Take advantage of First Hawaiian Bank promotions, bonuses, and offers here!

Update 2/6/26: There’s currently a $350 checking bonus valid through 4/30/26.

First Hawaiian Bank $350 Checking Bonus

Earn a $350 bonus when you open a new checking account and meet the qualifying requirements.

- What you’ll get: $350 bonus

- Account Type: Checking

- Availability: HI (Locator)

- Direct Deposit Requirement: Yes (see what works)

- Credit Inquiry: Hard Pull or Soft Pull? Let us know.

- ChexSystem: Unknown

- Credit Card Funding: Unknown

- Monthly Fees: $4-$25; waivable

- Early Account Termination Fee: Not listed

- Household limit: None listed

(Expires 04/30/2026)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

| Bank of America ($500 bonus offer) | U.S. Bank Smartly® Checking ($450 bonus) |

How To Earn Bonus

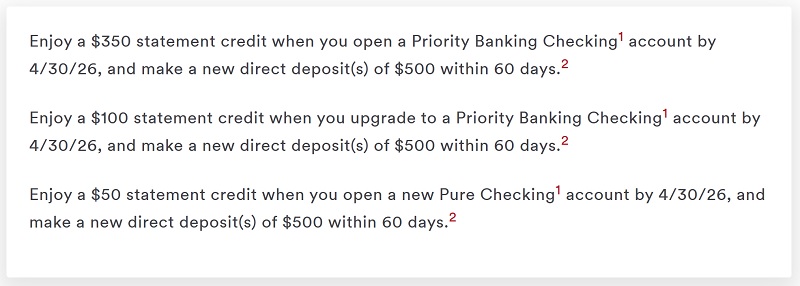

- Enjoy a $350 statement credit when you open a Priority Banking Checking1 account by 4/30/26, and make a new direct deposit(s) of $500 within 60 days.

- Enjoy a $100 statement credit when you upgrade to a Priority Banking Checking1 account by 4/30/26, and make a new direct deposit(s) of $500 within 60 days.

- Enjoy a $50 statement credit when you open a new Pure Checking1 account by 4/30/26, and make a new direct deposit(s) of $500 within 60 days.

- The minimum opening deposit is $20. Open a new Pure Checking Account, Priority Banking Gold/Platinum Checking Account or upgrade to a Priority Banking Gold/Platinum Checking Account (“Checking Account”) from January 1, 2026, through April 30, 2026, to qualify for the offer. Account Closing Fee of $75 will apply if a Personal Priority Banking Checking Account is closed or converted to a corresponding checking account (not a Personal Priority Banking Checking Account) within 180 days of opening and a $50 fee will apply for a Pure Checking Account closed within 180 days of opening. Account with a zero balance for 30 consecutive days will be closed automatically. For other fees that may be assessed, refer to the Important Terms and Conditions and Schedule of Charges provided during the account opening process.

- The newly established direct deposit(s) must post to your new Checking Account within 60 days from the account opening or upgrade date. A new direct deposit is a direct deposit amount that has not been previously established with the bank. A direct deposit is defined as certain recurring electronic deposits through the Automated Clearing House (“ACH”) Network such as payroll, pension, or social security benefits. Peer to Peer transfers (i.e. Venmo or PayPal), tax refunds, wire transfers, etc. are examples of non-qualifying direct deposits. First Hawaiian Bank has the sole discretion to determine a qualifying direct deposit for this promotion. A one-time statement credit will be completed the month following meeting the criteria and may be reported as taxable income. Checking Account must be open and not overdrawn to receive the statement credit. The offer is limited to one per customer and account.

How To Waive Monthly Fee

- Pure Checking: $4 monthly service charge waived with: (1) eStatements1; (2) aggregate direct deposits of $500 per statement cycle; (3) primary account holder is 25 years of age and under or 50 years of age and above.

- Priority Banking Gold Checking: Monthly Service Charge of $15 per month waived with a combined balance12 of $6,000 or direct deposit or $2,000 per statement cycle

- Priority Banking Platinum Checking: Monthly Service Charge of $25 per month waived with a combined balance 12 of $35,000 or direct deposit of $4,000 per statement cycle

|

|

|

|

Bottom Line

Although you can earn a generous bonus from First Hawaiian Bank, check out our list of bank promotions for more offers. With fantastic offers such as Money Market and CD rates, you are able to get the most out of your banking experience!

Compare First Hawaiian Bank Promotions with other bank bonuses from banks like U.S. Bank, Citi, Huntington, HSBC, Chase, TD Bank, Axos Bank, PNC Bank, BMO, SoFi, and more!

Leave a Reply