If you are interested in learning about WaterStone Bank promotions, bonuses and offers, be sure to keep reading!

Update 10/28/24: There’s currently a $300 checking savings/money market bonus available though 11/30/24.

About WaterStone Bank Promotions

Established in 1921, WaterStone Bank has been dedicated to being a top financial resource to their communities. Additionally, using their expertise, they aspire to strengthen customer loyalty and maximize shareholder value.

I’ll review the Waterstone Bank Promotions below.

WaterStone Bank $300 Checking Bonus

- What you’ll get: $300 bonus

- Account Type: Checking & Savings/Money Market

- Availability: Wisconsin

- Direct deposit required: Yes (see what works)

- Hard/soft pull: Soft pull

- ChexSystems: Unknown

- Credit card funding: Unknown

- Monthly fees: None

- Early account termination fee: 90 days, $30 fee

- Household limit: One

(Expires 11/30/2024)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How to Earn Bonus

- Open a new checking account with direct deposit to earn $200. Add on a new savings or money market account and get an extra $100!

- $200.00 Automatic Deposit bonus offer requires a $500.00 minimum recurring automatic deposit of payroll or government benefits to be received within 60 calendar days of account opening and will be credited to the checking account on the first statement cycle after the direct deposit is received.

- $100.00 Money Market Account Bonus requires $5,000.00 or more opening deposit and a Universal checking account to receive bonus. Bonus will be credited to the money market account within 60 calendar days of account opening.

- Checking and Money Market Offer effective 09/16/2024.

- Bonus offers require a new WSB Universal Checking account to be open and active for the entire statement cycle* to qualify for that statement cycle’s* bonus.

- Annual Percentage Yields (APYs) are accurate as of 09/16/2024, variable, and subject to change at any time Universal Checking account is a tiered rate product and pays interest.

- Fees may reduce earnings.

- $200.00 Automatic Deposit bonus offer requires a $500.00 minimum recurring automatic deposit of payroll or government benefits to be received within 60 calendar days of account opening and will be credited to the checking account on the first statement cycle* after the direct deposit is received.

- A $200.00 payback fee will be imposed if the checking account is closed within 180 calendar days of account opening. Fees may reduce earnings.

- Offer applies to new checking account customers only, is redeemable at any branch location, cannot be combined with other offers, is limited to one per household, and does not apply to individuals that closed a WSB checking account within the past 180 calendar days. Ultimate Money Market account is a tiered rate product and pays interest.

- APY for each tier is based on daily balance method: 0.40% APY on balances from $0.00 to $24,999.99, 1.15% APY on balances from $25,000.00 to $49,999.99, 2.50% APY on balances from $50,000.00 to $99,999.99, 2.75% APY on balances from $100,000.00 to $249,999.99, and 3.00% APY on balances $250,000.00 or more, and requires $5,000.00 minimum balance to open. $10.00 minimum balance fee will be imposed monthly if the average daily balance° for the statement cycle falls below $5,000.00. Account must be open and active for 180 calendar days, or a $30.00 closing fee may be assessed at account closing. Fees may reduce earnings.

- $100.00 Money Market Account Bonus requires $5,000.00 or more opening deposit and a Universal checking account to receive bonus.

- Bonus will be credited to the money market account within 60 calendar days of account opening.

- A $100.00 payback fee will be imposed on your money market account if either the money market account or Universal checking account is closed within 180 calendar days of account opening.

- Offer applies to new money market account customers only and does not apply to individuals that currently have a money market or closed a WSB money market within the past 180 calendar days.

- Offers expire 10/19/2024. Checking and Savings Offer effective 09/16/2024.

- Bonus offers require a new WSB Universal Checking account to be open and active for the entire statement cycle* to qualify for that statement cycle’s* bonus.

- Annual Percentage Yields (APYs) are accurate as of 09/16/2024, variable, and subject to change at any time Universal Checking account is a tiered rate product and pays interest.

- APY for each tier is based on daily balance method: 0.05% APY on balances from $0.00 to $9,999.99, 0.10% APY on balances from $10,000.00 to $49,999.99, 0.15% APY on balances from $50,000.00 to $99,999.99, and 0.15% APY on balances $100,000.00 or more, requires $100.00 minimum balance to open account and must be open and active for 180 calendar days, or a $30.00 closing fee may be assessed at account closing.

- Fees may reduce earnings. $200.00 Automatic Deposit bonus offer requires a $500.00 minimum recurring automatic deposit of payroll or government benefits to be received within 60 calendar days of account opening and will be credited to the checking account on the first statement cycle* after the direct deposit is received.

- A $200.00 payback fee will be imposed if the checking account is closed within 180 calendar days of account opening. Fees may reduce earnings.

- Offer is redeemable at any branch location, cannot be combined with other offers, is limited to one per household and does not apply to individuals that closed a WSB checking account within the past 180 calendar days. Account must be open and active for 180 calendar days, or a $30.00 closing fee may be assessed at account closing.

- Fees may reduce earnings. $100.00 Savings Account Bonus $100.00 or more opening deposit and a Universal checking account to receive bonus.

