TD Bank is here to help you take control of your wealth and legacy. With an expert financial team, they work with you to create a personalized plan to fit your needs and prepare you for the future. With over 22 million customers and more than 1,200 locations in the U.S, you can be sure that they know exactly how to help you. Having access to these advisers will help you withstand any sort of unforeseen accident and really help protect your assets. In addition to the advisers, you also have access to resources like Online and Mobile Banking, Bill Pay, and much more! If you want to learn more about these resources, be sure to check out our TD Bank Checking Features Review.

TD Bank is here to help you take control of your wealth and legacy. With an expert financial team, they work with you to create a personalized plan to fit your needs and prepare you for the future. With over 22 million customers and more than 1,200 locations in the U.S, you can be sure that they know exactly how to help you. Having access to these advisers will help you withstand any sort of unforeseen accident and really help protect your assets. In addition to the advisers, you also have access to resources like Online and Mobile Banking, Bill Pay, and much more! If you want to learn more about these resources, be sure to check out our TD Bank Checking Features Review.

| PROMOTIONAL LINK | OFFER | REVIEW |

| TD Bank Beyond Checking | $300 Cash | Review |

| TD Bank Convenience CheckingSM | $200 Cash | Review |

How to Take Control of your Future:

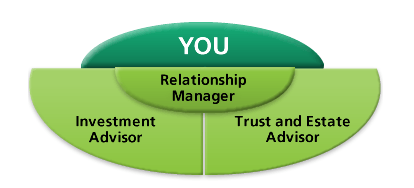

First Step: Apply to for a dedicated Personal Relationship Manager. They are the bridge between you and the resources that you’ll need. They are the ones who consult with the rest of the team. They are the ones who want to get to know you, your ideals, beliefs, aspirations, so that they understand your goals and aspirations. They use this knowledge to create an individualized plan to accommodate to your needs. Once you’ve made a plan, it’s all a matter of execution, which leads us to the second step.

Second step: Bringing that plan into reality. This is the job for the rest of the team, those who make the change. This team involved people like Investment Advisers, Trust and Real Estate Advisers, lawyers, and tax accountants. With the plan created, they’ll take the complexities of each industry and break it down step by step to ensure your assets are secure. For example, Investment Advisers can use your interests of companies you believe in, companies that you think will do well, and combine it all into one portfolio, readily accessible and easy to understand.

Final step: Being constant. Not only do your assets and investments change as time passes on, so do you, with everything that you do. As you grow with your investments, your beliefs and priorities grow too, and the plan that you started may not be what’s best for you anymore. That’s why it’s important to remain constant, because the more you work with your Relationship Manager, the better that they can adjust your plan to fit your needs.

Additional TD Bank Features:

Trust and Estate Management Service is there to guide you and make sure you have foundations and philanthropic giving, professional management of trusts, assistance for clients serving as Trustees and Executors, and impartial estate settlement. Each trust that they handle is just as unique as the families that they manage, just like how no two families are the same. This team possesses years of industry knowledge that they can utilize to prepare you for any sort of situation.

High Net Worth Planning is a specific asset of TD Bank to help you plan for your retirement, allocate your assets, fund your education, and assist in an major purchases. Their goal is to make sure that the money is going into all the right places to make sure that your future is secure. Whether you buy a house, car, pay for a college tuition, they are there to break it down and formulate a budget so that these large purchases don’t seem as daunting anymore.

Along with these two services, TD Bank also offers an Investment Management Service as well, to help you create a portfolio geared towards your financial needs. If you’re interested, be sure to check out TD Bank Investment Management Service Review.

Bottom Line:

TD Bank created a trustworthy program that will help you take control of your future and all you have to do is sign up for their TD Bank Personal Relationship Manager. These managers are they to get to know you, because their number one priority is to make sure that you’re prepared for the future. They work together with a multitude of other resources and departments to ensure that your money will always be in safe hands. Furthermore, don’t hesitate to check out our full list of TD Bank Promotions to learn more about what TD Bank has to offer!

The Chase Sapphire Preferred® Card offers 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. You'll earn: • 5x on travel purchased through Chase TravelSM • 3x on dining, select streaming services and online groceries • 2x on all other travel purchases • 1x on all other purchases • $50 Annual Chase Travel Hotel Credit • Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027. Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase TravelSM This card carries a $95 annual fee. |