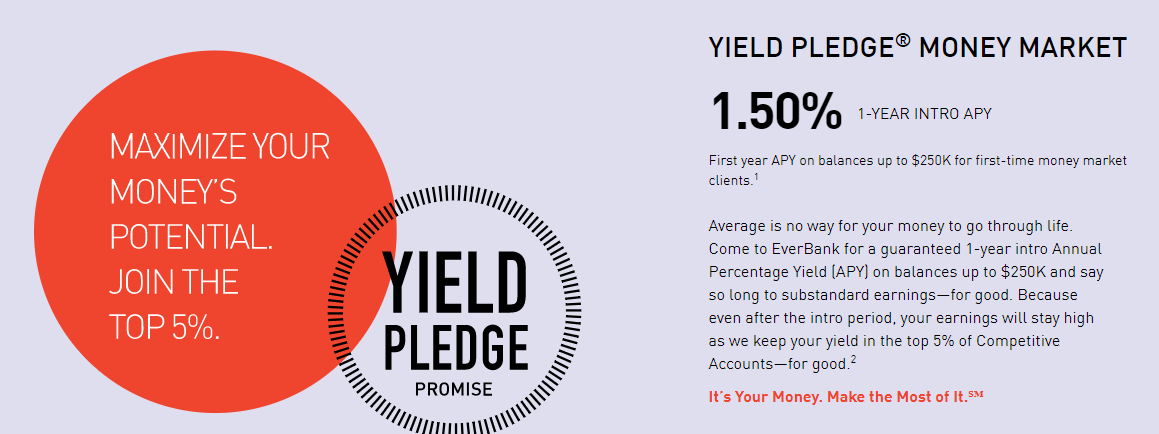

For first-time EverBank money market clients and available nationwide, open a EverBank Yield Pledge® Money Market account online and earn 1.50% 1-Year Intro APY on balances up to $250,000.00! EverBank is a Florida-based financial institution that operates mostly through online banking. In addition, EverBank is a publicly traded company that was originally organized as First Alliance Bank with the FDIC in 1998. Soon after being established, the bank obtained Mercantile Bank’s world currency division in order to offer accounts that consist of foreign currencies.

For first-time EverBank money market clients and available nationwide, open a EverBank Yield Pledge® Money Market account online and earn 1.50% 1-Year Intro APY on balances up to $250,000.00! EverBank is a Florida-based financial institution that operates mostly through online banking. In addition, EverBank is a publicly traded company that was originally organized as First Alliance Bank with the FDIC in 1998. Soon after being established, the bank obtained Mercantile Bank’s world currency division in order to offer accounts that consist of foreign currencies.

There is only a soft pull via ChexSystems and no monthly fee. EverBank is an online bank so you do not have to be in Florida to sign up. You must keep in mind that this is only for the first year and the maximum amount is $250k. Features you’ll get is automatic reimbursements of all U.S. ATM fees with a minimum $5,000 balance, free online & mobile banking, and free paper checks & mobile check deposits. This is a straightforward account that you just sign up and receive!

To get started, click the “Sign Up” button below. When you are on EverBank’s webpage press “Apply Now”, select the EverBank Yield Pledge® Money Market account and begin inputting your information!

Editor’s Note: In addition to the EverBank Yield Pledge® Money Market account’s rate, there are other savings offers similar to this one so be sure to refer to our reviews below for more information!

- CIT Bank Premier High Yield Savings review

- Synchrony Bank High Yield Savings review

- Discover Online Savings review

- Barclays Bank Online Savings review

- Ally Bank Online Savings review

- BBVA Compass ClearChoice Money Market review

EverBank Yield Pledge Money Market Credentials

Is the EverBank Yield Pledge® Money Market account right for you?

| Good For | Bad For |

| Those Looking For a High Interest Rate | Minimum Opening Deposit |

| Online & Mobile Banking | Limited Physical Branch Locations |

EverBank Yield Pledge Money Market Rates

| Balance | Annual Percentage Rate |

| $0 – $9,999,99 | 1.05% |

| $10,000 – $24,999.99 | 1.10% |

| $25,000.00 – $49,999.99 | 1.15% |

| $50,000.00 – $99,999.99 | 1.25% |

| $100,000.00 – $10,000,000.00 | 1.35% (After 1-year introductory APY) |

| Balances up to $250,000.00 | 1.50% (1-year introductory APY) |

Rates are effective as of 04/02/2018, and are subject to change.

EverBank Yield Pledge Money Market Pros & Cons

- High Interest Rate

- Mobile App Available

- No Monthly Maintenance Fee

- No Physical Locations

- Minimum Opening Deposit

EverBank Yield Pledge Money Market Fees

| Account Type | EverBank Yield Pledge® Money Market |

|---|---|

| Minimum Deposit | $5,000 |

| Monthly Service Charge | $0 |

| Insufficient Funds Fee | $30 |

| Domestic Wire Transfer Fee – Inbound | $0 |

| Domestic Wire Transfer Fee – Outbound | $25 |

| Excess Pre-Authorized Withdrawals, Transfers or Checks | $10 |

| Overdraft fee | $30 |

| Stop Payment Fee | $30 |

| Cashier’s check | $10 |

Similar to most savings accounts, you are limited to six (6) withdrawals per statement cycle. Fees may be different depending on your location. For more details, visit their terms and conditions page.

