Find the latest and up to date Regions Bank promotions and bonuses here.

Update 1/14/25: There is now a $400 checking bonus offer available through 3/31/25. The $300 checking bonus is back through 6/30/25. You can ask for a $50 referral bonus to stack on top of that. Those with a business can request for the $150 business checking bonus.

About Regions Bank Promotions

Established in 1928, Regions Bank is headquartered in Birmingham, Alabama, and is the largest bank in the state. The bank is widespread across multiple states including Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Missouri, North Carolina, South Carolina, Tennessee, Texas, and Virginia with 1,600+ branches.

I will review the current Regions bank offers below.

Regions Bank $400 Checking Bonus

Regions Bank is offering a $400 bonus when you open a new checking account and meet certain requirements.

- What you’ll get: $400 bonus

- Account Type: LifeGreen Checking Account

- Availability: AL, AR, FL, GA, IL, IN, IA, KY, LA, MS, MO, NC, SC, TN & TX (Bank Locator)

- Direct Deposit Requirement: Yes, or ACH $1000(see what works)

- Credit Inquiry: Soft Pull

- ChexSystem: Unknown

- Credit Card Funding: Up to $125. Another $125 for opening savings. Visa only.

- Monthly Fees: $8, waive-able

- Early Account Termination Fee: $25 if closed within 180 days

- Household limit: None

(Expires 03/31/2025)

Editor’s Note: There is also a referral bonus you can receive in addition to this $300 bonus (bringing the total to $350). This has worked in the past, but it is no guarantee to work this time around. To try for an additional referral bonus, send an email to referbankbonus@gmail.com and title your email “Regions Bank Referral Bonus”

*Keep $1,500 in your checking account to keep fee-free.

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | HSBC Premier Checking (Up to $3,000 Cash Bonus), |

How To Earn Bonus

- First, you must register for your offer in the form. You must register by March 31, 2025. You will receive a registration confirmation email with your next steps to earn your offer.

- Open a new personal LifeGreen Preferred Checking® account by May 1, 2025. Open your account online or visit your local branch to open your account in person.

- Enroll in Online Banking within 90 days of opening your account.

- Make $1,000 or more of qualifying ACH direct deposits to your new LifeGreen Preferred Checking® account that must post within 90 days of account opening. Deposits must be new to Regions.

- Offer only applies to personal LifeGreen checking accounts.

- Offer expires April 1, 2025.

- However, offer may be discontinued or changed at any time prior to the expiration date without notice.

- Email address used when opening your checking account must match the email address used when registering.

- We reserve the right to terminate this offer without notice at any time in the event of any suspected or actual abuse or fraud.

- Offer valid in Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Missouri, North Carolina, South Carolina, Tennessee, and Texas.

- This offer is nontransferable, may not be combined with any other offer, and does not apply if you have or had an ownership interest in a personal Regions checking account on or after January 1, 2024, and may be withdrawn at any time without notice.

- When the credit is issued, new account must be open and have a positive balance.

- Enrolling in Online Banking requires a Social Security or Taxpayer ID number (alternative options may be available by visiting a branch).

- Regions may report bonus value to the IRS as required by law, and customer is responsible for any tax due on any amount received under this offer.

- Anyone without a valid U.S. Taxpayer Identification Number (Form W-9 for U.S. persons including a resident alien), or who has been notified they are subject to backup withholding, or non-resident aliens signing Form W-8 are not eligible for the offer.

- Regions associates are not eligible.

- Deposit Accounts: All LifeGreen checking accounts require a $50 minimum opening deposit.

- As of January 1, 2025, the Annual Percentage Yield (APY) paid on LifeGreen Preferred Checking® accounts was 0.01% for all balances.

- Regions may change the APY at any time.

- Check the current interest rates and APYs for LifeGreen Savings and LifeGreen Preferred Checking.

- No interest is paid on other personal checking accounts.

- Fees may reduce earnings.

- Accounts opened in Iowa may be subject to a 6% Iowa State Tax.

