There are plenty of ways to easily earn points and miles on your credit card, such as welcome bonuses, flights and hotel stays. Then, there are some lesser known ways that rewards hackers think are the best. One such trick is called “double dipping,” where you can earn two different types of rewards for a single activity. It is definitely one of the best methods to consider when figuring out one of the best ways to spend your credit card.

See our best credit card bonuses here.

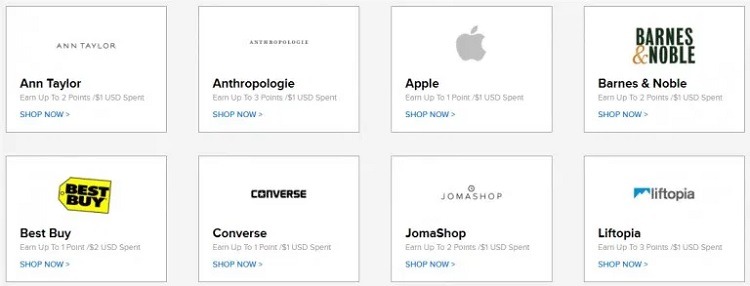

Shopping Portals

If you prefer to do most of your shopping online, then shopping portals is the way to go for double dipping. These shopping portals are basically third-party sites that partner up with various retailers to give you points, miles or cash back when you click through the portal to the merchant’s site. Rewards earned from these shopping portals can be stacked with the points, miles or cash back you get from making the purchase with your credit card.

There are a couple types of shopping portals, including airline, hotel, credit card and cash back. To find the best bonus, check out a shopping portal aggregator like Cashback Monitor. These sites compare earning rates across multiple portals and by specific retailers, so you can find the one that matches you perfectly.

A lot of the time, shopping portals also offer limited time promotions with elevated earning rates for certain merchants, or bonus rewards for select purchases over a holiday. Keep in mind though that yo should read the fine print whenever you decide to check out a shopping portal to make sure you are eligible for the bonus.

Restaurants

Whenever you dine out with the right credit card, you can earn a ton of rewards for your restaurant purchases. Especially if you have a card like the Chase Sapphire Reserve® which can earn you triple points on restaurant purchases. You can earn even more points if you double dip. Here area few ways you can do it.

- Dining Programs. Airline and hotel loyalty programs often have dining rewards networks. When you pay for a meal with a linked credit card, participating restaurants will reward you with points or miles. Again, these bonuses are separate from the rewards you earn with your credit card. Below is a list of popular dining programs and their welcome bonuses

| DINING PROGRAM | WELCOME BONUS | EARNING RATE |

| Alaska Airlines MileagePlan Dining |

1,000 bonus points | Up to 5x points |

| American Airlines AAdvantage Dining |

1,000 bonus points | Up to 5x points |

| Delta Air Lines SkyMiles Dining |

Up to 3,500 miles | Up to 5x points |

| JetBlue TrueBlue Dining |

N/A | 3x points |

| Southwest Airlines Rapid Rewards Dining |

1,000 bonus miles | 3x points |

| Spirit Airlines Free Spirit Dining |

1,000 bonus miles | Up to 5x points |

- OpenTable. You’ll get 100 points for every reservation you make (or 1,000 points at select restaurants and times) which you can redeem for future dining. So, each completed OpenTable reservation you make earns a discount on a future meal.

- Restaurant Vouchers/Certificates. Purchase discounts on meals at certain restaurants via sites like Restaurant.com, Groupon and Living Social. Be sure to read the fine print, as many of these vouchers have special limits on days, times and dishes.

Here is an example of how you can quadruple dip for the most amount of points. OpenTable + Restaurant.com/Groupon/Living Social/other discount + dining program + credit card dining rewards.

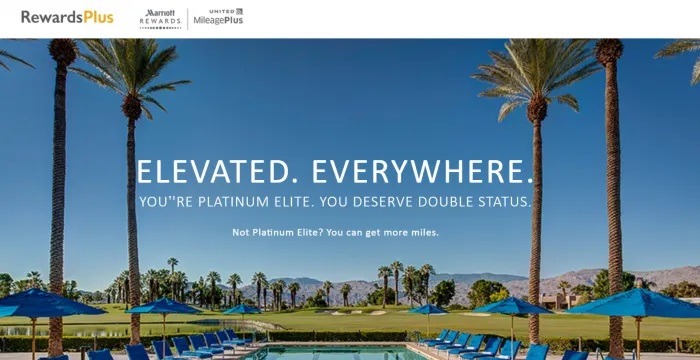

RewardsPlus

United Airlines and Marriott partnered up to offer their members elevated bonus points and elite status benefits through the RewardsPlus program.

