Overdraft happens when you try to pay for something with a check or your debit card without having sufficient funds in your account. Some banks even offer overdraft services to prevent your checking account from overdrafting and triggering an overdraft fee. Continue reading to learn more about overdraft protection and how that protects your bank account.

If you want to be sure you’re always protected against overdraft fees, definitely consider signing up for overdraft protection. This works by linking your checking account to another account and uses that account to pay for your transactions.

This prevents you from triggering an overdraft fee. You have the option of using a savings account, credit card, or line of credit as a method of overdraft protection.

To use a line of credit or a credit card for overdraft protection, your credit history must be good enough to qualify for this product. However, you must have a checking account and credit product with the same bank. Each bank will have different qualification criteria.

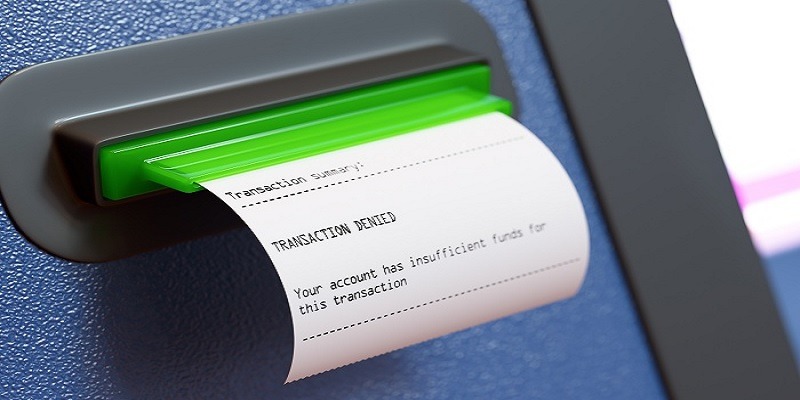

Without having overdraft protection, your bank will decline any transaction you try to make over the amount available in your checking account. Instead of being charged an overdraft fee, your bank will charge you a insufficient funds fee. The merchant might also charge you a fee in addition to original amount of your transaction.

Credit Card and Line of Credit Overdraft Protection

Keep in mind that overdraft protection could affect your credit if you’ve linked your checking account to a credit card or line of credit as a backup source of funding. Some credit card issuers may even treat your overdrafted payments as a cash advance.

This results in overdraft protection being more expensive because cash advances often have a higher interest rate with no grace period. As time passes, you might end up paying just as much, if not more, on the cash advance then you would have in overdraft fees.

As mentioned above, if your overdraft is connected to some form of credit, such as a line of credit or a credit card, you might risk paying fees on the overdraft if you don’t pay the balance before the grace period runs out (if there even is one).

However, if you already have a balance on your line of credit, then the overdraft will just be added to your current balance. If you don’t have enough available credit to cover the transaction, then you’ll be charged an overdraft fee anyways.

Impact To Your Credit

Overdraft protection is actually a great tool that can help protect you from problems that stem from not having enough money in your checking account. However, do not rely to heavily on this feature because you will be in bigger trouble if you can’t afford to pay the overdraft later.

For example, your credit score may be damaged if you can’t pay a overdraft that is on your credit card. If the overdraft pushes your credit utilization above 30%, your credit score could drop because of the higher balance.

Optional Overdraft Protection

Nowadays, banks are required to ask their customers if they would like to opt-in or opt-out of overdraft fees. If you decide to opt out, your bank will simply decline any debit card transactions that may go over your checking account balance.

Instead, you will be charged an non-sufficient funds fee. If you decide to opt in to overdraft fees, this means you will be able to charge any amount to our checking account balance, but you will be charged an overdraft fee.

|

|

Bottom Line

To summarize what we’ve went over, overdraft protection can be a great tool in helping you, but it can also hurt you if you’re not responsible. Opting in to the feature will allow you to still make purchases even if you don’t have sufficient funds in your checking account balance.

Regardless, you will still be charged some sort of fee if you go over your balance. Be sure to check out our bank guides, credit card bonuses and ways to save money!

Leave a Reply