For select residents nationwide, Citibank (requires unique code) is offering a targeted promotion for a chance to earn up to 60k American Airlines AAdvantage miles when you open a new checking account by September 30, 2018! To earn the bonus, you must have received the mailer with an offer code along with the last name and enroll for this promotion online at offer.citibank.com. Then simply open a Citigold account and make $1,000 worth of debit card purchases and perform 1 qualifying bill payment for 2 consecutive months within 60 days of account opening. Your bonus will be deposited into your account within 90 days of requirement completion! Citibank offers many great features including over 30,000 fee-free ATMs nationwide, free online bill payment, free mobile banking, and many more! If you are looking for more deals, all of the latest CitiBank bonuses are located on the HMB master list of CitiBank Promotions.

For select residents nationwide, Citibank (requires unique code) is offering a targeted promotion for a chance to earn up to 60k American Airlines AAdvantage miles when you open a new checking account by September 30, 2018! To earn the bonus, you must have received the mailer with an offer code along with the last name and enroll for this promotion online at offer.citibank.com. Then simply open a Citigold account and make $1,000 worth of debit card purchases and perform 1 qualifying bill payment for 2 consecutive months within 60 days of account opening. Your bonus will be deposited into your account within 90 days of requirement completion! Citibank offers many great features including over 30,000 fee-free ATMs nationwide, free online bill payment, free mobile banking, and many more! If you are looking for more deals, all of the latest CitiBank bonuses are located on the HMB master list of CitiBank Promotions.

Let us know know you find a new bank bonus and get paid through our Rewards Program.

| BMO Bank Checking: Open a new BMO Smart Money Checking Account and get a $400 cash bonus* when you have a total of at least $4,000 in qualifying direct deposits within the first 90 days. Learn More---BMO Checking Review *Conditions Apply. Accounts are subject to approval and available in the U.S. by BMO Bank N.A. Member FDIC. $4,000 in qualifying direct deposits within 90 days of account opening. |

| Chase Ink Business Unlimited® Credit Card: New cardholders can enjoy a welcome offer of $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. Click here to learn how to apply--- Review |

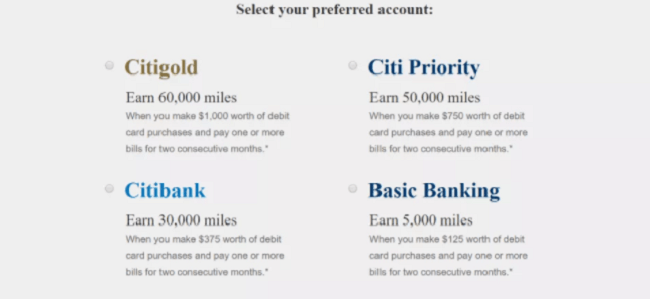

Citibank 60k AA Miles Information:

- Enrollment Page: Must enter a unique code along with the last name of offer recipient

- Maximum Bonus: 60k AA miles

- Account Type: Citi Account Package

- Availability: Nationwide (Bank Locator)

- Expiration Date: 09/30/2018

- Soft/Hard Pull: Soft Pull

- ChexSystems: Yes

- Credit Card Funding: No

- Direct Deposit Requirement: None.

- Monthly Fee: $0- $30, see below on how to avoid

- Additional Requirements: You must have received this offer through your mail in order to qualify.

- Household Limit: 1

- Closing Account Fee: None listed, however account must remain open and good standing to receive the bonus.

How To Earn Citibank 60k AA Miles Bonus:

- A unique code is required as well as the last name of the offer recipient is required in order to apply at offer.citibank.com by September 30th, 2018.

- Within 60 days of opening the qualifying checking account you must complete the following:

- Spend the required minimum amount from the Chart above on qualifying purchases using your Citibank® Debit Card or ATM Card. Spend $1,000 to earn maximum 60k AA miles bonus.

- Perform 1 qualifying bill payment in 2 consecutive calendar months. The first bill payment must be made within 60 calendar days of account opening. Qualifying bill payments must be posted to the new checking account each month for two consecutive calendar months.

- Once the requirements are met, the bonus will be credited to your account within 90 days.

How to Avoid Monthly Fees:

- Citigold Account: There is no monthly service fee for this account. However if you do not maintain a minimum combined average monthly balance of $200,000 in eligible linked deposit, retirement and investment accounts, your Citigold Account Package will be converted to The Citi Priority Account Package and your accounts will be subject to the terms and conditions then in effect for that package.

- Citi Priority Account: The $30 monthly fee can be waived when you maintain a combined average monthly balance of $50,000 or more in eligible linked deposits, retirement and investment balances.

- Citibank Account: The $25 monthly fee can be waived when you maintain a combined average monthly balance of $10,000+ in eligible linked deposit, retirement and investment accounts.

- Citi Basic Banking Account: The $12 monthly fee can be waived you make one qualifying direct deposit per month and one qualifying bill payment per month or maintain a $1,500+ combined average monthly balance in eligible linked accounts. Fee also waived for first listed account owners 62 or older.

Bottom Line:

Citibank is offering a great promotion for those who are interested in earning up to 60k AA miles! Keep in mind that this is a targeted promotion and that you must receive the mailer in order to qualify for this bonus. Also, you must spend at least $1000 with your debit card in order to receive the maximum miles bonus. Overall, this is a simple promotion to take advantage of and there are only a few requirements you need to complete. If you are not interested in this offer or looking for other options, see our complete list of Bank Deals for all your banking needs!

The Chase Freedom FlexSM offers a $200 bonus after spending $500 on purchases in your first 3 months from account opening. 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR. You'll earn: • Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter! • 5% cash back on travel purchased through Chase Travel?, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more • 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service • Unlimited 1% cash back on all other purchases You cash back rewards do not expire as long as your account is open and there is no minimum to redeem for cash back. This card has no annual fee. |