Additionally, all Marriott Bonvoy members enjoy a 10% bonus when transferring their Marriott points to United miles.

This bonus is in addition to the main 5,000-mile bonus you get for every 60,000 Marriott points you convert.

In terms of elite status:

- Marriott Bonvoy Titanium and Ambassador members automatically receive United MileagePlus Premier Silver status.

- United MileagePlus Gold members or higher automatically receive Marriott Bonvoy Gold status.

TIP: The Platinum Card® from American Express and Marriott Bonvoy Brilliant™ American Express® Card, both issued by American Express, automatically grant Marriott Gold elite status.

American Airlines + Hyatt

Started in 2019, American Airlines and Hyatt have also partnered up to offer some points back to help their customers earn elite status even faster. Hyatt elites earn 1x bonus points on AA flights while AA elites earn 1x bonus miles on Hyatt stays.

The bonuses mentioned are in addition the regular amount of AAdvantage miles you would normally earn from fli9ghts or Hyatt points you would normally earn on stays. All you have to do is link your AAdvantage and World of Hyatt accounts, and you will automatically be rewarded accordingly.

You may also get the opportunity to earn elite status much faster. For Hyatt, fast tracking towards elite status is available to Explorist or Globalist elites. AA fast tracking is limited to those who have AAdvantage Platinum status or higher. If you hold AA’s invite-only Concierge Key status, you’ll automatically receive Hyatt Globalist status.

TIP: The World of Hyatt Credit Card automatically grants Discoverist elite status.

Hyatt + M Life

Back in 2013, Hyatt partnered up with MGM Resorts so that members can easily earn and redeem points at luxurious properties on the famed Las Vegas Strip.

World of Hyatt members earn poitns and elite credits for stays at participating MGM properties, like the Bellagio, Mandalay Bay and Vdara. In addition to this, you can earn M life tier credits for these stays.

The Hyatt and M life partnership also offers status matching:

| WORLD OF HYATT | M LIFE |

| Member | Sapphire |

| Discoverist | Pearl |

| Explorist | Gold |

| Globalist | Gold |

With M life status, you will have access to on-property benefits such as room upgrades, priority check-in and VIP line access to night clubs and pool areas.

Retail Loyalty Programs

Although retail loyalty programs won’t get you any free luxurious hotel stays or first-class tickets, you will at least be able to earn some kind of reward for your loyalty with office supply stores, sports retailers, restaurants, pet supply stores and more.

Most retail loyalty programs will offer their customers future discounts. For example, customers can get a $5 coupon for every $100 you spend. Additionally, there may be instances where merchants will offer their customers perks such as complimentary shipping and a free birthday gift every year.

TRIPLE DIP EXAMPLE: Retail loyalty program + online shopping portal + credit card rewards.

Amex Offers

If you have an American Express credit card, you probably know all about Amex Offers or at least seen it. However, if you haven’t heard of these rewards, definitely take advantage of it because they come in three forms that can reward you:

- Spend X amount of dollars and get Y number of bonus points.

- Spend X amount of dollars and get Y amount of dollars back.

- Get X additional points for each dollar you spend at a select merchant.

Utliziing at least one or two of these deals every year can easily cover the annual fee of most Amex cards. Also, you can stack Amex Offers with other “double dips” on our list, so you can essentially “triple dip”.

TRIPLE DIP EXAMPLE: Amex Offer + dining program + credit card dining rewards.

Amex Fine Hotels & Resorts

Many luxury resorts partner up with platforms that help people book stays in order to offer additional benefits during your stay. One of the best options is to double dip through American Express Fine Hotels & Resorts for those that have The Platinum Card® from American Express.

This combination allows you to book rooms at high-end chain hotels as well as a boutique and unaffiliated properties worldwide. Because you are booking with Amex instated of directly with the hotel, you will enjoy a variety of benefits during your stay, which can include plenty of perks such as free food, room upgrades, property credits, early check in, late checkout or a welcome amenity. These perks are in addition to the 5x points you’d earn on prepaid hotel bookings.

