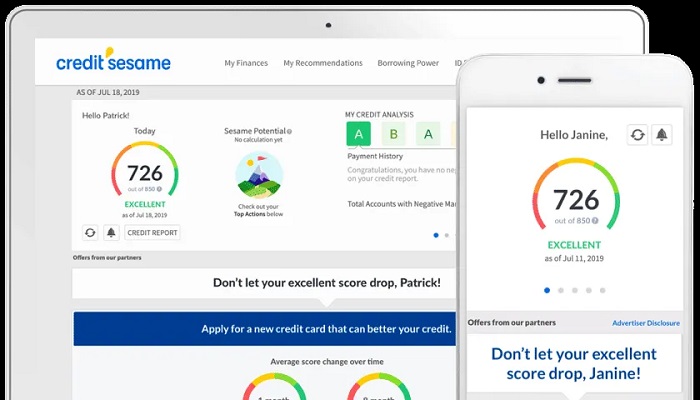

Credit Sesame is a site that offers a free credit score with no obligation of any kind. By monitoring your credit information, you can take action if errors or fraud occur and improve your score. Users can get access to their credit score and report for free, along with $50,000 in identity theft insurance. But with so many credit monitoring services out there, is it the right fit for you? They have plenty of services to offer, which makes it trustworthy for Americans everywhere.

(Click the link to learn more at Credit Sesame)

Credit Sesame Features

Credit Sesame allows you to monitor your VantageScore credit score and TransUnion credit report, see tips on how to improve your credit, and get alerted for any credit report changes.

For the premium subscription, you can access your full credit report from all three credit bureaus.

(Click the link to learn more at Credit Sesame)

Free Identity Theft Insurance

Credit Sesame’s free plan provides you with identity restoration tools and $50,000 of insurance for identity theft, fraud and other financial crimes, and covers:

- Attorney’s fees and legal representation, up to $125 per hour

- Notary and court costs

- Application and re-filing fees

- Lost wages for time off work

- Dependent care coverage

- Travel costs

- Postage and communication costs

If you sign up for the Credit Sesame Pro plan, enjoy $1 million in identity insurance.

Score Simulator

Credit Sesame’s “What If” tool lets you see what might happen if you pay off some debt or applying for a credit card. This helps you make education decisions when it comes to your credit.

Product Recommendations

Credit Sesame recommends credit cards and other financial products that you will likely qualify for and shows how much credit you’ll probably gain when you get approved. You can also check to see if you pre-qualify for any personal loans or mortgages.

Credit Sesame Credit Monitoring Plans & Pricing

A free Credit Sesame account will get you access to your credit score and report, along with alerts to credit score changes and up to $50,000 in identity theft insurance. For more robust features, you’ll want to upgrade to a paid, premium plan:

| ADVANCED | PRO | PLATINUM | |

|---|---|---|---|

| Pricing per month | $7.95 billed annually $9.95 billed monthly |

$12.95 billed annually $15.95 billed monthly |

$15.95 billed annually $19.95 billed monthly |

| Daily score update from 1 bureau | X | X | X |

| Monthly score update from 3 bureaus | X | X | X |

| Monthly report from 3 bureaus | X | X | X |

| ID theft insurance | $50,000 | $50,000 | $50,000 |

| Credit monitoring from all 3 bureaus | X | X | |

| 24/7 live experts to deal with credit report inaccuracies | X | X | |

| 24/7 lost wallet assistance | X | ||

| Monitoring of public records, dark web & SSN | X |

Bottom Line

If you’re someone who is frequently worrying about their credit, take advantage of signing up for Credit Sesame. You won’t lose anything by sign up because it is completely free! You’ll be able to monitor your credit report and score, as well as help you out if you need help with certain decision making.

Check out TransUnion and Experian, another credit monitoring service, if you are interested. For more ways to save more, check out our post on how save money online and bank guides here on HMB!

(Click the link to learn more at Credit Sesame)