Capital One offers high interest rates without all the online fees, however it’s not as high compared to other online banks. They also offer convenience checking and savings under one roof.

While Chase, one of the biggest banks in the Unites States, offers full service banking from personal banking to mortgages to loans, as well as a popular range of credit cards.

Not to mention, they offer more checking options compared to other competitors.

Continue reading below for a more in-depth look for both Capital One and Chase. You can choose to see which one fits your needs the most.

|

|

|

| Capital One | Citibank | |

| Locations | Online based banking | 700 Citibank branches across 13 states (Mostly in California and New York) |

| ATMs | Over 39,000 no-fee Capital One & Allpoint ATMs | 2400 ATMs across the country.Also works at all MoneyPass ATMs |

| Savings | 3.5/5 | 3/5 |

| CD | 3/5 | |

| Checking | 5/5 | 3/5 |

| Money Market | 4/5 | N/A |

| Customer Service | 4.5/5 | 4/5 |

| Mobile App | 4.5/5 | 4.5/5 |

| Pros | -Overdraft protection options -No account minimums -27 Capital One cafes for in-person support |

-Perks for high balance customers -Many fee-free ATMs -Global presence |

| Cons | -Low savings APY compared to other online banks | -No free checking option -Higher balance requirements -Low savings APY |

| Bottom Line | Capital One offers several banking products like checking and savings. | Citibank is offers credit cards and banking services, but it’s more geared towards people who have high balances in their deposit account. |

Capital One Promotions

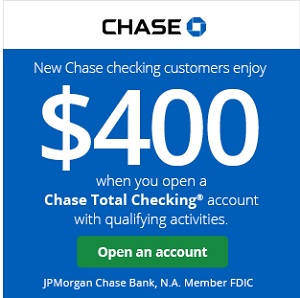

Chase Bank Promotions

|

|

|

|

Bottom Line

Which Bank is Better: Capital One or Chase?

In summary:

- Capital One has a good range of banking services. They are a good online bank that also has access to in-person support.

- Chase is a good choice if you’re looking for a bank with full range of services, physical locations, lots of ATMS, and good mobile banking.

For more variety of options, see our list of the best bank account bonuses & savings account offers.

Why do you compare Citibank with Capital One when you are supposed to compare chase with capital one?