Whenever you decide to open a checking or savings account, you’re going to probably want to know that your money is safe. Although it is rare, bank failures can still happen at any moment and could wipe out all the money in your accounts if you aren’t insured.

The Federal Deposit Insurance Corporation (FDIC) offers insurance to banks and their customers to safeguard against any bank failures. Since 1934, the FDIC has never failed to insure customers who bank with a partner bank.

It is quite simple to check if a bank is insured by the FDIC, however there are limits. To figure out whether or not your bank deposits are protected, learn more about the role of the FDIC and its limits.

How to Tell if a Bank is Covered by FDIC Insurance

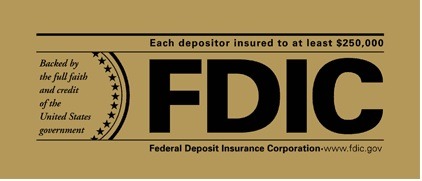

As mentioned above, it is very simple to spot which bank is FDIC insured. All FDIC-member banks must display the official FDIC sign at each teller window and on their websites. Additionally, the FDIC has a tool that will help you locate banks in your area that has FDIC deposit insurance.

Keep your eyes open for this image to confirm FDIC insurance:

FDIC insurance rules and limits apply to a number of different types of deposit accounts. However, to take advantage of these benefits, there are some exclusions that you must take note of to make sure your deposit qualifies.

Which Accounts Are Covered by FDIC Insurance?

Protected deposit products

The FDIC insures a specific group of deposit accounts:

- Checking accounts

- Savings accounts

- Negotiable Order of Withdrawal (NOW) accounts

- Money market accounts (MMAs)

- Certificates of deposit (CDs)

From the list above, you can probably recognize a couple of these bank products. The most common items people probably have is a checkings or savings account.

A Negotiable Order of Withdrawal or NOW account is something with which you might not be familiar. A NOW account is simply another term for an interest-bearing checking account. The main difference between this type of account and any other type of checking account is that you cannot automatically withdraw on demand. Legally, banks have the right to request seven days’ written notice, though they may not enforce this rule.

Other bank items

In addition to those deposit accounts, the FDIC also offers insurance coverage for:

- Cashier’s checks

- Money orders

- Traveler’s checks

- Accrued interest and other liabilities

With these, there are not any special rules you must meet to ensure that you’re covered. As long as the financial institution holding these deposits is FDIC-insured, so are the deposits. Also, many brokerages offer FDIC-insured CDs to their customers.

Which Accounts Do Not Have FDIC Insurance Coverage?

Although FDIC insurance will protect certain types of bank products when banks fail, they do not offer blanket coverage for other types of products. Assets from failed banks or other financial institutions that wouldn’t be covered include:

- Annuities

- Stocks

- Bonds

- Life insurance policies

- Mutual funds

- Municipal securities (such as municipal bonds)

- Safe deposit boxes and their contents

- U.S. Treasury bills, bonds or notes

There is an upside, however. Any U.S. Treasury bills, bonds or notes you own are backed by the full faith and credit of the U.S. government.

How Much Is Covered Under FDIC Insurance Limits?

It is critical to know the extent of insurance coverage when it comes to your deposit accounts. For FDIC insurance limits, the current limit is $250,000 per depositor, per bank.

However, you are only bound by these limits at that bank only. If you were to hold a $250,000 CD at Bank A and another $250,000 CD at Bank B, the principal in both CDs would be fuly protected by the FDIC insurance limit. Keep in mind that these must be at different banks. It won’t work if they are just at different branches of the same bank.

Does Adding Owners to an Account Increase Coverage?

The short answer to this question is that the ownership category does matter for how assets are covered. If an individual has a $500,000 savings account, only the first $250,000 is covered. However, if the account has the name of the individual and their spouse, they will each be insured up to $250,000 of coverage. This way, the whole account will be insured.

