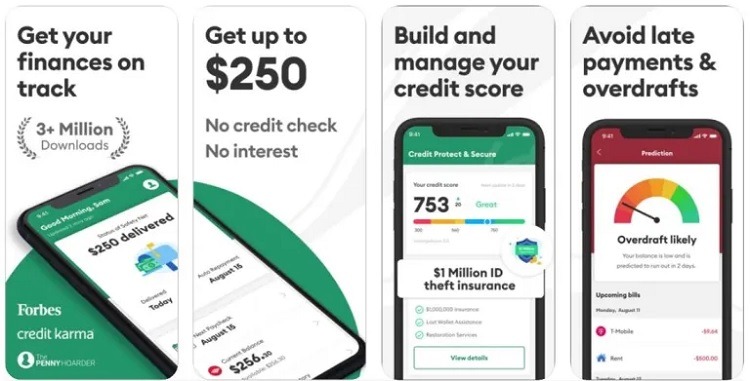

What exactly is Brigit (hellobrigit.com)? It is a financial wellness company that offers a “cash safety net,” bridging the gap between when you need money and when your paycheck clears. They offer cash advances of up to $250 without any interest. According to the company, they’ve helped their members each save an average of $514 annually.

If you’re living paycheck to paycheck, it only takes one emergency expense to not have enough money to pay a monthly bill, which means getting hit with a late fee or NSF fee and digging yourself into a deeper hole. Keep reading down below to learn more.

(click the link above to learn more)

Brigit Features

Brigit is a financial app that offers budgeting and credit-building features, as well as paycheck advances with no credit check or credit approval needed.

Brigit Plus

Brigit Plus is a paid membership that provides access to cash advances (automatic and by request), credit monitoring, and up to $1 million of identity theft insurance.

Members can take out advances of up to $250 to cover money shortages with no fees or interest. Repayment happens automatically, when you get your paycheck. Don’t worry, you’ll get a reminder one business day ahead of the withdrawal, and you can extend the due date without a late fee or penalty.

To be eligible for Brigit Plus, you’ll need to have a Brigit Score of 70 or higher. The Brigit Score is a number between 0 and 100. It is determined by a variety of factors, including account balance over time, deposit amounts, and how much money is spent compared to how much is earned.

Other Features

Brigit offers the following features for free:

- Alerts when overdraft risk is high

- Budgeting tools

- Financial insights

- Credit monitoring

- Identity theft protection

- Opportunities for full- and part-time work.

- Credit-builder loans (0% APR, 1 to 2 year terms)

Customer support is available via email.

Brigit Cash Advance Eligibility

To qualify for Brigit cash advances, you’ll need to meet the following requirements:

- You have had at least three recurring deposits from the same employer, totaling a minimum of $1,500 per month.

- You have a checking account that is at least 60 days.

- You use your checking account daily for at least two weeks.

- You have a bank account balance of more than $0.

- You have a cash cushion two days after you get paid.

Brigit Limitations

To get full access to all of Brigit’s features, you’ll need to pay a $9.99 monthly subscription, and even then, not everyone is eligible. Other limitations include:

- Not compatible with Chime, Capital One, and Netspend.

- Not compatible with joint checking accounts.

- Requires access to your banking account.

Brigit cash advances, like other cash advances, may also create a bad habit of borrowing against future earnings.

|

|

Bottom Line

Brigit is a better alternative to costly payday loans. You won’t pay any interest on your cash advance, but keep in mind, you will have to pay a $9.99 monthly fee. It’s best suited for those who need to cover an emergency expense every once in awhile. If you regularly spend more than you earn, we suggest you review your finances and consider a better alternative.

You might also want to have a look at Dave. They offer advances of up to $200 and charge a $1 monthly subscription fee. Dave is currently offering a $5 welcome bonus.