Dieterich Bank is a local bank that has limited account options. To find out if Dieterich Bank is right for you, continue reading the review below.

This bank has pretty basic checking and savings accounts, but at least their CD earns higher than average rates.

They also provide both a holiday savings and health savings account that both earn interest.

Checking Account Options

Dieterich Bank has a few checking accounts that come with pretty standard benefits any other checking account would have.

This is considered a free checking account and you will need $25 to open.

There are also no monthly fees nor minimum balance requirements to worry about.

This is a high interest bearing checking account that can be opened with $1,000.

As long as you can keep a daily balance of $1,000, you won’t have to worry about paying any monthly fees!

This is a unique checking account that also earns interest, but they refund ATM fees as well!

You can open this account with just $25 and earn high rates if you can keep a balance around $100 – $10,000.

Compare Checking Accounts

Savings Account Options

Dieterich Bank has a few savings accounts that offer the same benefits as any other savings account.

This is a basic savings account that can be opened with just $25.

It earns tiered interest rates and comes with all kinds of online banking available.

You can receive a debit card if you are already linked to a Dieterich checking account.

This is a holiday savings account that can be used towards special occasions. While you shop for the holidays, you can earn interest.

You can open it with just $2!

Dieterich Bank will also send you a check or direct deposit of your balance when statements are available.

This is like any other health savings account that can be used towards paying for your medical expenses.

You will need at least $25 to open it and you also must be enrolled in a High Deductible Health Plan.

Compare Savings Accounts

Money Market Account Options

Money Market accounts allow for a higher yield and gives access to your funds with either checks or a bankcard.

Dieterich Bank offers one money market account that earns tiered interest rates.

Money Market Plus:

- Open with $1,000

- Waive the monthly fee by keeping a daily balance of $1,000

- This account earns tiered interest rates

- Comes with check writing privileges

- Free Online, Mobile and Telephone banking

Compare Money Market Accounts

CD Account Options

Dieterich Bank offers CDs with competitive rates and their opening deposits vary depending on CD term lengths.

They have regular CD terms that range from 3 months to 60 months.

They also offer jumbo CDs ranging from 7 – 31 days.

To see the rates offered, click here.

The CDs will automatically renew upon maturity.

Compare CD Accounts

• Available nationwide online, Discover® offers CDs with some of the highest & most competitive rates! with select terms as short as 3 months up to 120 months • Rates ranging from 2.00% APY up to 4.05% APY. • Opening a Discover Bank Certificate of Deposit is extremely quick and easy. • Funds on deposit are FDIC-insured up to the maximum allowed by law. • Get started and open a Discover CD in 3 easy steps. |

Reasons to Bank with Dieterich Bank

- Good ratio of checking to savings accounts.

- On most accounts, you can earn interest on any of your balances.

- Anyone ages 16+ can open any of their checking accounts actually.

- Their CDs earn pretty high interest rates.

- They have low minimum balance requirements and waiveable monthly fees.

- They offer a holiday savings account that earns interest.

- Provides a health savings account for those who have a HDHP.

- Simplistic if you like simple account options.

- Conduct all your banking online or through the Dieterich Bank mobile app.

Reasons Not to Bank with Dieterich Bank

- They are only located in Illinois with nine branches in total.

- Lacking a youth checking or savings account.

- Lack of a senior checking or savings account.

- Low variety of savings accounts.

- They could earn slightly higher interest rates on their savings accounts.

Dieterich Bank Routing Number

The routing number for Dieterich Bank varies depending on state and regions. You can also check the lower left corner of your Dieterich Bank check.

Contact Customer Service

You can speak to a customer representative at Dieterich Bank by calling 1-(800)-699-9766.

Their business hours are:

- Monday – Friday at 7:30 a.m. – 5:00 p.m. (CST)

- Saturday at 8:00 a.m. – 12:00 p.m. (CST)

How Dieterich Bank Compares

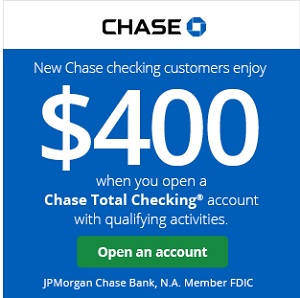

- Chase Bank: Chase is one of the biggest banks in the U.S and offers just about almost everything. Compared to its other competitors, Chase offers much more checking account options.

- Discover Bank: Discover Bank is also an online nationwide bank that offers bonuses for their checking and savings accounts! You can earn cash back rewards when you open a checking account and generous bonuses for opening a savings one.

- Regions Bank: While the checking options are similar, there is a wider variety of other account options to help you save.

- Capital One 360: Capital One 360, you can bank fee-free with online and mobile checking that actually pays you back. Whether you’re looking for one of their 40,000 fee-free ATMs or a Capital One location–chances are they are right nearby.

Bottom Line

If you happen to live in Illinois and are interested in simplistic banking, then Dieterich Bank has a good amount of accounts to explore.

Since all their checking accounts can be opened by anyone who is at least 16 or older, they don’t need a minor nor senior citizen checking or savings account specifically.

Although it would be nice to have separate ones, Dieterich encourages anyone to start paying attention to their finances at an early age.

Since they prefer you to physically contact them in some way, their customer service must be top notch to make up for the lack of information presented on their website.

However, keep in mind that when you look for a checking or savings account be sure to look into all the fees charged. Don’t focus on the interest rate alone, but on what the account will cost you overall.

If you’re interested in banking with Dieterich Bank, then apply today! For more options from a variety of banks, see our list of the best bank promotions!

Leave a Reply