Here you can find the most recent Georgia’s Own Credit Union promotions, bonuses, and offers.

Update 1/30/26: There’s currently a $200 bonus when you open a new checking account and follow the requirements good through 2/28/26.

About Georgia’s Own Credit Union Promotions

Georgia’s Own Credit Union is a full-service, not-for-profit financial institution, owned by members rather than controlled by stockholders. You’ll find all the products and services you’d expect from a financial institution, but with better rates and fewer, lower fees. They believe when they invest in their members, it strengthens their communities, too.

| Eligibility: Must live or work in one of the following counties: Baker, Barrow, Bartow, Brooks, Calhoun, Carroll, Chatham, Cherokee, Clarke, Clay, Clayton, Cobb, Colquitt, Columbia, Coweta, Crisp, Dekalb, Dougherty, Douglas, Early, Effingham, Fayette, Forsyth, Fulton, Gwinnett, Hall, Henry, Lee, Lowndes, Meriwether. See here for a full list of membership requirements. |

We will review current Georgia’s Own Credit Union promotions below.

Georgia’s Own Credit Union $200 Checking Bonus

You can receive a $200 bonus when you open a new checking account and meet the requirements.

- What you’ll get: $200 bonus

- Account Type: Checking Account

- Availability: GA (Bank Locator)

- Direct Deposit Requirement: Yes, $2500+ per statement cycle required (see what works)

- Credit Inquiry: Hard Pull

- ChexSystem: Unknown

- Credit Card Funding: Unknown

- Monthly Fees: None with eStatements

- Early Account Termination Fee: None listed

- Household Limit: None listed

(Expires 02/28/2026)

Editor’s Note:

- Here’s an alternative link to the offer valid through 2/28/26.

- There’s also an offer offering two tickets to an upcoming Hawks game when you open a new All Access Checking account by February 28, 2026.

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

| Bank of America ($500 bonus offer) | U.S. Bank Smartly® Checking ($450 bonus) |

How to Earn Bonus

- Open a new All Access Checking account online and use promo code WELCOME26 on the account funding page (the promo code is required to activate your bonus!)

- Register for online banking

- Make 15 debit card transactions within each of the first two consecutive statement cycles

- Establish $1,500 in qualifying direct deposits per statement cycle for the first two consecutive statement cycles

- After you have completed all the above All Access Checking bonus requirements, we’ll deposit the bonus in your new account within 120 days of promotion enrollment.

- Offer only valid January 1, 2026 through February 28, 2026.

- You can receive only one (1) new checking account opening related bonus every two (2) years from the last promotion enrollment date.

- WELCOME26 promotion code is good for one-time use.

- This offer may be withdrawn without notice.

- To receive the $200 All Access Checking Bonus: 1) open a new All Access Checking account, which is subject to approval; 2) enroll in online banking; 3) complete 15 debit card transactions within each of the first two (2) statement cycles after account opening; AND 4) establish qualifying direct deposits made into the new checking account totaling at least $1,500 per statement cycle for the first two (2) statement cycles.

- Your direct deposit needs to be an electronic deposit of your paycheck, pension, or government benefits (such as Social Security) from your employer or the government.

- Person-to-Person payments are not considered a direct deposit.

- After you have completed all the above All Access Checking bonus requirements, we’ll deposit the bonus in your new account within 120 days of promotion enrollment.

- Terms and conditions will apply.

- All Access Checking: all balances earn 0.01% APY. Annual Percentage Yield (APY) is current as of January 1, 2026 and subject to change after account opening.

- Fees can reduce earnings.

- Georgia’s Own may change or discontinue this offer at any time without notice.

- Offer does not apply to business, employee, second, or multiple checking accounts with Georgia’s Own.

- Offer not available to existing Georgia’s Own checking account holders, or those whose accounts have been closed within 90 days or closed with a negative balance within the last three (3) years.

Georgia’s Own Credit Union $750 Checking Bonus (Expired)

You can receive a $750 bonus when you open a new checking account and meet the requirements.