- Bonus will be credited to the savings account within 60 calendar days of account opening.

- A $100.00 payback fee will be imposed on your savings account if either the savings account or Universal checking account is closed within 180 calendar days of account opening.

- Offer applies to new savings account customers only and does not apply to individuals that currently have a savings account or closed a savings account within the past 180 calendar days.

- Offers expire 11/30/2024.

- The average daily balance is calculated by adding the principal in the account for each day of the period and dividing that figure by the number of days in the period.

- A statement cycle may be from the 17th (a calendar day) of a month to the 16th (a calendar day) of the next month.

- To determine your statement cycle please ask your Personal Banker at the time of account opening.

- For tax reporting purposes, a 1099 form may be issued at yearend for recipients of bonuses.

- See disclosure for details. REV091824

WaterStone Bank $400 Checking Money Market Bonus (Expired)

Earn up to a $400 bonus when you open a new checking and money market account!

WaterStone Bank is offering a $350 cash bonus and 1,000 bonus points ($50 value) when you open a new qualifying checking account and money market account!

- What you’ll get: $400 bonus

- Account Type: Universal Checking, Money Market

- Availability: WI (Bank Locator)

- Direct Deposit Requirement: No

- Credit Inquiry: Soft

- ChexSystem: Unknown

- Credit Card Funding: Unknown

- Monthly Fees: None

- Early Account Termination Fee: 90 days, $30 fee

- Household Limit: One

(Limited time offer)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | HSBC Premier Checking (Up to $3,000 Cash Bonus), |

How To Earn Bonus

- Open a Universal Checking account with the minimum opening deposit of $100 and complete the following within 90 days:

- $200 cash bonus when direct deposit of payroll or government benefits totaling $300.00 or more is deposited

- 1,000 ScoreCard® Rewards bonus points (a $50 value!) when logging into ScoreCard® Rewards website

- $25 e-statement credit when e-statements are set up.

- $25 CheckCard usage bonus if used five times within one statement cycle.

- Open a Money Market account and complete the following:

- $100 cash bonus when the account balance reaches $10,000 or more within 90 calendar days of account opening.

- For tax reporting purposes, a 1099 form may be issued at year end for recipients of bonuses.

- Other checking options are available for this offer, ask CSR for more details.

- Employees and agents of WaterStone Bank SSB, its respective affiliates and subsidiaries are not eligible.

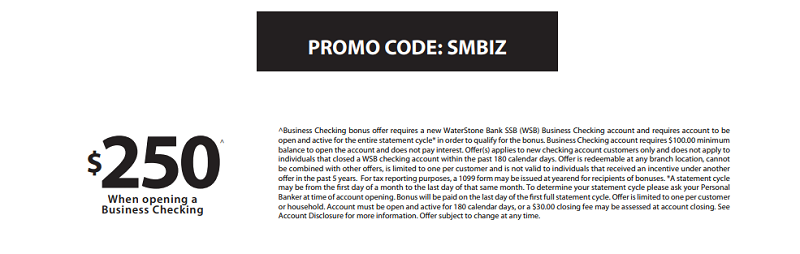

WaterStone Bank $250 Business Checking (Expired)

- What you’ll get: $250 bonus

- Account Type: Business Checking

- Availability: WI only

- Direct deposit required: No

- Additional requirements: See below

- Hard/soft pull: Soft pull

- ChexSystems: Unknown

- Credit card funding: Unknown

- Monthly fees: None

- Early account termination fee: 90 days, $30 fee

- Household limit: One

(Limited time offer)

| Chase Business Checking ($300 or $500 Bonus) | Bank of America Business Checking ($200 bonus offer) |

| Axos Business Premium Savings ($375 Bonus) | Axos Bank Basic Business Checking ($400 Bonus) |

| Axos Bank Business Interest Checking ($400 Bonus) | Huntington Unlimited Plus Business Checking ($1,000 Bonus) |

| Huntington Unlimited Business Checking ($400 Bonus) | Bluevine Business Checking ($300 Bonus) |

| U.S. Bank Business Checking ( $500 or $900 Bonus) | |

How To Earn Bonus

- In order to earn the bonuses, you must do the following:

- Use promo code SMBIZ

- Account must be active for the entire statement cycle in order to qualify for the bonus

- Business Checking bonus offer requires a new WaterStone Bank SSB (WSB) Business Checking account and requires account to be open and active for the entire statement cycle* in order to qualify for the bonus. Business Checking account requires $100.00 minimum

balance to open the account and does not pay interest. - Offer(s) applies to new checking account customers only and does not apply to individuals that closed a WSB checking account within the past 180 calendar days.

- Offer is redeemable at any branch location, cannot be combined with other offers, is limited to one per customer and is not valid to individuals that received an incentive under another

offer in the past 5 years. - For tax reporting purposes, a 1099 form may be issued at yearend for recipients of bonuses.

- A statement cycle may be from the First day of a month to the last day of that same month.

- To determine your statement cycle please ask your Personal Banker at time of account opening.

- Bonus will be paid on the last day of the First full statement cycle.

