If you ever need to cancel a Chase check, don’t worry. Simply follow our guide on How to Stop Payment for a Chase Check.

If you ever need to cancel a Chase check, don’t worry. Simply follow our guide on How to Stop Payment for a Chase Check.

By following our guide, you will be able to request a stop payment for any check or range of checks that you do not wish Chase to pay.

Alternatively, if you need to order a new set of checks, see our guide on How to Order New Chase Checks Online.

If you are looking for the perfect account for you, consider a Chase Account. But if you are looking to earn a bonus or more premier service you may want to check out Chase Total Checking® + Chase SavingsSM accounts, Chase Premier Plus CheckingSM account, or even the Chase Private Client.

| PROMOTIONAL LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up to $700 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

How To Request Stop Payment Using Chase

Recently, Chase removed the Customer Center that you may be really familiar with. However, we have the most up to date method to request a Stop Payment by logging into Chase.

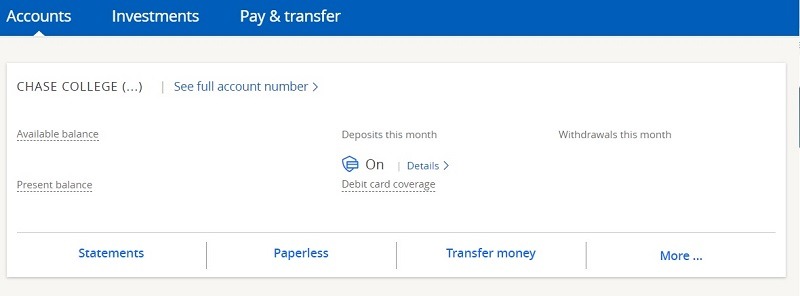

- Log in to Chase.com

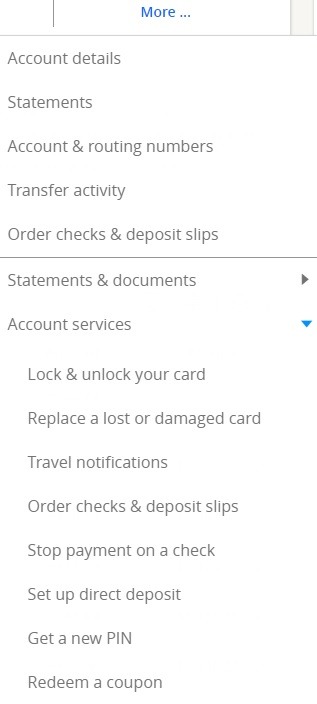

- Under the Accounts tab, locate and press the “More…” button.

- Select “Account Services”.

- Select the “Stop Payment of a check” option.

- You can stop a payment on a check by choosing “Add stop payment.”

How To Request Stop Payment by Chase Mobile App®

Alternatively, you can follow these steps using the Chase Mobile App® to request a Stop Payment on a Check.

- Sign-in to your chase account using the Chase Mobile App® .

- Scroll down to Account Services and select “Stop Payment on a check”.

- You can stop a payment on a check by choosing “Add stop payment.”

Additional Options

Alternatively, you may want to use Chase QuickDeposit. Chase added Zelle, an online service that allows you to transfer or receive money. This is a simpler, quicker, and safer means of transferring checks to your account.

Chase Bank Promotions

• Enjoy $125 as a new Chase checking customer when you open a Chase College CheckingSM account and complete 10 qualifying transactions within 60 days of coupon enrollment. • $0 Monthly Service Fee while in school up to the expected graduation date provided at account opening (five years maximum) for students 17-24 years old. • Wire funds internationally using the Chase Mobile® app or chase.com. Send money to recipients around the world with multiple currency options. Fees apply. • Keep track of your money with confidence and control in the Chase Mobile® app. The Chase Mobile app helps you bank securely and conveniently from anywhere. • With Zelle®, you can send and receive money with people and businesses you know and trust who have an eligible account at a participating U.S. bank. • With Fraud Monitoring, Chase may notify you of unusual debit card purchases and with Zero Liability Protection you won't be held responsible for unauthorized debit card purchases when reported promptly. • JPMorgan Chase Bank, N.A. Member FDIC *With Chase Overdraft AssistSM, we won’t charge an Overdraft Fee if you’re overdrawn by $50 or less at the end of the business day OR if you’re overdrawn by more than $50 and you bring your account balance to overdrawn by $50 or less at the end of the next business day (you have until 11 PM ET (8 PM PT) to make a deposit or transfer). Chase Overdraft Assist does not require enrollment and comes with eligible Chase checking accounts. |

• You're eligible for up to a $3,000 bonus when you open a new Chase Private Client CheckingSM account with qualifying activities. • Speak with a Private Client Banker to open your Chase Private Client CheckingSM account today. Schedule your meeting at your nearest branch to get started. • Priority service for everyday banking. Receive personalized attention from a dedicated Chase Private Client Banker and 24/7 access to a U.S. based banking service line. • Earn $1,000 when you deposit $150,000 or earn $2,000 when you deposit $250,000 or earn $3,000 when you deposit $500,000. • No fees at Chase and non-Chase ATMs worldwide. • No Chase fee on incoming or outgoing wire transfers. • Get higher limits on Chase Private Client debit card purchases and ATM withdrawals, as well as higher Zelle® and Chase QuickDepositSM limits. • Relationship rates which may make you eligible for a 0.25% auto loan rate discount, and access to events, including cultural and sporting events, family experiences, and financial seminars. • Enhance your relationship with J.P. Morgan Wealth Management and partner 1:1 with a dedicated J.P. Morgan Private Client Advisor who can create a personalized financial strategy and custom investment portfolio. Get a holistic view of your banking and investing, and make seamless transfers between accounts with the Chase Mobile® app. • Deposit products provided by JPMorgan Chase Bank, N.A. Member FDIC. Deposit products are FDIC insured up to the maximum amount allowed by law. |

Bottom Line

If you need to know how to stop payment for a Chase Check, just follow the steps above. The simple form that you have to fill out should take no more than a few minutes to complete.

If you don’t have a bank account, head to our full list of Chase Coupons for a detailed review of the best chase accounts. We do recommend checking out one of Chase’s most popular checking accounts that offers a generous bonus when signing up.

great info.

This info is no longer valid. Now, you go to your account, click the dropdown list “Things you can do”, expand “Account Services”, and then select “Stop Payment on a Check”

I want stop payment on to checks , check number are 207 amount $200 and check 208 amount $975.