Located mostly in the South, Pinnacle Bank offers a fair amount of checking and savings accounts and are convenient in their services. To find out if Pinnacle Bank is right for you, continue reading the review below.

Pinnacle Bank was founded in Fort Worth, Texas and has about 20 branches solely in Texas. They have branches in other Southern states, but Texas is widespread.

If you want variety, then Pinnacle Bank is where you should look. They offer premium checking accounts, relationship accounts and other options to help you manage your money properly and responsibly.

Checking Account Options

Pinnacle Bank has several checking accounts that offer different benefits each and have varying opening deposits.

With this premium checking account, you will have access to IDProtect®, which issues an identity theft protection on your card. You also get Cell Phone Protection covered up to $300 in case it gets stolen or damaged.

This account also comes with:

- A Pinnacle Bank Visa® Debit Card

- Access to CardValet® mobile app

- Online Banking/Bill Pay

- Mobile Banking

- Account Alerts

You will need a minimum deposit of of $100 in order to open this account.

This is a premium relationship checking account that comes with a large list of benefits.

This account also comes with:

- Refund up to $32 on NSF Paid Item fee/NSF Returned Item Fee per statement cycle

- Up to $10 back per statement cycle on foreign ATM fees or surcharges

- Your first box of checks

- No fees for paper statements and notices

- Refund for up to 5 money order fees and 5 cashier’s check fees per statement cycle

- Refunds of incoming wire fees (up to $25 per statement cycle)

- $300 credit toward home equity loans and lines of credit and secondary market real estate closing fees

- IDProtect® Identity Theft Protection Service

- Cell Phone Protection

- CardValet® card management app

This account earns competitive interest, but you will need to maintain a minimum balance of $1,000 to start earning interest.

To avoid the monthly fees, have at least a daily balance of $15,000.

You will also need a minimum deposit of of $100 in order to open this account.

This is a completely free checking account. That means no monthly fees and no minimum balances are required!

This account also comes with some pretty nice benefits, such as:

- A Pinnacle Bank Visa® Debit Card

- Online Banking/Bill Pay

- Mobile Banking

- Account Alerts

However, this account does require a minimum opening deposit of $100 and doesn’t earn interest.

This account was designed to be convenient. When you open a Select Checking account, you can receive notifications reminding you of your balances, bill payments and overall just statements.

Every month you will receive a paper statement for your account in the mail and you can keep a copy for yourself as well.

However, keep in my mind that paper statements will incur a $5 fee per statement cycle.

This account also comes with:

- A Pinnacle Bank Visa® Debit Card

- Online Banking/Bill Pay

- Mobile Banking

- Account Alerts

You will also need a minimum opening deposit of $100 to open this account and this account also doesn’t earn interest.

This checking account does earn interest and is ideal for big spenders.

If you manage to keep at least $1,000 as a daily balance amount, then your interest will increase daily.

There is unfortunately a $15 service fee if you fail to maintain the the minimum balance, so, be wary of that.

This account also comes with:

- A Pinnacle Bank Visa® Debit Card

- Online Banking/Bill Pay

- Mobile Banking

- Account Alerts

You will need at least $100 to open this account.

Compare Checking Accounts

Savings Account Options

Pinnacle Bank has a small selection of savings accounts, but they earn decent interest rates.

This is a savings account with a variable interest rate. Interest is compounded daily.

You will also gain access to Pinnbank, Telebank and Mobile Banking.

You will need a minimum of $100 to open this account.

Keep in mind that there is a $3 service charge if you exceed 6 withdrawals within a month.

This savings account is for kids 18 and under and they only need $0.01 to open it.

However, even if there are no fees nor minimum balance requirements to worry about, a $3 service charge will incur if they go past 6 withdrawals within a month.

This account earns interest as well, just not as high as PinnSavings.

The interest earned is compounded daily but deposited quarterly.

Compare Savings Accounts

Money Market Account Options

Money Market accounts allow for a higher yield and gives access to your funds with either checks or a bankcard. Pinnacle Bank offers one money market that earns tiered interest rates.

PinnCheck Market Account

- Requires a $100 minimum opening deposit

- Interest is compounded monthly based on your balance

- There is $15 service charge if the balance falls below $1,000

- For current rates contact your local branch

Compare Money Market Accounts

Reasons to Bank with Pinnacle Bank

- They have a good selection of checking accounts and each of them come with useful benefits.

- Most of their accounts don’t have monthly fees.

- Their premium checking accounts come with ID Theft Protection and Cell Phone Protection.

- They have a youth savings account to encourage kids to manage their finances responsibly at an early age.

- If you live in Texas, you are definitely able to find a Pinnacle Bank near you.

- They have a relationship checking account that comes with unique benefits.

- Conduct all your banking online or with the Pinnacle mobile app.

Reasons Not to Bank with Pinnacle Bank

- They have a low variety of savings accounts.

- The interest earned on all accounts aren’t that high.

- They have locations mostly in the South.

Pinnacle Bank Routing Number

Pinnacle Bank’s routing number is 111903517.

Contact Customer Service

You can reach Pinnacle Bank at 817-558-2700.

A customer representative will be available to speak with you at these hours:

- Monday – Wednesday at 8:00 AM – 5:00 PM CST

- Thursday – Friday at 8:00 AM – 6:00 PM CST

How Pinnacle Bank Compares

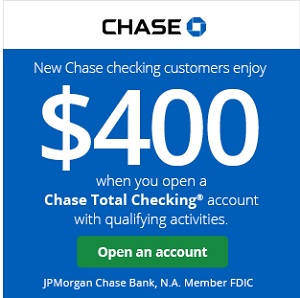

- Chase Bank: Chase is one of the biggest banks in the U.S and offers just about almost everything. Compared to its other competitors, Chase offers much more checking account options.

- Discover Bank: Discover Bank is an online nationwide bank that offers bonuses for their checking and savings accounts!

- Wells Fargo: Located throughout the US with over 5,800 branches and 13,000 ATMs. They offer a variety of deposits accounts, including accounts for teens and customers who need a second chance.

Bottom Line

For those who live in either Texas or anywhere in the Southern region, you might want to consider banking with Pinnacle Bank.

With a large variety of account options to choose from, you’re bound to find an account that suits you.

However, keep in mind that when you look for a checking or savings account be sure to look into all the fees charged. Don’t focus on the interest rate alone, but on what the account will cost you overall.

If you’re interested in banking with Pinnacle Bank, then check out these other Pinnacle Bank Promotions! For more options from a variety of banks, see our list of the best bank promotions!

Helpful Tips:

Leave a Reply