If you’re a loyal customer to Apple, consider looking into the Apple Credit Card, you might find yourself getting rewarded towards your next Apple purchase!

You can earn the best rewards towards Apple purchases where you can earn 3% back, while also earning 2% back on transactions made using Apple Pay.

Although there is no sign-up bonus, this card comes with no annual fee as well as no foreign transaction fee! Continue reading below if the Apple Credit Card is worth signing up for!

Apple Card $75 Sign Up Bonus

- Direct Link to Offer

- What’s the offer: $75 bonus

- When it expires: 01/16/2024

- How to earn it:

- Get $75 Daily Cash when you make your first purchase within 30 days

- Terms: Subject to credit approval. Valid only for new Apple Card owners who (1) apply for a new Apple Card using the link https://apple.co/referdailycash, 2) open an account by January 16, 2024, and (3) make a purchase within 30 days of account opening will earn $75 in Daily Cash. For clarity, any purchase by Apple Card Family Participants and Co-Owners does not qualify. $75 Daily Cash is earned after the first purchase transaction posts to your new Apple Card account. A return of this purchase may result in a $75 Daily Cash adjustment charge to the new account. An additional purchase made during the offer period may qualify the new account for re-fulfillment of the $75 Daily Cash bonus, but re-fulfillment may be delayed. Changes to the new account status during the o?er period may delay the fulfillment of the Daily Cash bonus. You can choose to direct Daily Cash to a Savings account or to an Apple Cash card. If you do not have either set up to receive your Daily Cash, it can be applied as statement credit upon request. Apple Card and Savings accounts are issued or provided by Goldman Sachs Bank USA, Salt Lake City Branch, Member FDIC. The Apple Cash card is issued by Green Dot Bank, Member FDIC. Daily Cash is subject to exclusions, and additional details apply. See the Apple Card Customer Agreement for more information. If we determine that the new account owner has engaged in or plans to engage in abuse or gaming in connection with this offer the new account will not be eligible for this offer.

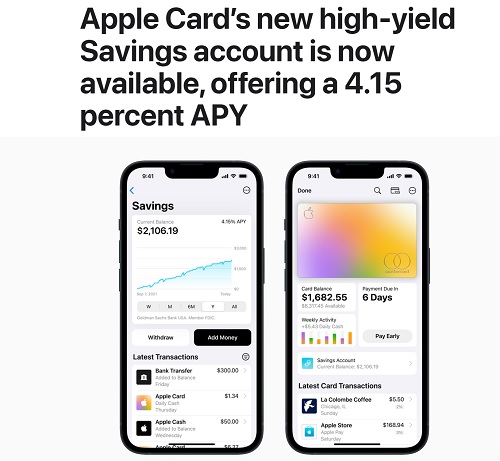

Apple High Yield Savings Account

Apple has announced that “Starting today, Apple Card users can choose to grow their Daily Cash rewards with a Savings account from Goldman Sachs, which offers a high-yield APY of 4.15 percent — a rate that’s more than 10 times the national average.2 With no fees, no minimum deposits, and no minimum balance requirements, users can easily set up and manage their Savings account directly from Apple Card in Wallet.”

Apple Card Summary

| Ongoing Rewards/Benefits |

|

| Foreign Transaction Fee | $0 |

| Annual Fee | None |

(Visit Apple.com to learn more about this card and its features)

| Ink Business Preferred® Card 90K Points after $8,000 spend within first 3 months | Ink Business Unlimited® Credit Card $750 Bonus after $6,000 spend within 3 months |

| Capital One Venture X Business 150K Miles after $30,000 spend within 3 months | Ink Business Cash® Credit Card Up to $750 Bonus: Earn $350 after $3,000 spend in the first 3 months and an additional $400 with $6,000 spend in the first 6 months. |

| Chase Sapphire Preferred® Card 75K Points after $5,000 spend within 3 months. | Chase Freedom FlexSM $200 Bonus after $500 spend within 3 months |

| The Platinum Card® from American Express 80K Points after $8,000 spend within 6 months. Terms Apply. | Capital One Venture X Credit Card 75K Points after $4,000 spend within 3 months. |

| American Express® Gold Card 60K Points after $6,000 spend within 6 months. | Chase Freedom Unlimited® Card $200 Bonus after $500 spend within 3 months |

| Chase Sapphire Reserve® Card 100K Points + $500 Chase Travel promo creditafter $5,000 spend within 3 months. | Capital One Quicksilver Cash Rewards Card $200 Bonus after $500 spend within 3 months |

