Check out Fremont Bank promotions, bonuses, and offers here!

Update 11/25/24: The $150 checking bonus is still available!

About Fremont Bank

Founded in 1964, Fremont Bank is headquartered in Fremont, California, and has grown to 23 locations throughout the state. Fremont Bank’s CD rates are 67% higher than the national average, and it has an A health rating.

I’ll review the Fremont Bank offers below.

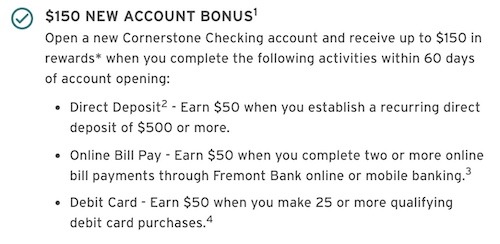

Fremont $150 Checking Bonus

Fremont Bank is offering up to $150 bonus when you open a new qualifying checking account.

- What you’ll get: $150 bonus

- Account Type: Cornerstone Checking Account

- Availability: CA (Bank Locator)

- Direct Deposit Requirement: Yes (see what works)

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown, sensitive

- Credit Card Funding: $100

- Monthly Fees: $15+, avoidable

- Early Account Termination Fee: $50, six months

- Household Limit: None listed

(Limited time offer)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- Open a new Cornerstone Checking account and receive up to $150 in rewards when you complete the following activities within 60 days of account opening:

- Direct Deposit – Earn $50 when you establish a recurring direct deposit of $500 or more.

- Online Bill Pay – Earn $50 when you complete two or more online bill payments through Fremont Bank online or mobile banking.

- Debit Card – Earn $50 when you make 25 or more qualifying debit card purchases of $5 or more.

- Accounts are subject to approval. The terms of the account, including any fees or features, may change. See the Deposit Account Agreement and Account Terms and Conditions Schedule of Fees and Charges for the terms and conditions associated with the product.

- Rewards will be credited to the account and reported as interest, and Fremont Bank may issue an Internal Revenue Service Form 1099 (or other appropriate form) to you that reflects the value of the account credit.

- Offer valid for new Fremont Bank Cornerstone personal checking clients only. Clients who currently have a personal checking account with Fremont Bank as a primary or secondary account holder are not eligible for this bonus.

How to Waive Monthly Fees

- Premier Checking: $29.00 monthly can be waived with average daily balance of $50,000 or $50,000 with Combined Balance Option

- Freedom Checking: $10.00 monthly can be waived with:

- Monthly direct deposit6 of at least $500 to this account or

- $1,500 average daily balance or $5,000 combined balance5 or

- 10 or more qualifying debit card transactions

- For students under 26

- Cornerstone Checking: $15.00 monthly, can be waived with Automatic Loan Payment to an existing Fremont Bank personal mortgage loan or Home Equity Line of Credit.

- Statement Savings: $5.00 monthly, can be waived with minimum daily balance of $300

- Money Market Checking: $4.00 a month with e-Statements; other wise $14.00 monthly, can be waived with an average daily balance of $2,500

- Plus Business Checking: $12.00 monthly, can be waived with:

- $5,000 Average Daily Balance, or

- 10 qualifying purchases or one or more qualifying purchases of $250 or more with your Business Debit Card or

- Merchant Services, or

- Payroll Services, or

- Remote Deposit Capture Monthly Service Fee, or

- Commercial Lending Relationship

- Preferred Business Checking: $40.00 monthly can be waived with:

- $15,000 Average Daily Balance or

- Commercial Lending Relationship

- Premier Business Checking: $90.00 monthly can be waived with:

- $100,000 Average Daily Balance

- $250,000 Combined Balance

- Business Interest Checking: $25.00 monthly can be waived with an average daily balance of $10,000.

- Analyzed and Analyzed Interest Checking: $22 monthly plus activity charges in excess of earnings credit. The bank applies an earnings credit based on the account balance(s), which can offset all or some of the monthly service fees.

- Business Statement Savings: $5.00 monthly if minimum daily balance of $500 is not met

- Business Money Market Checking: $6 with e-Statement; otherwise $16 monthly, can be waived with an daily average balance of $2,500

- Business Premier Money Market Checking: $30.00 monthly, can be waived when linked with a Business Premier Checking Account

|

|

Bottom Line

Fremont Bank currently has many bonuses when you open a qualifying account. Although this promotion has a variety of features and services to choose from, I can only recommend this post if it triggers a soft pull and you carefully look over the fine print. Therefore be sure to check with your local CSR and find out if you are eligible!

Feel free to leave a comment below letting us know if this event triggers a soft pull! We will continue to make sure to keep you guys updated on all the latest deals nationwide!

Fremont Bank has pretty competitive CD rates compared to traditional banks. However, you should still take advantage of our full list of Bank Rates and CD Rates to get the best deal for you!

Compare Fremont Bank Promotions with other bank bonuses from Chase Bank, HSBC, Huntington Bank, TD Bank, Citi, Bank of America, Wells Fargo, and more.

*Check back at this page for updated Fremont Bank promotions, bonuses, and offers.

Leave a Reply