If you’re 60 years or older and want to earn interest while keeping a lower minimum daily balance to avoid a monthly fee, TD Bank‘s 60 Plus Checking account might be a great choice for you. This offer is good for senior residents at following states: CT, DC, DE, FL, MA, MD, ME, NC, NH, NJ, NY, PA, RI, SC, VA & VT. You can simply earn the $50 by making $500 in debit card purchases within 90 days of your account opening. In addition, you will receive great benefits such as Free money orders, Free official bank checks, Free paper statements, Free Mobile Banking plus many more. If you qualify, make sure to sign up now as this offer is good until March 11, 2017. If you are looking for more TD Bank bonuses, come check out our HMB’s master list of TD Bank Promotions.

If you’re 60 years or older and want to earn interest while keeping a lower minimum daily balance to avoid a monthly fee, TD Bank‘s 60 Plus Checking account might be a great choice for you. This offer is good for senior residents at following states: CT, DC, DE, FL, MA, MD, ME, NC, NH, NJ, NY, PA, RI, SC, VA & VT. You can simply earn the $50 by making $500 in debit card purchases within 90 days of your account opening. In addition, you will receive great benefits such as Free money orders, Free official bank checks, Free paper statements, Free Mobile Banking plus many more. If you qualify, make sure to sign up now as this offer is good until March 11, 2017. If you are looking for more TD Bank bonuses, come check out our HMB’s master list of TD Bank Promotions.

| PROMOTIONAL LINK | OFFER | REVIEW |

| TD Bank Beyond Checking | $300 Cash | Review |

| TD Bank Convenience CheckingSM | $200 Cash | Review |

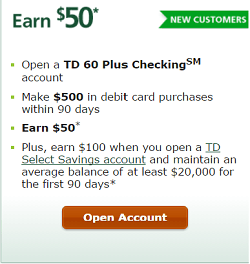

TD Bank $50 Bonus Information:

- Sign Up Offer

- TD 60 Plus Checking $50 Bonus Printout

- Account Type: 60 Plus Checking

- Availability: CT, DC, DE, FL, MA, MD, ME, NC, NH, NJ, NY, PA, RI, SC, VA, VT

- Branches: 1300+ (Bank Locator)

- Expiration Date: 03/11/2017

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Opening Deposit: Optional

- Credit Card Funding: Up to $300(YMMV); Make sure to set your cash advance to $0.

- Direct Deposit Requirement: No

- Monthly Fee:$10, see below on how to avoid

- Additional Requirements: Account must remain open, active, in good standing, and in the same product type through the qualifying period to receive the bonus.

- Household Limit: None listed

- Closing Account Fee: None listed

How to Earn TD Bank $50 Bonus:

- Open a new TD Bank 60 plus Checking account online or in-Store by March 11, 2017.

- Then you must complete $500 in Visa® Debit Card purchases within 90 days of account opening. Qualifying Visa® Debit Card purchase transactions are those made using a TD Visa® Debit Card to buy goods and services and must be posted to the new account within 90 days of account opening (ATM withdrawals do not qualify)

- After completion of the requirement, the bonus will be credited into your new personal checking account no later than 125 days from account opening.

How To Avoid Monthly Fees:

- 60 Plus Checking: $10 monthly fee can be waived if you keep minimum daily balance of $250

Bottom Line:

If you are a senior resident at any of the mentioned states, you should check out this great offer that TD Bank is offering. This is an easy way to receive the $50 bonus and you can avoid the monthly fee by simply keeping $250 daily balance. Keep in mind the bonus will be reported as taxable income to the IRS on 1099-MISC. If you’re interested and qualify, hurry and sign up today because the offer is for limited time only! If you want to check out other offers, see our complete list of Bank Deals for all your banking needs!

The Delta SkyMiles® Gold American Express Card offers 50,000 Bonus Miles after you spend $2,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Delta SkyMiles Gold American Express Card Members get 15% off when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. Discount not applicable to partner-operated flights or to taxes and fees. You'll earn: • 2X Miles on Delta purchases, at U.S. Supermarkets and at restaurants worldwide, including takeout and delivery in the U.S. • 1X Miles on all other eligible purchases. • $100 Delta Stays Credit: Get up to $100 back per year as a statement credit after using your Delta SkyMiles Gold American Express Card to book prepaid hotels or vacation rentals through Delta Stays on delta.com. • $200 Delta Flight Credit: After you spend $10,000 in purchases on your Card in a calendar year, you can receive a $200 Delta Flight Credit to use toward future travel. Receive a 20% savings in the form of a statement credit on eligible Delta in-flight purchases after using your Card. Want even more flexibility? Take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com. You can check your first bag free on Delta flights, saving up to $70 on a round-trip Delta flight per person. For a family of four that's a potential savings of up to $280 per round-trip flight. There is a $150 annual fee ($0 introductory annual fee for the first year, then $150) and no foreign transaction fees. (See Rates & Fees). Now, you'll get get more savings with your first checked bag for free on Delta flights. Terms Apply. |