Earning Points & Rewards

The Apple Card offer its own version of cashback rewards called ‘Daily Cash.’ Cardholders can earn:

- 3% Daily Cash on Apple purchases

- 2% on purchases made with Apple Pay

- (additional 3% when using Apple Pay for purchases from Walgreen’s, Duane Reade, Uber, UberEATS, T-Mobile store, Nike)

- 1% on purchased made at merchants that don’t accept Apple Pay.

There is no limit on the amount of Daily Cash you can earn and Daily Cash does not expire. Plus, if you choose to close the account and you have unredeemed Daily Cash, the bank will either credit it to your account, send it to you electronically, or mail you a check.

Redeeming Rewards

Daily Cash automatically goes on your Apple Cash card, which you can use on anything that you pay for using Apple Pay. If you don’t have an Apple Cash account, your Daily Cash will be redeemed as a statement credit.

Apple Card Features

Since it doesn’t offer things like cash advances or balance transfers, Apple Card has very few fees. Late or missed payments don’t carry a fee, but it will result in additional interest accumulating on your balance.

Plus, most merchants in different countries accept Apple Pay, so if you happen to come across by one, Apple Card doesn’t charge a foreign transaction fee.

Both the physical and virtual Apple Cards have no numbers on them. For non-Apple Pay transactions on apps or websites requiring a card, the Wallet app or Safari web browser autofills a virtual card number.

The Apple Card through your wallet app has a built-in spending summary. Spending summaries help see and track where you money goes; everything is color coded, so you can pinpoint which area you spent the most.

The spending summary can be viewed weekly or monthly. For chronic over-spenders, this could curve spending.

Another convenient feature, that allows you to locate your transactions. Apple Card uses the Maps app to help you pinpoint where you made your purchases!

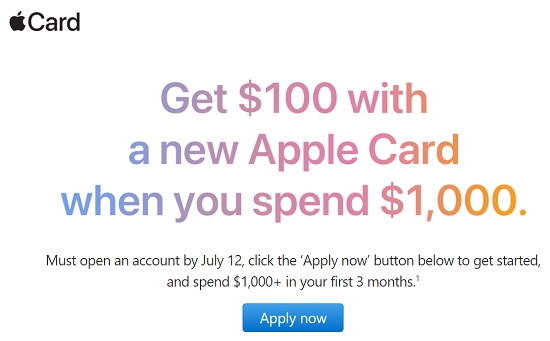

Apple Card $100 Sign Up Bonus

- No direct link. Check your email for subject line “Get $100 when you spend $1,000 with a new Apple Card. Limited time only.”

- What’s the offer: $100 bonus

- When it expires: 07/12/2023

- How to earn it:

- Get $100 when you spend $1,000 with a new Apple Card. Limited time only.

- Terms: Subject to credit approval. Valid only for new Apple Card holders who (1) directly received this email offer.

Apple Card $150 Sign Up Bonus (Expired)

- No direct link to offer – check your email.

- What’s the offer: $150 bonus

- When it expires: Must open an account by March 20 and spend $1,000+ in your first 3 months.

|

|

Bottom Line

The Apple Credit Card is a good option for those who spend a lot at Apple since you get 3% cashback! The numberless card feature is its most recognizable characteristic, it’s meant to be a safer option that could help with reducing skimming accidents!

However, there are a few downsides with this card like no sign-up bonus and if you lose your phone, it’s a big security risk since your card is on it.

If you’re interested on what more Apple has to offer, check out the latest Apple promotions! While you’re here on HMB, Be sure to check out more credit cards from our latest list best credit card bonuses!

* The Apple Credit Card is issued by Goldman Sachs. They also offer great sign-up bonuses for their Checking/Savings accounts. You can also compare this card with other credit card bonuses!

The editorial content on this page is not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are author’s alone.

Leave a Reply