Regions Bank $300 Checking Bonus

Regions Bank is offering a $300 bonus when you open a new checking account and meet certain requirements.

- What you’ll get: $300 bonus

- Account Type: LifeGreen Checking Account

- Availability: AL, AR, FL, GA, IL, IN, IA, KY, LA, MS, MO, NC, SC, TN & TX (Bank Locator)

- Direct Deposit Requirement: Yes, or ACH $1000(see what works)

- Credit Inquiry: Soft Pull

- ChexSystem: Unknown

- Credit Card Funding: Up to $125. Another $125 for opening savings. Visa only.

- Monthly Fees: $8, waive-able

- Early Account Termination Fee: $25 if closed within 180 days

- Household limit: None

(Expires 06/30/2025)

Editor’s Note: There is also a referral bonus you can receive in addition to this $300 bonus (bringing the total to $350). This has worked in the past, but it is no guarantee to work this time around. To try for an additional referral bonus, send an email to referbankbonus@gmail.com and title your email “Regions Bank Referral Bonus”

*Keep $1,500 in your checking account to keep fee-free.

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- First, you must register for your offer in the form. You must register by June 30, 2025. You will receive a registration confirmation email with your next steps to earn your offer.

- Open a new personal LifeGreen® checking account by July 31, 2025. Open your account online or visit your local branch to open your account in person.

- Enroll in Online Banking within 90 days of opening your account.

- Make $1,000 or more of qualifying ACH direct deposits to your new LifeGreen checking account that must post within 90 days of account opening. Deposits must be new to Regions.

- Your bonus will be deposited directly to your new checking account within 60 days of completing the above requirements.

- Offer only applies to personal LifeGreen checking accounts.

- Offer expires July 1, 2025.

- However, offer may be discontinued or changed at any time prior to the expiration date without notice.

- Email address used when opening your checking account must match the email address used when registering.

- We reserve the right to terminate this offer without notice at any time in the event of any suspected or actual abuse or fraud.

- Offer valid in Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Missouri, North Carolina, South Carolina, Tennessee, and Texas.

- This offer is nontransferable, may not be combined with any other offer, and does not apply if you have or had an ownership interest in a personal Regions checking account on or after January 1, 2024, and may be withdrawn at any time without notice.

- When the credit is issued, new account must be open and have a positive balance.

- Enrolling in Online Banking requires a Social Security or Taxpayer ID number (alternative options may be available by visiting a branch).

- Online Banking is subject to separate terms and conditions.

- Regions may report bonus value to the IRS as required by law, and customer is responsible for any tax due on any amount received under this offer.

- Anyone without a valid U.S. Taxpayer Identification Number (Form W-9 for U.S. persons including a resident alien), or who has been notified they are subject to backup withholding, or non-resident aliens signing Form W-8 are not eligible for the offer. Regions associates are not eligible.

- Deposit Accounts: All LifeGreen checking accounts require a $50 minimum opening deposit. As of January 1, 2025, the Annual Percentage Yield (APY) paid on LifeGreen Preferred Checking® accounts was 0.01% for all balances.

- Regions may change the APY at any time.

- Check the current interest rates and APYs for LifeGreen Savings and LifeGreen Preferred Checking.

- No interest is paid on other personal checking accounts. Fees may reduce earnings.

- Accounts opened in Iowa may be subject to a 6% Iowa State Tax.

Regions Bank $50 Checking Bonus

Regions Bank is offering a $50 bonus when you open a new checking account. You must use a referral link to get this bonus.

To request for a $50 checking bonus, send an email to referbankbonus@gmail.com and title your email “Regions Bank Referral Bonus”

- What you’ll get: $50 bonus

- Account Type: LifeGreen Checking Account

- Availability: AL, AR, FL, GA, IL, IN, IA, KY, LA, MS, MO, NC, SC, TN & TX (Bank Locator)

- Direct Deposit Requirement: Yes, or ACH deposit $500+

- Credit Inquiry: Soft Pull

- ChexSystem: Unknown

- Credit Card Funding: Up to $125. Another $125 for opening savings. Visa only.

