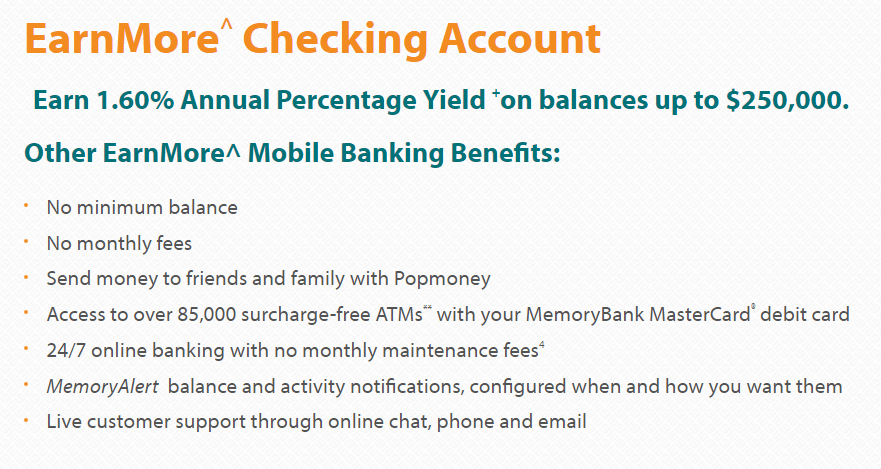

For residents nationwide, MemoryBank is offering a $100 bonus with EarnMore 1.60% APY when you open a EarnMore Checking account using the promo code TA2018 with a $50 opening deposit good through December 31, 2018. To earn this $100 bonus, you must have at least 3 ACH deposits of at least $200 by the end of the third statement cycle. There are no longer any requirements to earn the 1.6% APY rate! So with the EarnMore Checking account, you can enjoy features such as mobile banking, alerts, and much more. If you are interested and qualify, make sure to take advantage of this offer and sign up today!

For residents nationwide, MemoryBank is offering a $100 bonus with EarnMore 1.60% APY when you open a EarnMore Checking account using the promo code TA2018 with a $50 opening deposit good through December 31, 2018. To earn this $100 bonus, you must have at least 3 ACH deposits of at least $200 by the end of the third statement cycle. There are no longer any requirements to earn the 1.6% APY rate! So with the EarnMore Checking account, you can enjoy features such as mobile banking, alerts, and much more. If you are interested and qualify, make sure to take advantage of this offer and sign up today!

Editor’s Note: The $100 in Bonus Cash described above is intended for users of the TaxAct tax preparation software who meet MemoryBank’s eligibility requirements and other terms, and is offered and administered by MemoryBank.

If you’d like to participate in our Rewards Program, simply contact us when you find a new bank promotion and get paid up to $15!

| BMO Bank Checking: Open a new BMO Smart Money Checking Account and get a $400 cash bonus* when you have a total of at least $4,000 in qualifying direct deposits within the first 90 days. Learn More---BMO Checking Review *Conditions Apply. Accounts are subject to approval and available in the U.S. by BMO Bank N.A. Member FDIC. $4,000 in qualifying direct deposits within 90 days of account opening. |

| Chase Ink Business Unlimited® Credit Card: New cardholders can enjoy a welcome offer of $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. Click here to learn how to apply--- Review |

MemoryBank $100 Bonus with 1.60% APY Info:

- Sign up today

- MemoryBank Promotion PDF Printout

- Account Type: EarnMore Checking

- Availability: Nationwide (Bank Locator)

- Expiration Date: 12/31/2018

- Credit Inquiry: Soft Pull.

- ChexSystems: Yes

- Opening Deposit: $50

- Credit Card Funding: Up to $500.

- Direct Deposit Requirement: Yes

- Monthly Fee: None

- Additional Requirements: You must use the Promo Code: TA2018 when applying.

- Household Limit: 1 per customer

- Closing Account Fee: None listed

Earn MemoryBank $100 Bonus with 1.60% APY:

- Open a EarnMore Checking account from MemoryBank using the promo code TA2018 with a $50 minimum opening deposit by December 31, 2018.

- Then you must have at least 3 ACH deposits of at least $200 by the end of the third statement cycle to earn the $100 bonus.

- To also earn an APY Rate of 1.60% all you must:

Receive at least 1 electronic deposit such as payroll, transfers from other financial institutions, or even Popmoney.Use your debit card at least 5 in-person or online purchases.Enroll in online statements.

*As of 05/03/18 there are no longer any requirements needed to earn the mentioned APY rate

How to Avoid Monthly Fees:

How to Avoid Monthly Fees:

- EarnMore Checking: There are no monthly fees.

Bottom Line:

Make sure you check out MemoryBank to learn more about the $100 bonus promotion and also earn a 1.60% APY rate. If you like to see how their rates compare, we have composed great offers on our Best Savings Rates list that you can consider with little or no monthly requirements. Also, don’t forget, the $100 bonus will be reported on IRS Form 1099-INT. Feel free comment below and let us know about how it went and if you could fund your account with credit card or not. If you would like to see more, check out our full list of Bank Bonuses for all your banking needs.

The American Express® Gold Card offers 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases on your new Card in your first 6 months of Card Membership. You'll earn: • 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. • 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. • 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. • 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. • 1X Membership Rewards® point per dollar spent on all other eligible purchases. Other benefits: • $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That's up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards points for Uber Eats purchases made at restaurants or U.S. supermarkets. Point caps and terms apply. • $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express(R) Gold Card at U.S. Dunkin' locations. • $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express(R) Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required. • $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express(R) Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required. • Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property. This card has an annual fee of $325 with no foreign transaction fees (See Rates & Fees). Terms Apply. |