The Bank of American Business Advantage Cash Rewards Mastercard Credit Card is a great way to earn some cash back for purchases made for your business. To help your business out, they are even offering a $350 statement credit when you make at least $3,000 in purchases within 90 days of account opening. Additionally, you’ll get 3% back at gas stations and office supply stores, 2% on restaurants and an unlimited 1% cash back on everything else. With no annual feed and cash back that never expires, this is a card worth consideration. If you’re interested in the Bank of America Business Advantage Cash Rewards Mastercard Credit Card, read on!

The Bank of American Business Advantage Cash Rewards Mastercard Credit Card is a great way to earn some cash back for purchases made for your business. To help your business out, they are even offering a $350 statement credit when you make at least $3,000 in purchases within 90 days of account opening. Additionally, you’ll get 3% back at gas stations and office supply stores, 2% on restaurants and an unlimited 1% cash back on everything else. With no annual feed and cash back that never expires, this is a card worth consideration. If you’re interested in the Bank of America Business Advantage Cash Rewards Mastercard Credit Card, read on!

The Ink Business Unlimited® Credit Card offers $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. You'll earn an unlimited 1.5% cash back on every purchase made for your business and you'll receive employee cards at no additional cost. This card carries no annual fee. |

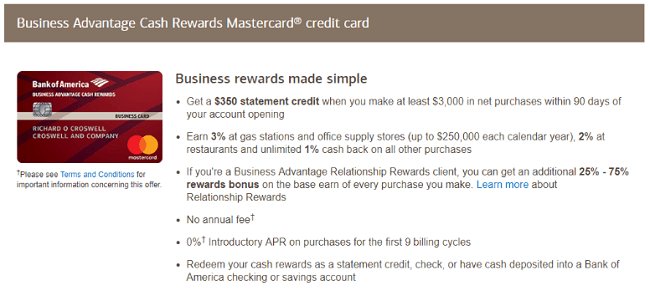

Business Advantage Cash Rewards Card Summary:

- Earn $350 statement credit when you make $3,000 in purchases within 90 days of account opening

- 3% on gas stations and office supply stores

- 2% cash back at restaurants

- 1% cash back on all other purchases

- Business Advantage Relationship Rewards Clients can get an additional 25% – 75% rewards bonus on the base of every purchase you make

- No Annual Fee

Business Advantage Cash Rewards Card Bonus:

- Cash Flow Management Tools. Manage your business with online services including automatic payments, transfers, downloading transactions into QuickBooks and tracking it all in the MyReport Center.

- $0 Liability Guarantee. The $0 Liability Guarantee covers fraudulent transactions made by others using your account. Claims against posted and settled transactions subject to dollar limits and verification, including providing requested information supporting fraudulent use claim.

- Overdraft Protection. Overdraft transfers to your eligible Bank of America deposit account from your credit card account will be Bank Cash Advances under your Credit Card Agreement. Transfers will be subject to the terms of both your Credit Card Agreement and the account agreement(s) and disclosures governing your Bank of America deposit account.

- Mobile and Text Banking. Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Bank of America does not charge for Text Banking. However, your mobile service provider may charge for sending and receiving text messages on your mobile phone. Check with your service provider for details on specific fees and charges that may apply. Message and data rates may apply.

- Alerts. You may opt in to receive alerts via text or email. Bank of America does not charge for this service but your mobile carrier’s message and data rates may apply. Delivery of alerts may be affected or delayed by your mobile carrier’s coverage.

- FICO® Score Program. The FICO Score Program is available only for primary cardholders with an open and active consumer credit card account who have a FICO Score available. Simply access this through Online Banking, the Mobile website, and the Mobile Banking app.

Bottom Line:

In the market for a new business credit? Then be sure to check out the Bank of America Business Advantage Cash Rewards Mastercard Credit Card to earn some cash back for all your purchases! For a limited amount of time you can even earn a $350 statement credit promotion when you make $3,000 in purchase within the first 90 days of account opening. Don’t forget that you can earn up to 3% cash back on select purchases and 1% on all others. If this is something that you would be interested in and you would like more from Bank Of America, see our list of the Best Bank of America Promotions! For more credit cards, see our latest list of the best credit card bonuses!

The editorial content on this page is not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are author’s alone.

The Ink Business Cash® Credit Card offers $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening. You'll earn: • 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year • 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year • 1% cash back on all other card purchases with no limit to the amount you can earn. This card comes with no annual fee. You'll be able to take advantage of employee cards at no additional cost. |