- Monthly Fees: $8-$18, waive-able

- Early Account Termination Fee: $25 if closed within 180 days

- Household limit: None

*MUST Request via EMAIL*

(Limited time offer)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | HSBC Premier Checking (Up to $3,000 Cash Bonus), |

How To Earn Bonus

- $50 Personal Bonus:

- Within 90 days of receiving the referral:

- Register for the program (using the referral email or in a branch); and

- Open a new Regions personal LifeGreen® checking account.

- Within 60 days of opening the new account:

- Make at least ten Regions Visa® CheckCard purchases that post to the new account;

- Have at least one $300 or more ACH direct deposit (such as a reoccurring payroll or government benefit deposit) post to the new account; and

- Enroll in Online Statements through Regions Online Banking.

- Within 90 days of receiving the referral:

Regions Bank $150 Business Checking Bonus

Regions Bank is offering a $150 bonus when you open a new checking account and meet certain requirements. Referred business must open a new Regions business checking account within 90 days of receiving the invite. Opening deposit should be $500 or more. Within 60 days of account opening, complete at least one Visa Business CheckCard purchase that posts to the new account, and enroll in Online Statements through Regions Online Banking.

To request for a $150 business checking bonus, send an email to referbankbonus@gmail.com and title your email “Regions Bank Referral Bonus”

- What you’ll get: $150 bonus

- Account Type: Business Checking Account

- Availability: AL, AR, FL, GA, IL, IN, IA, KY, LA, MS, MO, NC, SC, TN & TX

- Direct Deposit Requirement: No

- Credit Inquiry: Soft Pull

- ChexSystem: Unknown

- Credit Card Funding: Up to $125. Another $125 for opening savings. Visa only.

- Monthly fees: $8-$18, waive-able

- Early Account Termination Fee: $25 if closed within 180 days

- Household limit: None

*MUST Request via EMAIL*

(Limited time offer)

| Chase Business Checking ($300 or $500 Bonus) | Bank of America Business Checking ($200 bonus offer) |

| Axos Business Premium Savings ($375 Bonus) | Axos Bank Basic Business Checking ($400 Bonus) |

| Axos Bank Business Interest Checking ($400 Bonus) | Huntington Unlimited Plus Business Checking ($1,000 Bonus) |

| Huntington Unlimited Business Checking ($400 Bonus) | Bluevine Business Checking ($300 Bonus) |

| U.S. Bank Business Checking ( $500 or $900 Bonus) | |

How To Earn Bonus

- For a Business Checking account, make an initial deposit of at least $500 within 90 days of this communication. Then, within 60 days of account opening:

- Complete one Visa Business CheckCard purchase that posts to the account

- Sign up for Online Banking with Online Statements (a Social Security or Taxpayer ID number is required to enroll)

- Get your $150 Visa Reward Card in 4-6 weeks after all conditions have been met!

Regions Bank Up to $100 Annual Savings Bonus *No Direct Deposit Requirement*

Earn a $100 bonus at Regions Bank!

Regions Bank is offering a $100 bonus when you open a new savings account and meet certain requirements.

- What you’ll get: $100 bonus

- Account Type: LifeGreen Savings Account

- Availability: AL, AR, FL, GA, IL, IN, IA, KY, LA, MS, MO, NC, SC, TN & TX

- Direct Deposit Requirement: No

- Credit Inquiry: Soft Pull

- ChexSystem: Unknown

- Credit Card Funding: Up to $125. Another $125 for opening savings. Visa only.

- Monthly fees: $8-$18, waive-able

- Early Account Termination Fee: $25 if closed within 180 days

- Household limit: None

(Limited time offer)

| AlumniFi Credit Union Savings (4.75% APY) | SoFi Checking & Savings ($325 Bonus + 3.80% APY) |

| Upgrade Premier Savings (4.15% APY) | Discover® Bank Savings (Up to $200 Bonus + 3.70% APY) |

| CIT Bank Platinum Savings (4.00% APY) | Harborstone Credit Union Money Market (4.30% APY) |

| FVCbank Advantage Direct Savings (4.55% APY) | Live Oak Bank Savings (4.10% APY) |

How To Earn Bonus

- Earn a 1% annual savings bonus (up to a maximum of $100) when you open a LifeGreen Savings Account AND have or open a Regions checking account.

