savings, or business checking accounts are eligible for the offer. You are not eligible for this offer if: (1) You are a current Bank of Blue Valley, a division of HTLF Bank consumer checking account owner. (2) You have received a bonus for opening a Bank of Blue Valley, a division of HTLF Bank consumer checking account within the past 12 months. Bonus Requirements: To receive a $300.00 bonus, you must have a balance of at least $50,000.00 or more in your new checking account 180 calendar days after the account open date. If 180th calendar day falls on a weekend or holiday, the account balance on the following business day will be used to qualify for the promotion. To receive a $300.00 bonus, you must have two direct deposits made into this account. Each direct deposit must be at least $1,000.00 or more posted to this account within 90 calendar days of account opening. If 90th calendar day falls on a weekend or holiday, the account balance on the following business day will be used to qualify for the promotion. A qualifying direct deposit is an ACH (Automated Clearing House), automatic electronic deposit of your salary, pension, Social Security, or other regular income into your bank account. Confirm with your employer, agency or company making these payments that they use the ACH network. Transfers from one account to another, mobile deposits, Person to Person payments (such as Zelle®) or deposits made at a branch or ATM do not qualify as a direct deposit. If the account is closed by the customer or bank within 90 business days after opening, we may deduct bonuses earned and received at closing, and a $25.00 account closing fee may be assessed. Closing the account will negate any unearned bonuses. Bonus Payment: All bonus dollars will be paid within 30 days after the qualification requirements are met and will be deposited into the new checking account. All bonus dollars will be paid to the newly opened Signature Checking account. The bonuses will be paid to the account opened first if multiple checking accounts are opened during the promotional bonus period under the same primary owner’s name. There is a limit of one bonus per new consumer account relationship. An IRS 1099 form may be issued. You are responsible for any federal, state, or local taxes due on the bonus and will report income to the tax authorities if applicable. Consult your tax advisor. Additional Terms and Conditions: The offer may be discontinued or changed at any time without notice. Geographic restrictions may apply. Account opening is subject to approval.

- Eligibility Requirements: This offer is for new consumer checking customers only. Existing customers with loans, savings, or business checking accounts are eligible for the offer. You are not eligible for this offer if: (1) You are a current Bank of Blue Valley, a division of HTLF Bank consumer checking account owner. (2) You have received a bonus for opening a Bank of Blue Valley, a division of HTLF Bank consumer checking account within the past 12 months. Bonus Requirements: To receive a $300.00 bonus, you must have a balance of at least $7,500.00 or more in your new checking account 180 calendar days after the account open date. If 180th calendar day falls on a weekend or holiday, the account balance on the following business day will be used to qualify for the promotion. To receive a $300.00 bonus, you must have two direct deposits made into this account. Each direct deposit must be at least $1,000.00 or more posted to this account within 90 calendar days of account opening. If 90th calendar day falls on a weekend or holiday, the account balance on the following business day will be used to qualify for the promotion. A qualifying direct deposit is an ACH (Automated Clearing House), automatic electronic deposit of your salary, pension, Social Security, or other regular income into your bank account. Confirm with your employer, agency or company making these payments that they use the ACH network. Transfers from one account to another, mobile deposits, Person to Person payments (such as Zelle®) or deposits made at a branch or ATM do not qualify as a direct deposit. If the account is closed by the customer or bank within 90 business days after opening, we may deduct bonuses earned and received at closing, and a $25.00 account closing fee may be assessed. Closing the account will negate any unearned bonuses. Bonus Payment: All bonus dollars will be paid within 30 days after the qualification requirements are met and will be deposited into the newly opened Platinum Checking account. The bonuses will be paid to the account opened first if multiple checking accounts are opened during the promotional bonus period under the same primary owner’s name. There is a limit of one bonus per new consumer account relationship. An IRS 1099 form may be issued. You are responsible for any federal, state, or local taxes due on the bonus and will report income to the tax authorities if applicable. Consult your tax advisor. Additional Terms and Conditions: The offer may be discontinued or changed at any time without notice. Geographic restrictions may apply. Account opening is subject to approval.

