With large welcome bonuses and chances to earn high rewards, Chase offers some of the best credit card on the market for these reasons.

Although, we may want immediate approval so that we don’t have to wait, it doesn’t always end up like that. For people who just applied for a new Chase credit card, you may not know how to check your application status.

Generally, there are a couple of methods to check for your Chase Credit Card Application Status. Continue reading to learn more!

Call The Automated Status Hotline

Chase has an automated hotline to check your application status. You just need to enter your Social Security number. It should provide your current Chase card application status.

The lines are open 24/7 and you can call as often as you’d like. Call these numbers if you need to check your status:

- For Chase personal cards: 1-888-338-2586

- For Chase business cards: 1-800-453-9719

Check Online

Chase doesn’t have a dedicated website to check your credit card application status online. However, if you have other products from Chase, such as a checking account or credit card, you can log into your Chase account and check their.

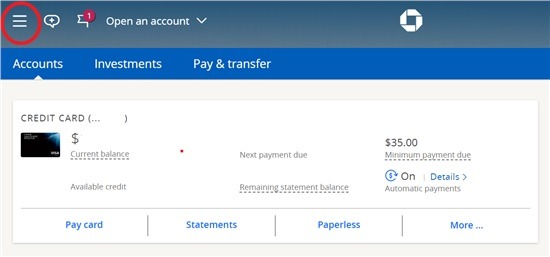

First go to the menu icon on the very upper left corner:

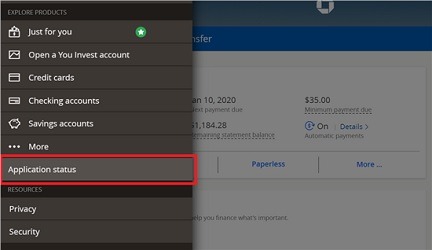

Open the pop-up menu and scroll down to the bottom. You’ll see an option for “Application status.”

Click on this to check the status of any outstanding applications.

There is a chance you will be able to see a new credit card account once you have logged into Chase. This would also mean that your application has been approved, even if you haven’t received a confirmation email.

Call The Reconsideration Line

If it has been awhile and your application is still pending or denied, it wouldn’t hurt to call the reconsideration line and check the status with the representative to learn more.

The Chase reconsideration line is 1-888-270-2127. The operating hours are 8 am–10 pm (Monday to Friday) and 8 am–8 pm (Saturday and Sunday).

Many people report being approved after calling the reconsideration line and providing more information. If it’s a denial, you can review the reason for denial and work towards approval next time.

Application Status for Chase Business Cards

As mentioned above, Chase offers some of the most rewarding credit card on the market. That goes for their business credit card as well. If you are pending for a business card, it is best to wait for a notice instead of jumping to call the reconsideration line.

This is because the reconsideration line is harder on business credit cards. Business card applications take longer to process to it is better to wait for the official decision.

If you call the reconsideration line right away, they might ask for more information about your business or to provide legal documentation.

In this case, the analyst will decide your approval. If you’re not very good at answering questions, it could hurt your chances.

If you do end up being denied, then the reconsideration phone number for Chase business cards is 1-800-453-9719. This line is open Monday to Friday 1 pm–10 pm (no weekend hours).

Approval Time for Chase Credit Cards

Approval times can vary among all credit cards. However, if you have an excellent credit score and strong qualifications, you may get an instant approval. In this case, your new Chase card will be sent to you within 2 weeks.

If you don’t get instant approval and instead get an email saying a decision will be made in 7-10 business days, there is a chance you got rejected for the credit card. On the other hand, this could also mean that Chase simply needs more time to consider your qualifications. Wait a few days and give the reconsideration line a call.

Reason You May Not Get Approved

Here is a list of some of the most common reasons you don’t get instant approval for a credit card:

- Too many newly opened credit cards

- Too many recent hard inquiries

- Too much credit with Chase

- Poor credit

- Mistake on the application

Now, remember that just because you didn’t get instant approval doesn’t mean that your application is definitely denied. Keep checking the status. If your application is still pending after a few days, you can try calling reconsideration.

Chase Credit Card Application Rules

Chase is by far one of the toughest credit card issuers, with more application rules than other financial institutions. Here are some of the application restrictions you should watch out for.

5/24 Rule

This one of Chase’s rules that states that if you have opened 5 credit card accounts in the past 24 months (with any bank), you will not be approved for anew Chase card, even if you have an excellent credit score. This isn’t just a Chase rule, but it is a widely accepted rule.

2/30 Rule

This is another unofficial rule that states that you cannot be approved for more than 2 Chase cards within any 30day period. Generally, this goes for 2 personal cards.

Chase Sapphire Rules

There are some special rules when it comes to Chase’s signature card like the Chase Sapphire Preferred and the Sapphire Reserve card.

For example, you cannot own more than one card in the Sapphire family. So, if already have a Sapphire Preferred card and want the Reserve, you will not be able to apply. In this case, you have to call customer service and do one of either 2 things:

- Upgrade your current Preferred to Reserve, or

- Close your Preferred account and apply for Reserve

There are some rules regarding the welcome bonus too. You can only earn the welcome bonus on a Sapphire card once every 48 months.

|

|

|

|

Bottom Line

If you did not receive instant approval, there are ways to check on your Chase credit card application status online and by phone.

It is understandable to be anxious waiting for the pending status to go away, but it is best to be patient. If you end up being denied for a Chase credit card, you can always call the reconsideration hotline to talk to an agent.

For more posts like this, check out our Chase Coupons!

Leave a Reply