Available nationwide, the Western Alliance Bank High-Yield Savings account is offering 3.80% APY rate for all balances + up to $1500 bonus powered by Raisin.

Western Alliance Bank High-Yield Savings

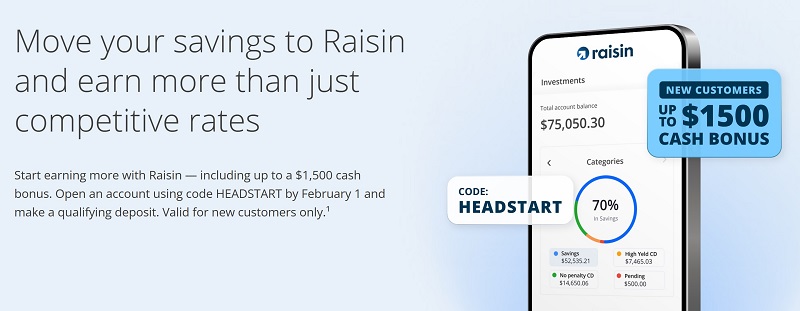

Update 3/4/26: You can currently earn up to $1500 bonus through 3/31/26!

- Start earning more with Raisin — including up to a $1,500 cash bonus. Open an account using code HEADSTART by March 31 and make a qualifying deposit. Valid for new customers only.

- Select a savings offer and sign up: Choose and fund at least one high-yield savings account or CD on the Raisin platform to get started. Be sure to enter bonus code HEADSTART during sign-up to be eligible for a cash bonus.

- Deposit funds: The more you save, the more you can earn. Make a qualifying deposit(s) within 14 days of opening your account to set your bonus tier.

- Deposit $10,000 – $24,499, earns a $70 cash bonus

- Deposit $25,000 – $49,999 earns a $175 cash bonus

- Deposit $50,000 – $99,999 earns a $350 cash bonus

- Deposit $100,000 – $199,999 earns a $750 cash bonus

- Deposit $200,000 or more earns a $1,500 cash bonus

- Maintain your deposit(s): Maintain your deposit(s) for 90 days from your first deposit date to earn your bonus.

Terms:

- New customers only. Earn a cash bonus when you deposit and maintain funds with partner banks on the Raisin platform. Customers will receive $70 for depositing between $10,000 and $24,499, $175 for depositing between $25,000 and $49,999, $350 for depositing between $50,000 and $99,999, and $750 for depositing between $100,000 and $199,999, and $1,500 for depositing $200,000 or more. To qualify for the bonus, your first deposit must be initiated between January 15, 2026, and March 31, 2026, by 11:59 PM ET, and the promo code HEADSTART must be entered at the time of sign-up. Only funds deposited within 14 days of the initial deposit date and maintained with partner banks on the Raisin platform for 90 days will be eligible for this bonus. Bonus cash will be credited directly to your Cash Account within 30 of meeting all qualifying terms. This offer is available to new customers only and may not be combined with any other bonus offers. Raisin may modify or end this offer at any time and may withhold or revoke bonuses in cases of fraud, abuse, or violation of these terms or Raisin’s Terms of Service.

About Western Alliance Bank High-Yield Savings

Year after year, Western Alliance Bank ranks high among the best commercial banks in the nation with more than $70 billion in assets, thanks to a combination of strong capacity, proven expertise and outstanding customer service. Western Alliance is a trusted, award-winning financial institution with experienced bankers who put customers first. Major accolades include being ranked as a top U.S. bank in 2022 and 2023 by American Banker and Bank Director.

| Balance Requirement | APY Rate |

| $0.01+ | 3.80% APY |

Western Alliance Bank High-Yield Savings Rate

- Learn More at Western Alliance Bank

- Account Type: High Yield Savings Account

- Interest Rate: 3.80% APY

- Availability: Nationwide

- Minimum Balance: $0.01+

- Maximum Balance: None

- Credit inquiry: Soft Pull

- Opening Deposit: $1

- Monthly Fees: No account activity or maintenance fees

- Early Termination Fee: None

(FDIC Insured)

How to Earn Western Alliance Bank Rate

- Open a new account with a minimum opening deposit of $500.

- Fill out your personal information – Provide your name, address, phone, email and social security number or Tax ID.

- Fund the account/transfer funds – Transfer funds electronically from an internal account here or an external account at another bank.

- Earn 3.80% APY.

Why You Should Sign Up For This Account

- FDIC insured

- Excellent rates with NO fees from Raisin.

- $1 minimum deposit. 24/7 online access.

Bottom Line

Check out this offer from Western Alliance Bank and open a High-Yield Savings account to earn the high rate today!

For more bank offers, see the complete list of Best Bank Rates!

Check back often to see the latest info on the Western Alliance Bank High-Yield Savings account.

For more, see our review on Western Alliance Bank here.

How long has western alliance bank been paying 5.31% on their savings accounts?

And, is that rate due to be lowered shortly, since none of their offered CD’s come even close to that rate.

And although I didn’t see a caution or disclaimer, aren’t banks free to change their savings rates at will, while a CD does lock in the customer’s CD Rate at time of opening.

All the while a possible Fed rate cut could be around the corner.

Would appreciate replies from anyone, either firsthand knowledgeable or what you expect will happen?

And thanks for any and all feedbacks!

How long does a withdrawal transaction take?

This was the easiest sign up I’ve ever encountered. No hassles, no delays. The online account setup worked great. I did not have to unfreeze my credit files to apply. They did not overreach on data collection. Only the minimum required information was requested. I was allowed to name a beneficiary right in the sign up process. Before I applied, I asked their support about ACH limits. Apparently, there are none except that the maximum single transaction is $250,000. The entire response is below. I’ll see what happens when I try to withdraw $200K on a single day. There is only a minimum $500 deposit to open. It’s one of the best interest rates in the country. I just got started with Western Alliance, but I’m hoping I’ll have full access to my money without all the ACH games many other banks play.

RESPONSE FROM WESTERN ALLIANCE SUPPORT CONCERNING ACH LIMITS

Thanks for reaching out to the Savings Premier support team. The maximum ACH allowed in or out is $250,000. The account allows users to deposit up to $250,00, while the total balance is allowed to be over that limit due to interest accrued. There are no transactional count limits. Depositing funds into the account takes 5 business days to settle. Withdrawals occur much faster as there are no mandatory settle days on withdrawals.