Keep in mind, both individuals must have full and equal access to the funds (even in community property states) or the FDIC will consider only one of them an owner. The coverage then drops to $250,000.

Does Opening Different Accounts at the Same Institution Increase FDIC Insurance Coverage?

Coverage can be increased if you open accounts that are under a different ownership category. Of course each financial institution will have their own rules. Here is a quick summary of different accounts and how they are covered:

IRAs – Individual Retirement Agreements

IRA accounts – self-directed or traditional – are insured to a maximum of $250,000, and that is in addition to the $250,000 on other savings.

Corporate accounts

Corporate (but not sole proprietorship) accounts are treated as separate from personal accounts and subject to their own $250,000 limits.

Trust accounts

Trust accounts may qualify for up to $250,000 in coverage per beneficiary if certain conditions are met.

Joint accounts

Joint accounts are protected for up to $250,000 at each institution. So a married couple could keep $1,000,000 liquid and insured by dividing up the money as follows: husband’s single account: $250,000, wife’s single account: $250,000, joint account: $500,000 ($250,000 each).

Are There Other Ways to Gain Additional Insurance Coverage?

The Certificate Deposit Account Registry Service (CDARS) allows depositors at banks registered with the network to buy FDIC-insured CDs up to a total of $50 million. This is only possible because the network takes care of spreading the funds throughout different banks.

The only downside is that the CD rates offered may be lower than w hat could be obtained by shopping for rates with competing banking institutions. But, each of your CDs w ould be protected if one bank fails.

Are Credit Unions FDIC-insured?

Credit unions work under a different name but similar service as FDIC coverage and it is called the National Credit Union Administration (NCUA).

The National Credit Union Share Insurance Fund covers deposit accounts at credit unions, up to $250,000. Credit union members’ interest in all joint accounts combined is insured up to $250,000 as well. The Fund also offers the same coverage limit for IRA and KEOGH accounts and has the full faith and credit of the U.S. government.

How Does the FDIC Pay Depositors When a Bank Fails?

Simply put, if the FDIC is able to get another institution to take over, all accounts are merely transferred to a new institution when one bank fails. However, if no banks can take over, the FDIC cuts checks directly to the account holders, usually within a few days. The goal of the FDIC is to get the money to consumers within two days, but it doesn’t always happen.

What Coverage Mistakes Do Investors Most Commonly Make?

In 1999, a customer found that, of his $1.4 million deposited, nearly $1 million was uninsured when his bank went under. You might be wondering how that is possible. The FDIC claims that these most common errors result in unintentionally uninsured funds:

Underinsured joint accounts

This can be a very difficult situation to navigate around. This happens when one member of a joint account is unaware of accounts held by the other at the same bank. For example, if the couple has an account with $500,000 dollars, and one of the account holders has a secret account with $100,000 at the same bank, the $300,000 of coverage exceeds the limit of coverage for joint accounts.

Deposits by real estate agents, attorneys or brokerage firms going to existing accounts

This may be less common, but it is still a possibility. For example, money can be put into escrow for real estate transactions, used to purchase CDs as part of an investment strategy or paid as an inheritance or settlement. If those deposits go into financial institutions where you already have accounts, the balances could exceed insured limits. The result would be that you’d be left uninsured if a portion, if any, exceeds the amount of allowed coverage.

Brokerage accounts not appropriately titled

Brokerage accounts can cause other problems altogether. If a broker were to pool an investor’s funds with others bu the account is not properly titled, it will only be insured up to the $250,000 limit regardless of how many investors own the money. The FDIC suggests that investors know everything about the rules of their institution and keep track of all account balances.

|

|

Bottom Line

To make sure all of your assets are secure and covered by the FDIC, do you research to make sure your bank is covered. Generally, the FDIC is geared toward covering people who have simply banking needs as mentioned in our list above.

Use our post above to learn more about the FDIC insurance limit and our list of bank guides to continue your learning!