Available nationwide, BlueVine is a $300 bonus + 1.50% APY on their Small Business Checking account on balances up to $100,000. It’s one of the best Business checking account online!

Update 6/12/25: There is currently a $300 bonus available through 6/30/25. If you have a business checking account earning little to no interest, consider this account to earn 1.5% APY (decrease from 2%) on balances up to $100K.

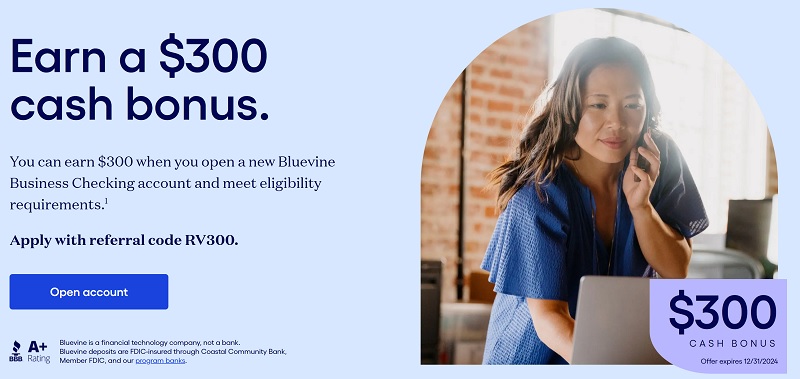

BlueVine Business Checking $300 Bonus

You can earn $300 when you open a new Bluevine Business Checking account and meet eligibility requirements.

How to earn it:

- To get your $300 bonus, apply for a Bluevine Business Checking account anytime between now and 6/30/2025 using referral code RV300.

- After opening your account, deposit a total of $2,000 within the first 30 days. After 30 days, maintain a minimum daily balance of $2,000 while also completing at least one of the following eligibility requirements every 30 days for 90 days:

- Deposit at least $5,000 from eligible merchant services to your Bluevine account OR

- Make at least $5,000 of outbound payroll payments from your Bluevine account using eligible payroll providers OR

- Spend at least $2,000 on eligible transactions1 with your Bluevine Business Debit Mastercard® and/or Bluevine Business Cashback Mastercard®

(Learn more at BlueVine)

About BlueVine Business Checking

BlueVine was first founded in 2013 as a source of capital for smaller businesses. Since then, then have grown to hosting nearly 25,000 small businesses while disbursing nearly $3 billion dollars to those businesses.

The company has since added a business checking account, designed to improve the banking experience of business owners.

They were able to do this through invoice factoring, term loans and lines of credit. If you’d like to learn more about BlueVine and how they can help your business, check out our post below.

How To Earn 1.50% APY with BlueVine Small Business Checking Account:

- Spend $500 per month with your Bluevine Business Debit Mastercard OR

- Receive $2,500 per month in customer payments to your Bluevine checking account or sub-accounts.

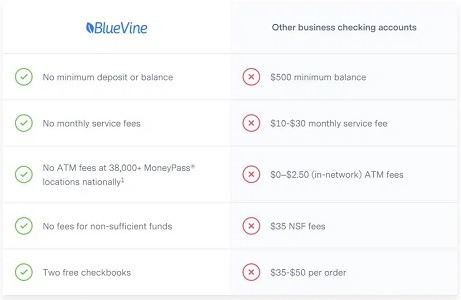

Here are some highlights of the BlueVine Small Business Checking account.

- Interest on Business Checking

- No minimum deposit or balance

- No monthly service fees

- No ATM fees at 38,000+ MoneyPass® locations nationally

- No fees for non-sufficient funds

- ATM card access

- Two free checkbooks

- Fast online sign-up

(Learn more at BlueVine)

| Chase Business Checking ($300 or $500 Bonus) | Bank of America Business Checking ($200 bonus offer) |

| Axos Business Premium Savings ($375 Bonus) | Axos Bank Basic Business Checking ($400 Bonus) |

| Axos Bank Business Interest Checking ($400 Bonus) | Huntington Unlimited Plus Business Checking ($1,000 Bonus) |

| Huntington Unlimited Business Checking ($400 Bonus) | Bluevine Business Checking ($300 Bonus) |

| U.S. Bank Business Checking ( $500 or $900 Bonus) | |

BlueVine Account Features

- Earn 1.50% interest on balances up to $100,000

- No monthly, NSF, ACH, or incoming wire fees

- Live customer support from dedicated professionals

- Pay vendors and bills by ACH, wire, or check

- Unlimited transactions, no minimum balance required

- Make transfers to and from your other accounts

- Deposit checks from the BlueVine mobile app

BlueVine Business Checking Features

The BlueVine Small Business Checking account offers a competitive APY, an ATM card, no hidden fees and live support.

Enjoy unlimited transactions – including ACH, wire and check – with no minimum balance required.

Customers have the option of making deposits by cash (at nearly 90,000 Green Dot locations) or check (mobile app). Also, the account is FDIC-insured up to $250,000.

Be sure to keep in mind that the BlueVine Small Business Checking account is online only, with no physical branches. Also, Green Dot locations charge a $4.95 fee on cash deposits.

To apply, you must be a U.S. citizen at least 18 years old with a verifiable address. The process only requires basic information about your business, including your tax ID or Social Security Number.

- Mobile and Online Banking. With an account from BlueVine, you will have the option of managing your account either online or through the mobile app. The online interface allows you to transfer money to designated payees, view and print account activity and documents and get assistance as necessary. The mobile app allows for remote check deposit as well.

- Lack of fees. However, there is a $15 fee for an outgoing wire transfer from your Business Banking account and a $2.50 fee for non-network ATM transactions.

- Availability of Funds. BlueVine Business Banking offers an ATM card that allows fee-free withdrawals at over 38,000 MoneyPass locations across the country.

| Chase Business Complete Checking®: Earn $300 or $500 when you open a new Chase Business Complete Checking® account. For new Chase business checking customers with qualifying activities. Chase offers financial products and services that let you bank when and how you want. Get Coupon---Chase Business Checking Review |

| Huntington Unlimited Business Checking: Earn $400 bonus when you open a Huntington Unlimited Business Checking account and make total deposits of at least $5,000 within 60 days of account opening. The $400 bonus will be deposited into your account after all requirements are met. This account is for businesses with higher checking activity and greater cash flow needs. Apply Now---Huntington Unlimited Business Checking Review |

| U.S. Bank Business Checking: Earn a $400 bonus when you open a U.S. Bank Business Essentials Account or $1,000 when you open a Platinum Business Checking Account online with promo code Q3AFL25 and complete qualifying activities, subject to certain terms and limitations. Offer valid through September 30, 2025. Member FDIC. Apply Now---U.S. Bank Business Checking Review |

|

| Bank of America Business Advantage Checking Bonus Offer Open a new Bank of America Business Advantage checking account and complete the eligible requirements to earn a $200 cash bonus offer. See offer page for more details. Additional terms and conditions apply. See offer page for more details. Learn More---Bank of America Business Checking Review |

Bottom Line

BlueVine is a great option for small businesses from offering loans, lines of credit and invoice factoring.

They have always been a finance company that supports small-business owners.

On top of that, their Business Banking offers small businesses a no-fee, high-yield checking account that could prove very convenient for existing customers.

Therefore, this is a good fit if you’re looking for a no-fee bank account with a relatively high APY.

For more options, see our list of the best business bank rates and business bank account bonuses from notable institutions like Chase Bank, Huntington Bank, U.S. Bank, Axos Bank, Bank of America, and more!