- What you’ll get: $750 bonus

- Account Type: Checking & Savings

- Availability: GA (Bank Locator)

- Direct Deposit Requirement: Yes (see what works)

- Credit Inquiry: Hard Pull

- ChexSystem: Unknown

- Credit Card Funding: Unknown

- Monthly Fees: No monthly fee (with eStatements)

- Early Account Termination Fee: None listed

- Household Limit: None listed

(Expires 12/31/2025)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

| Bank of America ($500 bonus offer) | U.S. Bank Smartly® Checking ($450 bonus) |

How to Earn Bonus

- Open a new All Access Checking and Primary Savings accounts. New members can cash in—up to $750—on the combo by opening accounts with promo code WELCOMEFALL by December 31, 2025 and completing the qualifying activities below.

- Get a $300 new account bonus when you:

- Open a new All Access Checking account online and use promo code WELCOMEFALL on the account funding page (the promo code is required to activate your bonus!)

- Register for online banking

- Make 10 debit card transactions per statement cycle for the first two consecutive statement cycles

- Have $2,500 in qualifying direct deposits per statement cycle

- Get a $200 new account bonus when you:

- Open a new Primary Savings account online and use promo code WELCOMEFALL on the account funding page (the promo code is required to activate your bonus!)

- Deposit a total of $15,000 or more in new money within 30 days of account opening

- Maintain a minimum balance of $15,000 for 90 days from account opening

- Get a $750 (an extra $250!) new account bonus when you:

- Open a new All Access Checking AND Primary Savings account online and use promo code WELCOMEFALL on the account funding page (the promo code is required to activate your bonus!)

- Complete the qualifying activities listed above

- Offer valid November 1, 2025 through December 31, 2025.

- Offer is comprised of three (3) separate bonus opportunities worth up to $750: $300 All Access Checking Bonus, $200 Primary Savings Bonus, and $250 Extra Bonus.

- All Access Checking Bonus offer is not available to existing Georgia’s Own Credit Union checking members.

- Primary Savings bonus offer is not available to existing Georgia’s Own Credit Union savings members. The Extra Bonus offer is not available to members whose accounts have been closed within 90 days or closed with a negative balance within the last three (3) years.

- Business and employee accounts are excluded. You can receive only one (1) new checking and one (1) new savings account opening related bonus every two (2) years from the last promotion enrollment date and only one (1) bonus per account. WELCOMEFALL promotion code is good for one-time use. This offer may be withdrawn without notice. To receive the $300 All Access Checking Bonus: 1) Open a new All Access Checking account, which is subject to approval; 2) enroll in online banking; 3) complete 10 debit card transactions within each of two (2) statement cycles after account opening; AND 4) have a direct deposit of at least $2,500 for two (2) consecutive statement cycles made into the new checking account. Your direct deposit needs to be an electronic deposit of your paycheck, pension, or government benefits (such as Social Security) from your employer or the government. Person-to-Person payments are not considered a direct deposit. After you have completed all the above All Access Checking Bonus requirements, we’ll deposit the bonus in your new account within 120 days of promotion enrollment.

- To receive the $200 Primary Savings Bonus: 1) Open a new Georgia’s Own Primary Savings account, which is subject to approval; 2) deposit a total of $15,000 or more in new money into the new savings account within 30 days of promotion enrollment. The new money cannot be funds held by you at Georgia’s Own Credit Union; AND 3) Maintain at least a $15,000 balance in the new savings account for 90 days. After you have completed all the above Primary Savings Bonus requirements, we’ll deposit the bonus in your new account within 120 days of promotion enrollment.

- To receive the $250 Extra Bonus: You must open the checking and savings account at the same time and complete all requirements above for BOTH the All Access Checking Bonus and Primary Savings Bonus.

- After you have completed the All Access Checking and Primary Savings Bonus requirements, we will deposit the remaining bonus due in your new account within 150 days of promotion enrollment.

- To receive any of the above bonuses, the enrolled account(s) must be open and in good standing at the time of bonus payout.

- Eligibility may be limited based on account ownership.

- Account terms are effective as of November 1, 2025. The Annual Percentage Yield (APY) for Georgia’s Own All Access Checking is 0.01% APY for all balances.

- Rates are variable and subject to change at any time.

- Fees may reduce earnings.

- The minimum opening balance for Georgia’s Own Primary Savings is $5.00.

- APYs by tier: $5.01 to $49,999.99 – 0.10% APY, $50,000 to $99,999.99 – 0.15% APY, $100,000 or greater – 0.20% APY.

- Rates are subject to change at any time.

- Fees may reduce earnings.

- Bonuses are considered income for tax purposes and will be reported to the IRS as required by law.