TRIPLE DIP EXAMPLE: Luxury hotel program + hotel loyalty program + credit card hotel rewards

Credit Cards Mentioned

The Chase Sapphire Reserve offers 100,000 points + $500 Chase Travel promo credit after you spend $5,000 in purchases in the first 3 months from account opening. You'll earn • 8x points on all purchases through Chase Travel, including The Edit • 4x points on flights?booked direct • 4x points on hotels?booked direct • 3x points on dining worldwide • 1x points on all other purchases This card does carry a $795 annual fee and there are no foreign transaction fees. However, you're able to earn a $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year & up to $120 application fee credit for Global Entry or TSA Pre?®, and more annual value from perks and benefits. Member FDIC |

The Platinum Card® from American Express offers 100,000 Membership Rewards points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. You'll earn: • 5X Membership Rewards Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year. • 5X Membership Rewards Points on prepaid hotels booked with American Express Travel. • $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts(R) or The Hotel Collection bookings through American Express Travel using your Platinum Card(R). The Hotel Collection requires a minimum two-night stay. • $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required. • With American Express Global Lounge Collection you can enjoy access to over 1,400 airport lounges globally, including The Centurion Lounge, Unlimited Delta Sky Club® Access when flying an eligible Delta flight, Escape Lounges, Lufthansa Lounges when flying Lufthansa Group, Plaza Premium, Priority Pass Select Lounges, & Additional Global Lounge Collection Partner Lounges subject to visit limitations. Lounges may have their own rules, like additional access rules and guest fees, and for Priority Pass Select, you need to enroll and there are unlimited airport lounge visits for Card Members. With Delta Sky Club Access, Card Members will receive 10 Visits to the Delta Sky Club to be used from February 1 until January 31 of the next calendar year and can unlock Unlimited Delta Sky Club Access by spending $75,000 in eligible purchases on their Card in a calendar year. To find a lounge, visit the membership section in the American Express App or visit http://www.americanexpress.com/findalounge#/loungefinder. • $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month. • $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card. • $200 Uber Cash: Platinum Card Members can ride or dine in style with $15 in Uber Cash each month, plus a bonus $20 in December after adding their Card to their Uber account. Use your Uber Cash on rides and orders in the U.S. when you select an Amex Card for your transaction. • $199 CLEAR® Plus Credit: CLEAR Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $199 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues. • Receive either a $120 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck (through a TSA official enrollment provider) application fee, when charged to your Platinum Card. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost. • Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card. That's up to $50 in statement credits semi-annually. Enrollment required. This card comes with a $695 annual fee.¤ (See Rates & Fees), but you cardholders can enjoy Uber VIP status and up to $200 in Uber savings on rides in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member and Additional Centurion Cards only. Terms Apply. Terms Apply. |

The Marriott Bonvoy Brilliant® American Express® Card offers 185,000 Marriott Bonvoy bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership. Each Card renewal year, get up to $300 in statement credits per calendar year (up to $25 per month) for eligible purchases at restaurants worldwide. With this card, you'll earn: • 6X Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy. • 3X points at restaurants worldwide and on flights booked directly with airlines. • 2X points on all other eligible purchases. • $300 Brilliant Dining Credit: Each calendar year, get up to $300 (up to $25 per month) for eligible purchases made on the Marriott Bonvoy Brilliant® American Express® Card at restaurants worldwide. A Marriott Bonvoy Platinum Elite member will earn 50% more points on eligible purchases at participating hotels for each U.S. dollar or the currency equivalent that is incurred and paid for by the member. Fee Credit for Global Entry or TSA PreCheck: Receive either a statement credit every 4 years after you apply for Global Entry ($120) or a statement credit every 4.5 years after you apply for a five-year membership for TSA PreCheck (up to $85 through a TSA PreCheck official enrollment provider) and pay the application fee with your Marriott Bonvoy Brilliant American Express Card. If approved for Global Entry, at no additional charge, you will receive access to TSA PreCheck. $100 Marriott Bonvoy Property Credit: Enjoy your stay. Receive up to a $100 property credit for qualifying charges at Marriott, The Ritz-Carlton or St. Regis when you book direct using a special rate for a two-night minimum stay using your Card. Free Night Award: Receive 1 Free Night Award every year after your Card renewal month. Award can be used for one night (redemption level at or under 85,000 Marriott Bonvoy points) at hotels participating in Marriott Bonvoy. Certain hotels have resort fees. This card comes with a $650 annual fee and no foreign transaction fees. (See Rates & Fees) Furthermore, enjoy unlimited airport lounge visits when you enroll in Priority Pass Select membership. Terms Apply. (See Rates & Fees) |

|

|

Bottom Line

Double dipping is simply a method to earn the most amount of points, miles, and rewards for your purchases. It is a quick and easy strategy to use and we have outlined the tools above in order to help you out. For more posts like this, check out our list of bank guides and rewards credit cards!

Leave a Reply