Check out the latest Summit Federal Credit Union promotions, bonuses, and offers here.

Update 3/5/25: There’s currently a $150 savings bonus available through 3/31/25.

About Summit Federal Credit Union Promotions

In 1941, three employees of the Rochester Telephone Corporation founded the credit union with a simple goal: to help members save and borrow at attractive rates in order to improve their lives. Over 75 years later, with a vastly expanded array of products and services, The Summit still holds that goal.

| Eligibility: Membership in The Summit Federal Credit Union is open to those who live, work, worship, volunteer or attend school in the City of Buffalo, City of Geneva, City of Rochester, City of Syracuse, City of Tonawanda, Town of Amherst, Town of Henrietta, Town of Tonawanda, or Cortland County. Employees, retirees, or volunteers of a member company are also eligible to join, as are the relatives of existing Credit Union members. See more information here. |

Summit Federal Credit Union $150 Savings Bonus

- What you’ll get: $150 bonus

- Account Type: Savings Account

- Availability: NY (Branch Locator)

- Direct Deposit Requirement: No

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Credit Card Funding: Unknown

- Monthly Fees: See below

- Early Account Termination Fee: Not listed

- Household Limit: None

(Expires 03/31/2025)

| AlumniFi Credit Union Savings (4.75% APY) | SoFi Checking & Savings ($325 Bonus + 3.80% APY) |

| Upgrade Premier Savings (4.15% APY) | Discover® Bank Savings (Up to $200 Bonus + 3.70% APY) |

| CIT Bank Platinum Savings (4.00% APY) | Harborstone Credit Union Money Market (4.30% APY) |

| FVCbank Advantage Direct Savings (4.55% APY) | Live Oak Bank Savings (4.10% APY) |

How To Earn Bonus

- Earn a $25 bonus when you open a new Summit Visa® Debit Card & RoundUp Savings account.

- Earn a $50 bonus when you make 20 point of sale purchases with your Summit Visa® Debit Card.

- Earn a $75 bonus when you reach your RoundUp Savings milestones.

- FEDERALLY INSURED BY NCUA.

- Membership eligibility required. Offer limited to members that have not had a debit card or RoundUp Savings account in the past 120 days or has been paid a checking/debit promotional bonus in the past 36 months.

- Limited to 1 cardholder per account (primary cardholder) for up to $75 with a new debit card and RoundUp Savings.

- You must complete the following to receive the maximum bonus of $75 with a new debit card and RoundUp Savings.

- To receive the one-time $25 debit card and RoundUp Savings opening bonus you must order a new debit card and open a RoundUp Savings account between 2/1/25 and 3/31/25.

- To receive the $50 bonus, you must complete 20 point-of-sale transactions post to your account by 5/31/25 and the card and account must remain open through 9/30/25.

- Please allow 4-6 weeks after meeting qualifications to receive your gift.

- Earn up to two special one-time bonuses totaling $75 that The Summit will deposit into your RoundUp Savings when your RoundUp Savings account reaches a balance of $250 ($25 bonus) and $500 ($50 bonus).

- The APY is 0.200% as of 2/1/25, and is subject to change at any time.

- Please refer to the RoundUp Savings account Terms and Conditions at summitfcu.org/roundup-terms.

- Cash bonus will be reported, and you will receive IRS Form 1099-INT.

- Any applicable taxes are the responsibility of the member.

- Offer subject to change at any time at our sole discretion without notice.

- The Account Maintenance Fee is waived if you meet certain conditions.

- See branch for details.

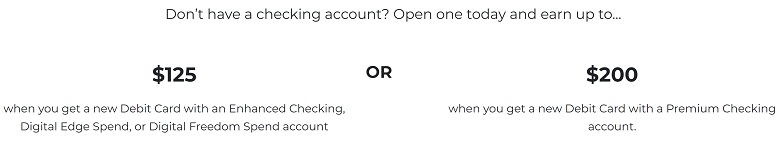

Summit Federal Credit Union $125 or $200 Checking Bonus *Expired*

- What you’ll get: $125 or $200 bonus

- Account Type: Checking Account

- Availability: NY (Branch Locator)

- Direct Deposit Requirement: Yes (see what works)

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Credit Card Funding: Unknown

- Monthly Fees: See below

- Early Account Termination Fee: Not listed

- Household Limit: None

(Expires 03/31/2023)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | HSBC Premier Checking (Up to $3,000 Cash Bonus), |

How To Earn Bonus

- Earn $125 when you get a new Debit Card with an Enhanced Checking, Digital Edge Spend, or Digital Freedom Spend account

- Earn $200 when you get a new Debit Card with a Premium Checking account.

- How it works:

- Order your Debit Card by September 30th

- Use your card to make 20 purchases

- Plus get $5 more when you sign up for e-statements

- FEDERALLY INSURED BY NCUA.

- Membership eligibility required.

- Offer limited to members that have not had a debit card in the past 12 months.

- Limited to 1 cardholder per account (primary cardholder) for up to $125 maximum with Enhanced Checking, Digital Edge or Digital Freedom Spend Accounts.

- To receive the $125 with Enhanced Checking, Digital Edge or Digital Freedom Spend Accounts, you must order a new debit card between 2/1/23 and 3/31/23, have 20 point-of-sale transactions post to your account by 11/30/22, enroll for e-statements prior to the 20 point-of-sale transactions post to your account and sign up for direct deposit.

- Please allow 4-6 weeks after meeting qualifications to receive your gift.

- Cash bonus will be reported, and you will receive IRS Form 1099-INT.

- Any applicable taxes are the responsibility of the member.

- Offer subject to change at any time at our sole discretion without notice.

- The Account Maintenance Fee is waived if you meet certain conditions.

- See branch for details.

How to Waive Monthly Fees

- Digital Edge: No monthly fees

- Digital Freedom: Waived with 10 Debit Card Transactions per month

- Enhanced Checking: Waived with Direct Deposit

- Premium Checking: Waived with Direct Deposit

|

|

Bottom Line

Make sure you check out Summit Federal Credit Union to learn more about the $150 bonus promotion. Don’t forget, the bonus will be reported on IRS Form 1099-INT.

However, if you are not a resident of New York, you can check out our list of the best bank bonuses, bank rates, and CD rates found nationwide!

*Check back at this page for updated Summit Federal Credit Union promotions, bonuses and offers.