Even with the advancement of online banking and making online payments extremely easy now, some customers will still want to pay in checks.

It may be beneficial for you considering the fact that paying through checks avoids processing credit payments and the possibility of a chargeback.

If you’ve read out posts on the fundamentals of a check, How to Write a Check and the Parts of a Check, you understand what a standard personal check is, but what is a business check? It’s not much different besides a tiny bit of details.

| PROMOTIONAL LINK | OFFER | REVIEW |

| U.S. Bank Silver Business Checking Package | $900 Cash | Review |

| U.S. Bank Gold Business Checking Package | $900 Cash | Review |

| U.S. Bank Platinum Business Checking Package | $900 Cash | Review |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Huntington Bank Unlimited Plus Business Checking | $1,000 Cash | Review |

| Huntington Bank Unlimited Business Checking | $400 Cash | Review |

| Axos Bank Basic Business Checking | $400 Cash | Review |

| Axos Bank Business Interest Checking | $400 Cash | Review |

| Regions Bank Business Checking | $150 Cash | Review |

| NorthOne Business Checking | $20 Credit | Review |

| Novo Business Checking | $75 Cash | Review |

| BlueVine Business Checking | 2.00% APY | Review |

How to Endorse a Check

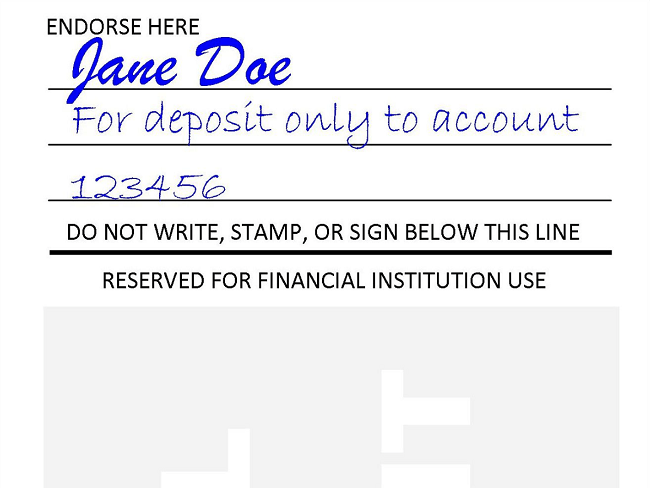

It’s actually really easy to endorse a check. Look on the back of your check and find an area labeled “Endorse Here.” Using a pen write down the following,

- Write the business name, which should match the payee on the front of the check.

- Sign your name.

- Write your title (President, Owner, Treasurer, etc.)

- Add restrictions to the check if you want to.

If you’re a business owner and you go through several checks a day and get tired of writing them, then you can get a stamp that you can use to stamp your endorsement on a check. Offices with check printers can also print them for you making it super easy to fly through the process.

Be sure to check with your bank before you use any of these techniques to make sure your bank is okay with printed endorsements.

Restricting an Endorsed Check

Restricting an endorsed check is a great way to prevent someone, i.e a thief, from cashing in your stolen check.

The most common way to restrict a check is by writing down on it, “For deposit only to account 1234567.” This makes it so that it’s clearly written on the check that you cannot cash in this check. It can only be directly deposited to your account.

Cashing an Endorsed Check

Banks will often be hesitant on cashing a check written out to a business, so most of the time you’ll be required to deposit the money before you can cash it in.

It is possible to cash in those checks, but it proves to be very difficult. Your best bet is to use your bank account after your account has been actively used for a while.

The reason it’s so hard is purely for security reasons, because businesses are legal entities. They may have multiple owners, and they may require the approval of multiple people to withdraw or spend money—and cashing a check is the equivalent to withdrawing money.

Acting like a Business

It’s wise to require that customers write checks to your business. You’re acting like a legitimate business, and assuming you’ve been doing everything right and avoiding personal guarantees, you can limit your personal liability if something happens to the company.

- Using Personal Accounts: Even though it seems inconvenient to go through the process of depositing it into your business account then transferring it to your personal account, it’s always good to continue that practice. Most banks won’t allow you to deposit a business check into a personal account and if you get caught doing so, it may cause delays on payments, so it’s best to just continue following the correct sequence to depositing your checks.

- Personal Liability: When you deposit business checks into your personal account, you put your personal assets at risk. It’s best to use a business account for business income. There may be other risks that come with it depending on your situation.

Easier Ways to Get Paid

If you get tired of using checks, there are always substitutes for them such as:

- Plastiq: You can always use debit/credit cards. Though they are the consumers favorite method of payments, they can be costly for merchants. Despite this, it’s still worth getting quotes on how much you’ll pay. Check out the latest Plastiq promotions here!

- Electronic Payments: For more affordable payment processing, try collecting funds directly from customers’ bank accounts. ACH payments often cost less than card payments.

- Cash: If cost is primary your concern, cash is the least expensive option, but it does create security problems.

Recommended Business Checking Accounts

• Open a Huntington Unlimited Plus Business Checking Account • Earn $1,000 bonus when you open a Huntington Unlimited Plus Business Checking account and make total deposits of at least $20,000 within 30 days of account opening. • Maintain minimum daily balance of $20,000 for 60 days after meeting deposit requirement. • The $1,000 bonus will be deposited into your account after all requirements are met. • Enjoy overdraft protection with no annual fee or deposit-to-deposit overdraft protection with no transfer fee! • Bonus Service. Choose one bonus service such as fraud tools, discounts on payroll services, or Huntington Deposit Scan® • Ideal for businesses with higher checking activity and greater cash flow needs. |

• Open a Huntington Unlimited Business Checking Account • Earn $400 bonus when you open a Huntington Unlimited Business Checking account and make total deposits of at least $5,000 within 60 days of account opening. • The $400 bonus will be deposited into your account after all requirements are met. • Get Overdraft Protection Account with no annual fee, or Deposit-to-Deposit Overdraft Protection with no transfer fee. • Enjoy unlimited transactions. And up to $10,000 in cash or currency deposits monthly in-branch or at an ATM at no charge. • Designed for businesses with higher checking activity and greater cash flow needs. • Bonus service. Choose one bonus service such as fraud tools, discounts on payroll services, or Huntington Deposit Scan®. |

|

|

Bottom Line

Endorsing and using business checks have their pros and cons. You avoid processing times and other costly matters, but it may be an inconvenience for you to deposit all the checks.

You should also always follow the practice of using your business account over your personal account to avoid any other delays. Be sure to check out our Bank Bonuses, Saving Rates and Credit Card Bonuses!

Leave a Reply