- You must set up a monthly automatic transfer of at least $10 from your Regions checking account to LifeGreen Savings account.

- Your bonus is based on the average monthly balance for 12 months. The maximum bonus is $100.

- An automatic transfer of funds of at least $10 from your Regions checking account to your LifeGreen Savings account in at least 10 of any of the 12 calendar months that precede the month of your account opening anniversary (your “Account Anniversary Month”) is required to earn a 1% annual savings bonus.

- The annual savings bonus is based on the average monthly balance for the 12 calendar months that precede your Account Anniversary Month.

- The annual savings bonus will be paid to your LifeGreen Savings account by the second business day of the month following your Account Anniversary Month.

- To receive the annual savings bonus, your LifeGreen Savings account must be open on the date the annual savings bonus is paid. Maximum annual savings bonus of $100.

- You are responsible for any tax due on any amount received under this offer. Fees could reduce earnings on the account.

- The Annual Percentage Yield (APY) for the LifeGreen Savings account is based upon balance and may change at any time.

Regions Bank $50/$150 Referral Bonus

Earn $150 bonus with a Regions Business Checking account

Regions Bank is offering two types of bonuses for just referring your friends! Earn a $50 bonus when you referring for a personal checking account or earn $150 bonus when referring to a business account.

Need a Referral Link?

- Send an email to referbankbonus@gmail.com and title your email “Regions Bank Referral Bonus”

- In the email, provide your full name along with the account you want to open whether it is personal checking account or business checking account.

- Account Type: LifeGreen Checking, Business Checking Account

- Availability: AL, AR, FL, GA, IL, IN, IA, KY, LA, MS, MO, NC, SC, TN & TX

- Early account termination fee: $25 if closed within 180 days from account opening

- Household limit: None listed

(Limited time offer)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | HSBC Premier Checking (Up to $3,000 Cash Bonus), |

How To Earn Bonus

- $50 Personal Bonus:

- Within 90 days of receiving the referral:

- Register for the program (using the referral email or in a branch); and

- Open a new Regions personal LifeGreen® checking account.

- Within 60 days of opening the new account:

- Make at least ten Regions Visa® CheckCard purchases that post to the new account;

- Have at least one $300 or more ACH direct deposit (such as a reoccurring payroll or government benefit deposit) post to the new account; and

- Enroll in Online Statements through Regions Online Banking.

- Within 90 days of receiving the referral:

- $150 Business Bonus:

- Within 90 days of receiving the referral:

- Register for the program (using the referral email or in a branch);

- Open a new Regions business checking account and deposit at least $500 the day the account is opened.

- Within 60 days of opening the new account:

- Make at least one Visa Business CheckCard purchase that posts to the new account; and

- Enroll in Online Statements through Regions Online Banking.

- Within 90 days of receiving the referral:

- Must be at least 18 years old to be eligible for reward.

- Employees of Regions Bank, Regions Financial Corporation, or affiliates are not eligible.

- The Referred Person and Referred Business cannot have (or have had) an ownership interest in a Regions deposit account within twelve months of the referral.

- The Referrer and the Referred Person and/or Referred Business cannot be the same person or share the same email address.

- Offer subject to change without notice—including special offers.

