CapStar Bank is a local bank that has limited account options. To find out if CapStar Bank is right for you, continue reading the review below.

Even though CapStar Bank’s website is not the best site for information regarding their deposit accounts, if you call them or are able to visit a bank in person, you might discover much more options.

CapStar is best recommended for those who prefer telephone banking and want one-on-one service.

Checking Account Options

CapStar Bank only has one general kind of checking account listed on their website.

You might have to call them or visit a branch in person to find out information such as opening deposits or minimum balance requirements.

It is assumed that their checking account comes with all the benefits that any standard checking account would have.

Compare Checking Accounts

Savings Account Options

Just like the checking account, CapStar Bank also has one general savings account listed.

You will have to contact them either by phone or visit them at a physical branch to discuss further account options and benefits.

From the information given, it seems that they offer a minor savings, holiday savings and a home buyer’s savings account as well.

Compare Savings Accounts

Money Market Account Options

Money Market accounts allow for a higher yield and gives access to your funds with either checks or a bankcard.

CapStar Bank offers one money market account that earns tiered interest rates.

Money Market Deposit Account:

- Call CapStar to discuss further information such as opening deposits or minimum balance requirements

- Can make up to 6 pre-authorized withdrawals without penalty

Compare Money Market Accounts

CD Account Options

CapStar Bank offers CDs with competitive rates. Their opening deposits vary depending on CD term lengths.

Their CDs earn pretty high competitive rates and the terms go up to 5 years.

You will have to call or visit a physical bank to find out other information.

Compare CD Accounts

• Available nationwide online, Discover® offers CDs with some of the highest & most competitive rates! with select terms as short as 3 months up to 120 months • Rates ranging from 2.00% APY up to 4.05% APY. • Opening a Discover Bank Certificate of Deposit is extremely quick and easy. • Funds on deposit are FDIC-insured up to the maximum allowed by law. • Get started and open a Discover CD in 3 easy steps. |

Reasons to Bank with CapStar Bank

- Although not listed on their website, they offer a minor savings, holiday savings and home buyer’s savings account.

- Simplistic if you like simple account options.

- If you prefer telephone banking or visiting a branch in person and you live in Tennessee, you might like CapStar.

- Conduct all your banking online or through the CapStar Bank mobile app.

Reasons Not to Bank with CapStar Bank

- They are only located in Tennessee with five branches in total.

- All of their accounts require you to either call them or visit a physical branch to open.

- They don’t have any crucial information listed for any of their checking or savings accounts.

- Those who prefer to bank online would find CapStar it an inconvenience.

- They could earn slightly higher interest rates on their savings accounts.

CapStar Bank Routing Number

The routing number for CapStar Bank varies depending on state and regions. You can also check the lower left corner of your CapStar Bank check.

Contact Customer Service

You can speak to a customer representative at CapStar Bank by calling 615-732-6400.

You may also fill out one of the request form on their website to acquire further information.

How CapStar Bank Compares

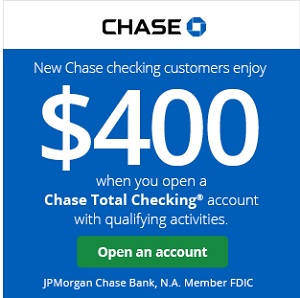

- Chase Bank: Chase is one of the biggest banks in the U.S and offers just about almost everything. Compared to its other competitors, Chase offers much more checking account options.

- Discover Bank: Discover Bank is also an online nationwide bank that offers bonuses for their checking and savings accounts! You can earn cash back rewards when you open a checking account and generous bonuses for opening a savings one.

- TD Bank: TD Bank also offer bonuses for signing up for a checking account! They have various account options that suit all kinds of consumers as well.

- Capital One 360: Capital One 360, you can bank fee-free with online and mobile checking that actually pays you back. Whether you’re looking for one of their 40,000 fee-free ATMs or a Capital One location–chances are they are right nearby.

Bottom Line

Overall, if you are able to visit a physical CapStar branch or don’t mind calling them, then maybe CapStar Bank could be of service.

Since they prefer you to physically contact them in some way, their customer service must be top notch to make up for the lack of information presented on their website.

However, keep in mind that when you look for a checking or savings account be sure to look into all the fees charged. Don’t focus on the interest rate alone, but on what the account will cost you overall.

If you’re interested in banking with CapStar Bank, then apply today! For more options from a variety of banks, see our list of the best bank promotions!

Leave a Reply