- Eligibility Requirements: This offer is for new consumer checking customers only. Existing customers with loans, savings, or business checking accounts are eligible for the offer. You are not eligible for this offer if: (1) You are a current Bank of Blue Valley, a division of HTLF Bank consumer checking account owner. (2) You have received a bonus for opening a Bank of Blue Valley, a division of HTLF Bank consumer checking account within the past 12 months. Bonus Requirements: To receive a $300.00 bonus, you must have 2 direct deposits made into this account. Each direct deposit must be at least $300.00 or more posted to this account within 90 calendar days of account opening. A qualifying direct deposit is an ACH (Automated Clearing House) automatic electronic deposit of your salary, pension, Social Security, or other regular income into your bank account. Confirm with your employer, agency or company making these payments that they use the ACH network. Transfers from one account to another, mobile deposits, Person to Person payments (such as Zelle®) or deposits made at a branch or ATM don’t qualify as a direct deposit. If 90th calendar day falls on a weekend or holiday, the following business day will be used to qualify for the promotion. If the account is closed by the customer or bank within 90 business days after opening, we may deduct any bonus earned and received at closing, and a $25.00 account closing fee may be assessed. Closing the account will negate any unearned bonus. Bonus Payment: All bonus dollars will be paid to the newly opened Free Checking with eStatement checking account. All bonus dollars will be paid in 30 days after the qualification requirements are met and will be deposited into the new checking account. The bonuses will be paid to the account opened first if multiple checking accounts are opened during the promotional bonus period under the same primary owner’s name. Limit one bonus per new consumer account relationship. An IRS 1099 form may be issued. You are responsible for any federal, state, or local taxes due on the bonus and will report income to the tax authorities if applicable. Consult your tax advisor. Additional Terms and Conditions: The offer may be discontinued or changed at any time without notice. Geographic restrictions may apply. Account opening is subject to approval.

Bank of Blue Valley $350 Checking Bonus (Expired)

Earn up to $350 when you open a new consumer checking

Bank of Blue Valley is offering you a chance to earn up to $350 bonus when you open a new qualifying checking account.

- What you’ll get: $350 bonus

- Account Type: Platinum Checking, Free Checking, and Signature Checking

- Availability: KS, MO

- Direct Deposit Requirement: Yes, $500+ (see what works)

- Hard/Soft Pull: Soft Pull

- ChexSystem: Unknown

- Credit Card Funding: None

- Monthly Fee: None with eStatements

- Early account termination fee: Bonus forfeit + $25 fee if closed within 90 days

- Household limit: None listed

(Expires December 14, 2020)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Up To $350 Checking Bonus

- To receive $100 bonus, one minimum direct deposit of $500 or more must be posted to your new checking account within 60 calendar days of account opening.

- A $250 bonus will be paid if the account has at least $7,500 balance 60 calendar days after account opening

- If the account is closed within 90 business days, we may deduct bonuses earned at closing and a $25 account closing fee may be assessed

- If multiple checking accounts are opened under the same primary owner name, the bonuses will be paid to the account that was opened first

- Limit one bonus per new consumer account relationship

How To Avoid Monthly Fees

- Free Checking with eStatements: No monthly fee

- Platinum Checking: $12 monthly fee waived with $7,500 average daily balance for the cycle month

- Signature Series Checking: $9 monthly fee waived with $50,000 average balance; or $100,000 in total relationship balances for the cycle month

- Small Business Checking: $5 monthly fee waived when you maintain an average daily balance of $1,500

|

|

Bottom Line

Make sure you check out Bank of Blue Valley to learn more about the promotions. While this promotion provides a lot of great services and a fantastic bonus, however I can only recommend if it triggers a soft pull. Also be sure to read the fine print carefully as earning bonus is a multi step process.

However you should still take advantage of our full list of Bank Rates and CD Rates to get the best deal for you!

Feel free to comment below and let us know about any additional information we may have missed. We value your feedback and will continue to keep you posted on the latest bank offers nationwide.

*Check back at this page for updated Bank of Blue Valley promotions, bonuses and offers.

Out of market area(Stl).

1. You need to live within 25 miles of a Bank of Blue Valley branch to have a checking account, according to Kayla at the bank’s Customer Service # 877-280-1862, 10/8 2. NOTE- Bank Of Blue Valley’s owner, Heartland Financial has similar bonuses at the other banks they operate. In future Posts PLEASE note this information.

Not all of MO.