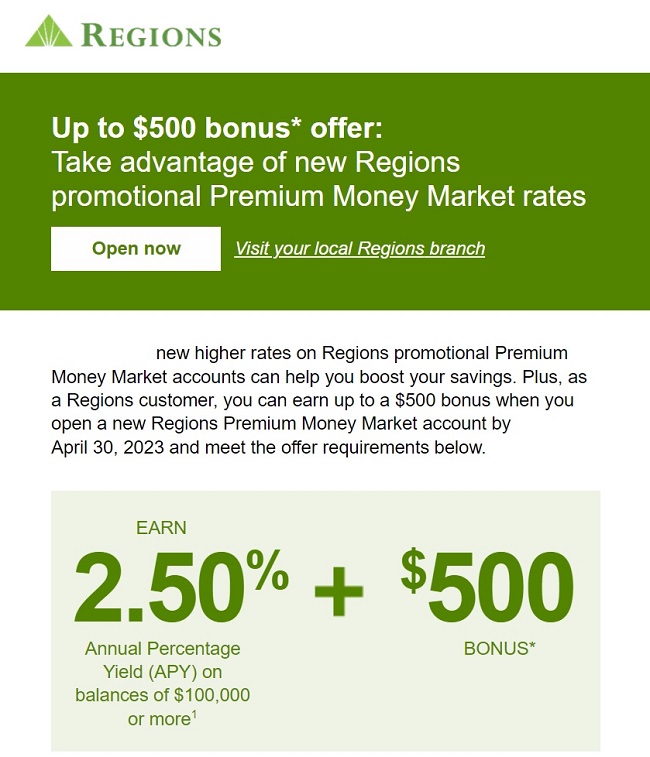

Regions Bank $500 Money Market Bonus (Targeted) (Expired)

Regions Bank is offering up to a $500 bonus when you open a new money market account and meet certain requirements.

- What you’ll get: Up to $500 bonus

- Account Type: Money Market

- Availability: AL, AR, FL, GA, IL, IN, IA, KY, LA, MS, MO, NC, SC, TN & TX (Bank Locator)

- Direct Deposit Requirement: No

- Credit Inquiry: Soft Pull

- ChexSystem: Unknown

- Credit Card Funding: Up to $125. Another $125 for opening savings. Visa only.

- Monthly Fees: None

- Early Account Termination Fee: Not listed

- Household limit: None

| AlumniFi Credit Union Savings (4.75% APY) | SoFi Checking & Savings ($325 Bonus + 3.80% APY) |

| Upgrade Premier Savings (4.15% APY) | Discover® Bank Savings (Up to $200 Bonus + 3.70% APY) |

| CIT Bank Platinum Savings (4.00% APY) | Harborstone Credit Union Money Market (4.30% APY) |

| FVCbank Advantage Direct Savings (4.55% APY) | Live Oak Bank Savings (4.10% APY) |

How To Earn Bonus

- Open a new Regions promotional Premium Money Market account by April 30, 2023.

- Deposit at least $25,000 in new-to-Regions funds in your promotional Premium Money Market account within 15 days of account opening. Deposits must be new to Regions and may not be transferred from other existing Regions accounts.

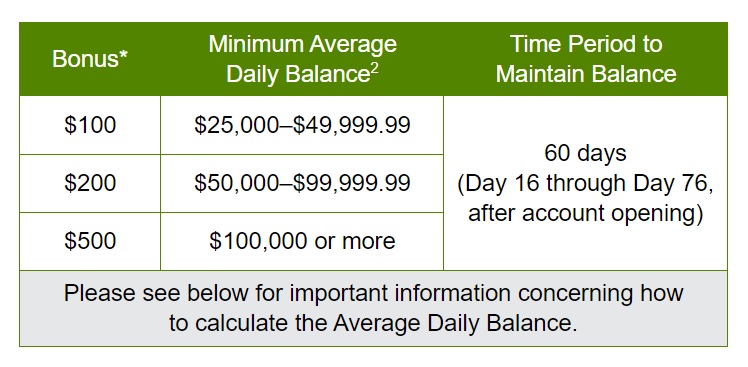

- After the 15 day funding period, maintain a qualifying Average Daily Balance2 in your new promotional money market account for at least 60 consecutive days. See the table below for bonus tiers.

- Bonus will be deposited directly to your new Regions promotional Premium Money Market account within 60 days of completing the above requirements.

- One bonus offer is available only to you (the individual identified in this email or an individual in your household), is nontransferable and may not be combined with any other offer.

- To be eligible, the contact information used to open your new account must match Regions’ records (such as name, physical address or email address).