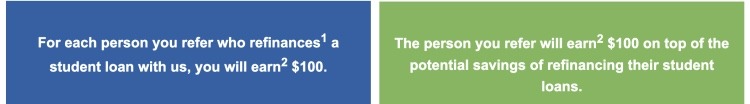

Georgia’s Own Credit Union $100 Referral Bonus *Expired*

Earn a $100 bonus for each qualifying referrals!

Georgi’s Own Credit Union is offering a $100 bonus for each qualifying referrals and meet the eligible requirements.

- What you’ll get: $100 bonus

- Account Type: Perks+ Checking Account, All Access Checking Account

- Availability: GA

(Offer expires August 31, 2021)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| HSBC Premier Checking (Up to $7,000 Cash Bonus), | |

How to Earn Bonus

- Use the form at the offer link to sign up for the referral program.

- For each person you refer who refinances a student loan, you will earn $100.

- The person you refer will also earn $100.

- Eligibility Requirements

- General eligibility requirements for Referring Members and Referred Friends:

- U.S. citizen or permanent resident

- Existing Credit Union member with an account in good standing including not having any outstanding delinquent loans with the Credit Union at the time the offer is funded

- At least the age of majority in the state of residence

- Is not ineligible to receive such incentives due to other legal reasons

- Current employees of the Credit Union and their parents, children, siblings, spouses or domestic partners are also not eligible for the incentive.

- Eligibility requirements for the Referring Member:

- May not be a co-borrower or cosigner on the new Private Education Financing opened by the Referred Friend

- Eligibility requirements for any Referred Friend:

- Is applying for and receives funding of new Private Education Financing

- Uses the referral link from the Referring Member

- Is a different person than the Referring Member. i.e Referring Member cannot refer themselves

- General eligibility requirements for Referring Members and Referred Friends:

- Offer Details:

- Incentive Amount will be deposited by the Credit Union into the Credit Union deposit accounts of the Referring Member and the Referred Friend within 120 days of the loan disbursement to college or funding to the servicer of an existing student loan for refinancing, provided the loan is not cancelled, refunded, or withdrawn during the Campaign Period.

- Referred Friends may earn a maximum of one Incentive on their first eligible Private Education Financing from the Credit Union regardless of the loan type (LOC, PEL, REFI)

- After the Referred Friend’s loan funds, Referred Friends may become a Referring Member and earn Referring Member Incentives

- Incentives will be capped at $5,000 for Referring Members and $100 for Referred Friends

- It is the responsibility of the Referring Member and/or Referred Friend to notify the Credit Union if the Incentive is not received as expected

- The Incentive(s) may be considered taxable income and may be reported on IRS Form 1099-MISC by the Credit Union. Please consult a tax professional for advice

- Participation in the program is not considered an employment relationship

- Payments are made directly to deposit accounts of the Referred Member and the Referred Friend at the Credit Union. If such account no longer exists at the time of the payment, the Incentive may be forfeit

- Lending and/or underwriting decisions will not be impacted in any way by participation in the program

How To Waive Monthly Fees

- Perks+ Checking: $5.95 monthly fee

- All Access Checking: $2 monthly fee, waivable with enrollment in eStatements

- i[check] Youth Checking: None

- Primary Business Checking: $12 monthly fee, waivable by maintaining a minimum daily collected balance of $1,000 or more, an average monthly balance of $3,000, or a combined average monthly collected balance of $10,000 in Checking, Savings, Money Market, or CDs

- Preferred Business Checking: $20 monthly fee, waivable by maintaining a minimum daily collected balance of $2,500 or more, an average monthly balance of $5,000, or a combined average monthly collected balance of $20,000 in Checking, Savings, Money Market, or CDs

- Not-for-Profit Business Checking: $3 monthly fee, waivable by maintaining a minimum daily collected balance of $500 or more, an average monthly balance of $1,500, or a combined average monthly collected balance of $5,000 in Checking, Savings, Money Market, or CDs

|

|

|

|

Bottom Line

Make sure you check out Georgia’s Own Credit Union to learn more about the current bonuses. Don’t forget, the bonus will be reported on IRS Form 1099-INT.

Additionally, feel free to comment below and let us know about how it went and if you could fund your account with a credit card or not. We value your feedback and will continue to keep you posted on the latest bank offers nationwide.

*Lastly, Check back on this page for updated Georgia’s Own Credit Union promotions, bonuses, and offers.

Leave a Reply