Take a look at the latest MidContry Bank promotions, bonuses, and offers here.

Right now, you can earn a $500 and $100 bonus when you open a new business checking account and meet the requirements.

About MidContry Bank Promotions

MidCountry actively engages in its communities to provide high quality, diversified financial services and solutions. A comprehensive scope of banking, cash management, equipment leasing, mortgage, insurance and investment products, tools and services makes us a solid financial ally for both traditional and progressive-minded clients.

- Availability: MN (Branch Locator)

- Routing Number: 291970033

- Customer Service: (877) 874-7376

However, if you don’t live near a branch, you can check out other great bank bonuses, bank rates, and also CD rates found nationwide!

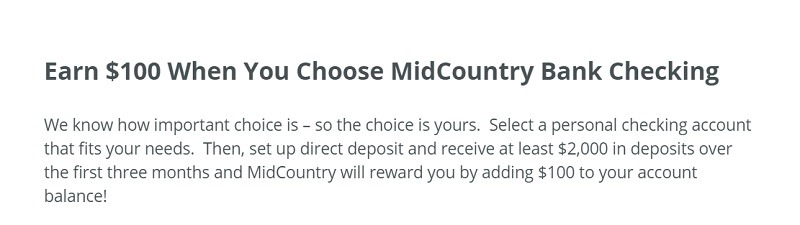

(Expired) MidCountry Bank $100 Checking Bonus

Earn a $100 bonus with MidCountry Bank!

Receive up to a $100 bonus for opening a new checking account and meeting certain requirements.

- Account Type: Rewards4Me or Checking4Me Account

- Availability: MN

- Direct Deposit Requirement: None

- Hard/Soft Pull: Unknown

- ChexSystem: Unknown

- Credit Card Funding: Unknown

- Monthly Fee: Yes

- Early account termination fee: None

- Household limit: 1

(Expires October 31, 2020)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How to Earn $100 Checking Bonus

- Open a qualified checking account and complete the following requirements

- Accountholder must have a minimum of $2000 deposited to the new checking account by direct deposit or automatic deposit during the first 90 calendar days after the account is opened

- Checking4Me

- MidCountry Bank Debit MasterCard®

- MoneyPass®ATM Transactions

- Online Banking

- Online Bill Pay

- Mobile Banking

- eStatements

- No Interest

- Up to $15 ATM transaction fee refunded per statement cycle

- Up to 5 Popmoney standard transaction fees refunded per statement cycle

- Standard Check Charges Apply

- Rewards4Me

- MidCountry Bank Debit MasterCard®

- MoneyPass®ATM Transactions

- Online Banking

- Online Bill Pay

- Mobile Banking

- eStatements

- Interest Earned on Tiered Balances

- 1 Complimentary Box of Specialty Checks per Year

- Up to $15 ATM transaction fee refunded per statement cycle

- Up to 3 official check fees refunded per statement cycle if your relationship balance is maintained at $10,000+

- Complimentary 3×5 safe deposit box, or a credit toward a larger box rental if your relationship balance is maintained at $10,000+

- Rewards4Me:

- $15 monthly service fee

- Earn rewards credit each statement cycle to offset the monthly service fee. Accounts must remain in active status to receive rewards credit.

- $15 monthly reward for customers who have attained age 55+

- $3 monthly reward for enrolling in eStatements

- $15 monthly reward if your relationship balance is maintained at $10,000+

- $5 monthly reward:

- If your checking account average balance is maintained at $1000+

- 10 or more debit card transactions posted within the statement cycle

- Direct deposit into your Rewards4Me Checking account each statement cycle

- Checking4Me:

- $8 monthly service fee

- Earn rewards credit each statement cycle to offset the monthly service fee

- $8 monthly reward for customers under age 18

- $3 monthly reward for enrolling in eStatements

- $5 monthly reward for 10 or more debit card transactions posted within the statement cycle

- $5 monthly reward for a direct deposit into your Checking4Me account each statement cycle

- If this requirement is met, the account is open and has a positive balance, the bonus will be credited to the account within the statement period following the 90 calendar day qualifying window

- If the account is closed within 12 months from the account open date, MidCountry Bank reserves the right to deduct the monetary bonus from the account prior to closing

- Accountholder is responsible for any applicable taxes

- Subject to termination at any time

- Other conditions and restrictions may apply

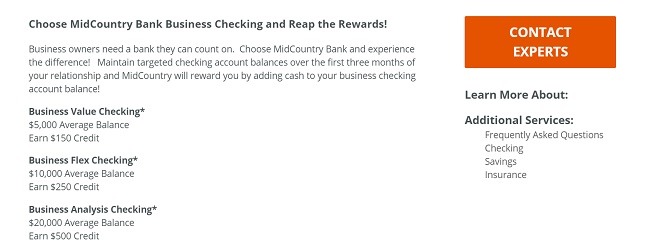

(Expired) MidContry Bank $500 Business Checking Bonus

Earn a $500 bonus when you open a new business checking account.

Receive up to a $500 bonus for opening a new business checking account and meeting certain requirements.

- Account Type: Business Value, Business Flex, Business Analysis Checking Account

- Availability: MN

- Direct Deposit Requirement: None

- Hard/Soft Pull: Unknown

- ChexSystem: Unknown

- Credit Card Funding: Unknown

- Monthly Fee: Yes

- Early account termination fee: None

- Household limit: 1

(Expires October 31, 2020)

| Chase Business Checking ($300 or $500 Bonus) | Bank of America Business Checking ($200 bonus offer) |

| Axos Business Premium Savings ($375 Bonus) | Axos Bank Basic Business Checking ($400 Bonus) |

| Axos Bank Business Interest Checking ($400 Bonus) | Huntington Unlimited Plus Business Checking ($1,000 Bonus) |

| Huntington Unlimited Business Checking ($400 Bonus) | Bluevine Business Checking ($300 Bonus) |

| U.S. Bank Business Checking ( $500 or $900 Bonus) | |

How to Earn $500 Checking Bonus

- Open a qualified business checking account and complete the following requirements.

- To qualify for the bonus, accountholder must meet a minimum average month-to-date (MTD) balance in the new checking, measured on the first 60 day period after the account is opened.

- Business Value accounts must maintain a $5,000 average MTD balance for a $150 bonus

- Business Flex Checking accounts must maintain a $10,000 average MTD balance for a $250 bonus

- Business Analysis Checking accounts must maintain a $20,000 average MTD balance for a $500 credit.

- Free checking with no minimum balance required

- Courtesy Pay

- eStatements

- Online Banking

- Value Checking: There are no monthly fees

- Flex Checking: No service charge if a $2,500 average collected balance is maintained. $12 monthly service charge if the minimum balance is not maintained.

- Analysis Checking: $16 monthly service charge is assessed, subject to earnings credit allowance.

- If the account is closed within 12 months of the account open date, MidCountry Bank reserves the right to deduct the monetary bonus from the account prior to closing.

- Accountholder is responsible for any applicable taxes.

- Limited time offer valid 9/21/2020 to 10/31/2020.

- Subject to termination at any time.

- Other conditions and restrictions may apply.

|

|

Bottom Line

If you live near a branch, be sure to check out this promotion for an easy way to earn some extra cash. All you have to do is open a new checking account and you will earn a $100 and $500 bonus and gain access to many great features that come with the account.

*Check back at this page for updated MidContry Bank promotions, bonuses and offers