Want to save money on your next fill up? Then take advantage of the Amex Offers Phillips 66, 76, Conoco Promotion where customers can get $5 back when they spend $30+.

Want to save money on your next fill up? Then take advantage of the Amex Offers Phillips 66, 76, Conoco Promotion where customers can get $5 back when they spend $30+.

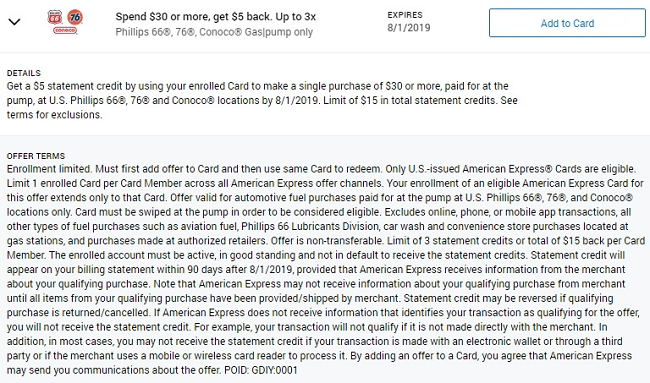

Simply enroll your card onto the offer and head to your nearest or preferred gas station to fill up. Once you pass the $30 mark, you’ll receive $5 back! Note that this promotion is set to expire on August 1, 2019, so take advantage of it while you can!

Amex Offers Phillips 66, 76, Conoco Promotion

- Check Your Offers!

- Promotion: Get $5/500 MR Points w/ $30 Spend

- Expiration: August 1, 2019

- Availability: Nationwide

- Terms: Must enroll card onto offer. Valid until 8/1/2019

Get $5 Statement Credit

- Log into your American Express account and add either one of the gas offers to your card if you have it.

- Make a $30+ purchase from whichever gas station offer you receive.

- Your $5 Statement Credit will appear on your billing statement within 90 days after your purchase.

Bottom Line

If you love saving money when you fill up your gas tank, be sure to take advantage of this Amex offer! Customers can get $5 off their $30+ fill up at any of the participating gas stations. Just be sure to enroll your card onto the offer before it expires on August 1, 2019.

If you love finding deals like this, be sure to check out more on HMB! You can also combine this offer with a great rewards card that you find on our compiled list of the Best Credit Card Bonuses!

| BMO Bank Checking: Open a new BMO Smart Money Checking Account and get a $400 cash bonus* when you have a total of at least $4,000 in qualifying direct deposits within the first 90 days. Learn More---BMO Checking Review *Conditions Apply. Accounts are subject to approval and available in the U.S. by BMO Bank N.A. Member FDIC. $4,000 in qualifying direct deposits within 90 days of account opening. |

| Chase Ink Business Unlimited® Credit Card: New cardholders can enjoy a welcome offer of $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. Click here to learn how to apply--- Review |

Leave a Reply