Commonwealth Bank and Trust Company, an ordinary bank, offers limited account options. To find out if Commonwealth Bank and Trust Company is right for you, continue reading the review below.

They have a checking account for anyone and a lot of them can be opened without needing to pay additional monthly fees nor maintain specific balance requirements!

Checking Account Options

Commonwealth Bank and Trust Company offers a wide range of checking accounts with similar benefits.

This is an interest bearing checking account that requires an opening deposit of $100.

There’s no monthly fee if you enroll in eStatements.

This standard checking account requires another $100 opening deposit, but it doesn’t earn interest.

There are however, no monthly fees nor minimum balance requirements.

This account has everything a standard checking account offers.

You need an opening deposit of $100 but this account earns interest.

Theres a $15 monthly fee but you can waive it by keeping a daily balance of $5,000.

You will need a $100 opening deposit. To waive the monthly fee just sign up for eStatements.

A senior checking account available to customers 62 and over.

You need a $100 opening deposit and there is also a $5 monthly fee, but you can maintain it by keeping a daily balance of $300.

Compare Checking Accounts

Savings Account Options

Commonwealth Bank and Trust Company has several savings accounts that have varying balance requirements.

This is an interest bearing checking account that has no monthly fees nor minimum balance requirements to worry about.

You can open it with $100.

The interest is compounded daily as well.

There seems to be no opening deposit requirement to open this account.

There are also no minimum balance requirements or monthly fees to worry about.

You will need a pretty big opening deposit of $5,000.

There’s also a $10 monthly fee but you can waive it if you can manage maintaining a daily balance of $5,000.

Compare Savings Accounts

Reasons to Bank with CWB and Trust Company

- A lot of their accouts don’t require a monthly fee nor minimum balance requirements.

- They offer a youth checking and savings account.

- They offer a senior citizen checking.

- Their savings and money market accounts earn a pretty high APY.

- They have easily waiveable monthly fees and not too high minimum balance requirements.

Reasons Not to Bank with CWB and Trust Company

- They are only located in Kentucky. They have a total of 18 physical branches.

- You might actually have to make an account on their website first to find additional information, otherwise they don’t provide much information.

- They don’t have 24-hour banking.

- Their customer service isn’t opened on weekends.

CWB and Trust Company Routing Number

The routing number for Commonwealth Bank and Trust Company varies depending on state and regions. You can also check the lower left corner of your Commonwealth Bank and Trust Company check.

Contact Customer Service

You can reach Commonwealth Bank and Trust Company at 1-855-535-5654.

How CWB and Trust Company Compares

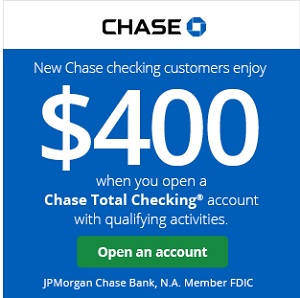

- Chase Bank: Chase is one of the biggest banks in the U.S and offers just about almost everything. Compared to its other competitors, Chase offers much more checking account options.

- Discover Bank: Discover Bank is also an online nationwide bank that offers bonuses for their checking and savings accounts! You can earn cash back rewards when you open a checking account and generous bonuses for opening a savings one.

- Wells Fargo: Located throughout the US with over 5,800 branches and 13,000 ATMs. They offer a variety of deposits accounts, including accounts for teens and customers who need a second chance.

Bottom Line

If you happen to live in Kentucky and prefer smaller, local banks and would rather open an account in person, then Commonwealth Bank and Trust Company is perfect for you.

Even though they have a very small amount of account options, their savings and money market accounts earn pretty high competitive rates.

However, keep in mind that when you look for a checking or savings account be sure to look into all the fees charged. Don’t focus on the interest rate alone, but on what the account will cost you overall.

If Commonwealth Bank and Trust Company has the variety and options you’re looking for, apply today! For more options from a variety of banks, see our list of the best bank promotions!

Leave a Reply