- When the credit is issued, new account must be open and have a positive balance.

- Regions may report bonus value to the IRS as required by law; anyone whose tax status would require Regions to impose tax withholding is not eligible.

- Regions associates are not eligible.

How To Waive Monthly Fees

- LifeGreen Checking: $8 with online statements or $11 with paper statements (without check images). Avoid fees with:

- $1,500 average monthly balance in your LifeGreen Checking account

- ACH direct deposit, such as a recurring payroll or government benefit deposit, of at least $500 single deposit or $1,000 combined deposit, to your LifeGreen Checking account

- LifeGreen eAccess Checking: $8 monthly fee. Waive the monthly fee with any combination of at least 10 Regions CheckCard and/or credit card purchases

- Regions LifeGreen Savings: No monthly fee if you have a Regions checking account

- Regions Savings: $5 monthly fee. Maintain a $300 minimum daily balance to avoid the monthly account fee

- LifeGreen Business Simple Checking: $7 monthly fee. Waive the monthly fee by generating at least $500 in Regions Business CheckCard and/or Business Credit Card purchases

- LifeGreen Business Checking: $12 monthly fee. Avoid fees with any of the following:

- Maintain an average monthly statement balance of $2,500

- At least $1,000 in Regions Business Visa CheckCard and/or Visa purchases

- One or more Merchant Services transactions.

|

|

Bottom Line

If you are looking to start a new banking experience with Regions Bank, there are multiple promotions for you! I’d recommend you take advantage of each promotion reviewed above to maximize your bonus amount.

CDs and Savings Accounts are another great way to save. However, their rates may not be the best, so check out our full list of Bank Rates and CD Rates for the best rates nationwide.

*Compare Regions Bank Promotions with other bank bonuses from banks like Citi, Huntington, HSBC, Chase, TD, Discover Bank, Aspiration, Axos Bank, PNC Bank, BMO, SoFi, Fifth Third Bank, Bank of America, Wells Fargo, US Bank, and more!

*These are all the current promotions from Region Bank. Check back regularly for updated Regions Bank promotions, bonuses and offers.

Anyone have success with Venmo or PayPal or capital one 360 transfers to cound as dir dep and trigger bonus?

Danny, would you please explain what the following means: “Credit Card Funding: Up to $125. Another $125 for opening savings. Visa only.” Thanks!

In 2021 I opened a Regions checking account, I jumped through all the required hoops within the timeframe listed in their fine print. Received $400 free. Sweet! I am about to open a business checking for a bonus now.

3rd September, 2021 – Account opened

7th September, 2021 – Made direct deposit

20th September, 2021 – Did 10 transactions of 0.50 each at Amazon Reload

9th December, 2021 – Received 200 dollars Bonus

These codes must be targeted.

regions bank promo code WINTER2021 is invalid.

Regions has been making it extremely hard to get these bonuses even after doing all of the legwork correctly, particularly for business accounts. Both in-branch and through the customer service center they claim to have “no record” of 3 business referrals that I had in 2020. They can only see personal referrals from 2019. I have all of the documentation showing that I was referred, registered for the referral, opened the business account in branch, and met the requirements in the specified timeframe. I never received the $150 prepaid Visa or any of the subsequent referral bonuses that I made even though those referrals also opened, funded, and met the requirements. They are also telling me that I never activated online banking or signed up for online statement delivery, which are both clearly active and have been active since I opened the account. Very frustrating. I can’t be the only one experiencing this. Side note: I had a personal account 2 years ago that was closed more than 12 months before I opened the business account.

max funding with CC is now only $100! anyone is still able to fund up to $1k?

That code for Regions doesn’t work. They have to send you an email with a link to get the $200 for opening up an account with them. I just left Regions bank. They wouldn’t accept it.

Dennis just opened a greenlife checking account with Region Bank, the Bank Clerk told me about printing out the voucher and bring it inside bank or open digital. Its Real!

I think this is a fishing scam… not sure if info.regions.com is a legitimate https site. Can you please verify?