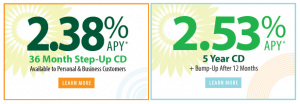

Available to the residents of Kentucky and Tennessee, Planters Bank has wide array of products to meet your individual needs. They offer plenty of services such as Online and Mobile banking, eStatements, and so much more! They currently offer standard CD rates from 12-months to 60-months with 2.10% to 2.60% APY Rates. By joining Planters Bank and opening a CD account, you get to enjoy earning higher interest rate than regular savings account. All you need is $2,500 to open. Right now, they are having a special 36-month step-up CD term with up to 2.38% APY and 60-month CD term with up to 2.53% APY on balances $2,500 or more. If you are interested, make sure to read on to learn more about Planters Bank’s wide array of CDs or visit any branch now and open your CD today!

Available to the residents of Kentucky and Tennessee, Planters Bank has wide array of products to meet your individual needs. They offer plenty of services such as Online and Mobile banking, eStatements, and so much more! They currently offer standard CD rates from 12-months to 60-months with 2.10% to 2.60% APY Rates. By joining Planters Bank and opening a CD account, you get to enjoy earning higher interest rate than regular savings account. All you need is $2,500 to open. Right now, they are having a special 36-month step-up CD term with up to 2.38% APY and 60-month CD term with up to 2.53% APY on balances $2,500 or more. If you are interested, make sure to read on to learn more about Planters Bank’s wide array of CDs or visit any branch now and open your CD today!

| Service Credit Union | 4.25% APY 9-Month CD | Review |

| Western Alliance Bank | 4.50% APY 3-Month CD | Review |

| Western Alliance Bank | 4.40% APY 6-Month CD | Review |

| First Tech Federal Credit Union | 4.35% APY 13-Month Share Certificate | Review |

| Sallie Mae | 4.35% APY 10-Month CD | Review |

| Western Alliance Bank | 4.25% APY 12-Month CD | Review |

| Ponce Bank | 4.25% APY 3-Month High Yield CD | Review |

| Sallie Mae | 4.25% APY 14-Month CD | Review |

| Ponce Bank | 4.15% APY 4-Month No-Penalty CD | Review |

| Live Oak Bank | 4.10% APY 12-Month CD | Review |

| Live Oak Bank | 4.10% APY 12-Month Business CD | Review |

| First Mid Bank & Trust | 4.08% APY 9-Month CD | Review |

| Discover Bank | Up to 4.00% APY CD | Review |

| Sun Canyon Bank | 3.87% APY 11-Month CD | Review |

| Western Alliance Bank | 3.85% APY 5-Month CD | Review |

| Quontic Bank | Up to 3.75% APY CD | Review |

| GreenState Credit Union | 3.65% APY 10-Month CD | Review |

| Blue Federal Credit Union | 3.55% APY 15-Month CD | Review |

| Blue Federal Credit Union | 3.50% APY 9-Month No Penalty CD | Review |

| CIT Bank | 3.50% APY 13-Month CD | Review |

| CIT Bank | 3.50% APY 11-Month No-Penalty CD | Review |

| Southwestern National Bank | 3.40% APY 8-Month CD | Review |

| Ponce Bank | 3.00% APY 1-Month High Yield CD | Review |

| CIT Bank | 3.00% APY 6-Month CD | Review |

| CIT Bank | 3.00% APY 18-Month CD | Review |

Planters Bank CDs:

CDs are a certificate issued by a bank to a person depositing money for a specified length of time and usually the longer of a term is – the higher APY rate you make! Planters Bank’s Best CD Offer pays the highest APY rate with a 3.60% APY rate on their 36-Month term. However, their current promotion is the 36-Month Step-Up CD special with 2.38% APY and the 60-Month CD special with 2.53% APY. Be sure to view our Best 36-Month CD Rates and Best 60-Month CD Rates list and see how they compare. Planters Bank wants to make you feel supported and helps put you in control of your hard earned funds. If you’re interested in making a higher rate than a traditional savings account then make sure to check out below CD rates.

Special CD Rates:

| Term | APY Rate | Minimum Deposit |

| 36 Month Step-Up | 2.38% | $2,500 |

| 60 Month | 2.53% | $2,500 |

Certificates of Deposits Rates:

| Term | APY Rate | Minimum Deposit |

| 12 Month | 2.10% | $2,500 |

| 24 Month | 2.35% | $2,500 |

| 36 Month | 2.60% | $2,500 |

*Rates Effective As Of 07/04/2018

CD Features:

- Competitive interest rates

- Open a CD with a just $2,500

- FDIC Insured

Bottom Line:

If you are interested in a short term or long term CD, look no further as Planters Bank offers you a standard and special CD rates 2.38% APY on 36-month term and 2.53% APY on 60-month term. All you need to do is to pick your CD term and watch your money grow! These are really great CD rates for the balance requirement so be sure to take advantage of that while it lasts. Sign up for a CD with Planters Bank and the enjoy their high APY rates today. If you are not interested or eligible, check out our Best CD Rates at HMB!

Disclaimer: Rates / APY terms above are current as of the date indicated. These quotes are from banks, credit unions and thrifts. Bank, thrift and credit union deposits are insured by the FDIC or NCUA. Contact the bank for the terms and conditions that may apply to you. Rates are subject to change without notice and may not be the same at all branches.

Leave a Reply