BTC Bank is a standard brick and mortar bank with unique account options. To find out if BTC Bank is right for you, continue reading the review below.

BTC Bank is a standard brick and mortar bank with unique account options. To find out if BTC Bank is right for you, continue reading the review below.

They have a large selection of both checking and savings account and offers great benefits. Plus, partnering with Kasasa eliminates all monthly fees and minimum balance requirements!

Checking Account Options

BTC Bank offers a wide variety of checking accounts including ones that can earn cash back rewards.

They have partnered with Kasasa for some of their accounts to ensure their customers get the most out of their banking.

This is a senior checking account for those 50 and older and you will need $100 to open it.

Enjoy not having to pay a monthly fee or worry about minimum balance requirements as you keep up with your spending.

This is a cash back checking account that will need a $100 to open it.

There are no monthly fees nor minimum balance requirements.

This is a high interest bearing checking account but you will still need an opening deposit of $100.

There are however no monthly fees nor minimum balance requirements to worry about.

BTC Bank’s regular checking account comes with all the default features and also require $100 to open.

This is another interest bearing account, but it earns high, competitive rates so it requires a higher deposit of $1,000 instead.

You will also need to maintain a minimum daily balance of $1,000 to waive any service fees.

Compare Checking Accounts

Savings Account Options

BTC Bank has a decent selection of savings accounts as they all offer a higher than average interest rates and has various benefits.

This savings account is automatically linked to your Kasasa checking account if you opened one.

You can earn a competitive APY the minute you deposit $100 as an opening deposit.

This is BTC Bank’s standard savings account that comes with the default benefits as any other savings account. It will require a $100 opening deposit.

This savings account is considered free for kids under 18 years old. Surprisingly, this account is also interest bearing but only because it is designed for kids to save money responsibly at an early age.

You will need at least $1 to open it, but there are some unique features to this particular kids savings account such as:

- Grade Rewards

- Earn $2 per each “A” you receive with cap of $10 per semester

This is a completely free holiday savings account. You can control the frequency of deposits.

However, there are no early withdrawals allowed.

Compare Savings Accounts

Money Market Account Options

Money Market accounts allow for a higher yield and gives access to your funds with either checks or a bankcard.

BTC Bank has one market that earns competitive interest rates.

Tiered Money Market:

- You will need a minimum opening deposit of $2,500

- This account earns competitive and variable interest rates

- You are allowed up to 6 transfers per statement cycle

- Maintain a daily balance of $2,500 to avoid the monthly fee

- Free Online Banking and Bill Pay

Compare Money Market Accounts

Reasons to Bank with BTC Bank

- Combine your checking and savings account with Kasasa, and earn higher than average APY as long as you manage maintain the daily minimum balance required.

- Low minimum opening deposits.

- All their checking accounts require no monthly fees.

- They have several checking accounts that earns interest and cash back rewards.

- They have a kids savings account that rewards kids for earning good grades.

- There is a senior citizen checking account.

- They offer a health savings account.

- They don’t require monthly service fees on all their savings accounts.

- You can earn cash rewards with Kasasa Cash Checking and transfer it to Kasasa Saver.

- Conduct all your banking online or through the BTC Bank mobile app.

Reasons Not to Bank with BTC Bank

- BTC Bank is only located in Missouri and has 12 locations.

- Their Personal NOW Checking account requires a high opening deposit as opposed to all their other checking accounts.

- They don’t have any ATMS available, they aren’t partnered with any.

- They don’t have a 24-hour banking service line.

BTC Bank Routing Number

The routing number for BTC Bank is 124384657.

Contact Customer Service

You can reach BTC Bank at 1-877-BTC-BANK.

Alternatively, you can also fill out a help request form on BTC Bank’s website.

How BTC Bank Compares

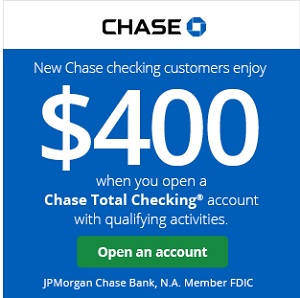

- Chase Bank: Chase is one of the biggest banks in the U.S and offers just about almost everything. Compared to its other competitors, Chase offers much more checking account options.

- Discover Bank: Discover Bank is also an online nationwide bank that offers bonuses for their checking and savings accounts! You can earn cash back rewards when you open a checking account and generous bonuses for opening a savings one.

- CIT Bank: CIT Bank offers various account options with significantly higher APY for their savings, money market and CD accounts.

- TAB Bank: TAB Bank also offers Kasasa checking and savings accounts but has less account options. They do have higher interest rates however.

- Wells Fargo: Located throughout the US with over 5,800 branches and 13,000 ATMs. They offer a variety of deposits accounts, including accounts for teens and customers who need a second chance.

Bottom Line

If you live in Missouri and want to bank with a pretty conventional financial institution, then BTC Bank may have what you’re looking for.

They have a great ratio of checking to savings account and a lot of their accounts require no monthly maintenance fees or easily maintainable minimum balance requirements. They basically have an account for all ages.

However, keep in mind that when you look for a checking or savings account be sure to look into all the fees charged. Don’t focus on the interest rate alone, but on what the account will cost you overall.

If BTC Bank has the variety and options you’re looking for, apply today! For more options from a variety of banks, see our list of the best bank promotions!

Leave a Reply