EverBank Yield Pledge Money Market Info

- Account Type: EverBank Yield Pledge® Money Market account

- Availability: Nationwide

- Minimum Balance: $5,000

- Maximum Balance: $250,000

- Expiration Date: None

- Credit Inquiry: Soft Pull via ChexSystems

- Opening Deposit: $5,000

- Credit Card Funding: No

- Monthly Fee: None

- Household Limit: None

- Early Termination Fee: None

- Insured: FDIC

EverBank Online Banking

EverBank Online Banking provides a modern and secure platform for customers to complete account management duties like paying bills, monitoring account activity, transferring funds, and checking account balances.

- Manage your accounts and account information online

- View and download statements and account activity

- Schedule and make transfers to and from other banks

- Schedule and make transfers

- Receive and manage account alerts

- Send secure messages

How to get started:

- Visit EverBank’s website and sign in.

- Once you log in, you can view your balance and transactions, make transfers, send and receive money, deposit checks, pay bills, view online statements, and more.

EverBank Mobile Banking

EverBank Mobile Banking is a great way to access your accounts on a mobile device or tablet with their mobile banking app available on the Apple Store and Google Play Store! With mobile banking, you will be able to:

- Make deposits

- Pay your bills

- Transfer money

- Find nearby ATMs and cash back locations

- View your balances and search transaction history

How to get started:

Ways to Avoid the Monthly Fee

The EverBank Yield Pledge® Money Market account has no monthly fee!

EverBank Yield Pledge Money Market Account

Follow the steps below in order to get started with your EverBank Yield Pledge® Money Market account!

- Open a EverBank Yield Pledge® Money Market account.

- Input your info – Provide your name, address, phone, email and social security number or Tax ID.

- Fund the account – Transfer funds electronically from an internal account or an external account at another bank

- Earn 1.50% 1-Year Intro APY on balances up to $250,000.00 with your EverBank Yield Pledge® Money Market account!

Bottom Line

When you open an FDIC-insured EverBank Yield Pledge® Money Market account, you can count on consistently high yields along with many other perks geared to save you money and time because EverBank is committed to keep your yield in the top 5% of Competitive Accounts offered at leading banks!

Overall, I’d recommend the EverBank Yield Pledge® Money Market Account to savers who can meet the minimum deposit requirement and to not worry about foreign ATM fees. The IRA option is another nice extra that might make it more appealing than competing accounts. On the other hand, with any money market account, be sure to compare the yield and the fees beforehand to make sure you’re choosing the right one.

If this offer did not suite you, please visit our list of the Best Savings Rates that are filled with various financial institutions from banks, credit unions, and even federal credit unions that are offering great rates!

The Platinum Card® from American Express offers 100,000 Membership Rewards points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. You'll earn: • 5X Membership Rewards Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year. • 5X Membership Rewards Points on prepaid hotels booked with American Express Travel. • $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts(R) or The Hotel Collection bookings through American Express Travel using your Platinum Card(R). The Hotel Collection requires a minimum two-night stay. • $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required. • With American Express Global Lounge Collection you can enjoy access to over 1,400 airport lounges globally, including The Centurion Lounge, Unlimited Delta Sky Club® Access when flying an eligible Delta flight, Escape Lounges, Lufthansa Lounges when flying Lufthansa Group, Plaza Premium, Priority Pass Select Lounges, & Additional Global Lounge Collection Partner Lounges subject to visit limitations. Lounges may have their own rules, like additional access rules and guest fees, and for Priority Pass Select, you need to enroll and there are unlimited airport lounge visits for Card Members. With Delta Sky Club Access, Card Members will receive 10 Visits to the Delta Sky Club to be used from February 1 until January 31 of the next calendar year and can unlock Unlimited Delta Sky Club Access by spending $75,000 in eligible purchases on their Card in a calendar year. To find a lounge, visit the membership section in the American Express App or visit http://www.americanexpress.com/findalounge#/loungefinder. • $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month. • $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card. • $200 Uber Cash: Platinum Card Members can ride or dine in style with $15 in Uber Cash each month, plus a bonus $20 in December after adding their Card to their Uber account. Use your Uber Cash on rides and orders in the U.S. when you select an Amex Card for your transaction. • $199 CLEAR® Plus Credit: CLEAR Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $199 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues. • Receive either a $120 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck (through a TSA official enrollment provider) application fee, when charged to your Platinum Card. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost. • Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card. That's up to $50 in statement credits semi-annually. Enrollment required. This card comes with a $695 annual fee.¤ (See Rates & Fees), but you cardholders can enjoy Uber VIP status and up to $200 in Uber savings on rides in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member and Additional Centurion Cards only. Terms Apply. Terms Apply. |