- Offer is limited to one per customer or household. Account must be open and active for 180 calendar days, or a $30.00 closing fee may be assessed at account closing.

- See Account Disclosure for more information. Offer subject to change at any time.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

WaterStone Bank $300 Checking Money Market Bonus (Military Valor Program) (Expired)

WaterStone Bank $300 Checking Money Market Bonus

WaterStone Bank is offering a $300 Bonus when you open a new MVP checking & money market account!

- What you’ll get: $300 bonus

- Account Type: MVP checking & money market account

- Availability: Wisconsin

- Direct deposit required: No

- Hard/soft pull: Soft pull

- ChexSystems: Unknown

- Credit card funding: Unknown

- Monthly fees: None

- Early account termination fee: 90 days, $30 fee

- Household limit: One

(Limited time offer)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | HSBC Premier Checking (Up to $3,000 Cash Bonus), |

How To Earn Bonus

- To earn the $300 Bonus, simply open a MVP checking & money market account, and get 1,000 ScoreCard Rewards bonus points!

- To enroll in the Military Valor Program you must show a government issued military identification card as proof you are an active duty, retired, National Guard or Reserve member or a veteran of the military and have a WaterStone Bank (WSB) Universal checking account.

- Fees that are assessed to your checking account for withdrawing funds at an ATM with your WSB Debit Card will be refunded to your WSB checking account within the next business day.

- WSB HELOC (Home Equity Line-of-Credit) annual fee will be refunded to your WSB Checking Account within 30 business days of the fee being assessed to your HELOC.

- $500.00 will be credited to your WSB checking account within 30 business days of closing your 1st mortgage home loan with WSB and setting up autopay from your WSB checking account.

- You may only receive this benefit one time with WSB.

- Free patriotic MVP club checks will be provided by WSB and this benefit does not include reimbursement of other check designs you have previously purchased or plan to purchase.

- Voucher for a free U.S. Flag will be provided annually in June if at that time your average balance of deposit accounts you own is greater than or equal to $10,000.00 or you have a WSB HELOC or 1st mortgage home loan.

- Employees and agents of WSB and affiliates are not eligible.

- All benefits and features for the Military Valor Program are subject to change.

WaterStone Bank $100 Checking Bonus (Expired)

Earn a $100 bonus when you open a new checking account!

WaterStone Bank is offering a $100 bonus when you open a new qualifying checking account!

- What you’ll get: $100 bonus

- Account Type: Checking Account

- Availability: Wisconsin

- Direct deposit required: Yes

- Hard/soft pull: Soft pull

- ChexSystems: Unknown

- Credit card funding: Unknown

- Monthly fees: None

- Early account termination fee: 90 days, $30 fee

- Household limit: One

(Limited time offer)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How to Earn Bonus

- Open a Essential Checking account with the minimum opening deposit of $100 and complete the following:

- Set up to receive at least $200 in direct deposits within 90 days.

- $100.00 will be credit to your WSB Checking account on the first statement cycle after the direct deposit is received.

- A statement cycle may be from the 17th (a calendar day) of a month to the 16th (a calendar day) of the next month.

- Fees that are assess to your Checking account for withdrawing funds at an ATM with your WSB CheckCard will be refunded to your WSB Checking account within the next business day.

WaterStone Bank $100 Checking Bonus (Expired)

Earn a $100 bonus with Waterstone bank!

WaterStone Bank is offering a $100 bonus when you open a new qualifying checking account!

- What you’ll get: $100 bonus

- Account Type: Checking Account

- Availability: Wisconsin

- Direct deposit required: Yes

- Hard/soft pull: Soft pull

- ChexSystems: Unknown

- Credit card funding: Unknown

- Monthly fees: None

- Early account termination fee: 90 days, $30 fee

- Household limit: One

(Limited time offer)

How to Earn Bonus

- The WaterStone Bank Military Valor Program* is exclusively for Active Duty Service Members, Military Veterans and Reserve and National Guard Service Members who have or open a new WaterStone Bank Checking account

- $100 direct deposit credit requires a $200 minimum automatic deposit of military payroll, government benefit or employer payroll to be received within 90 days of enrollment

- $100 will be credited to your WSB checking account on the first statement cycle after the direct deposit is received

- Employees and agents of WSB and affiliates are not eligible

- All benefits and features for the Military Valor Program are subject to change

- You may only receive this benefit one time with WSB

- Free patriotic MVP club checks will be provided by WSB and this benefit does not include reimbursement of other check designs you have previously purchased or plan to purchase

How To Waive Monthly Fees

- Essential Checking: $10 monthly fee. Complete one of the following to avoid the monthly account fee:

- With 5 Debit Card purchases or more that have posted and settled to the checking account each statement cycle(ATM transactions do not qualify)

- Direct deposits of payroll or government benefits totaling $300.00 or more each statement cycle

- Universal Checking: $25 monthly fee. Complete one of the following to avoid the monthly account fee:

- With $1,000.00 average daily balance, qualify to participate in the MVP, Student, or BRAVO Program,

- Have $10,000.00 or more in average daily balances for the statement cycle of related accounts

- Business Essential Checking: $15 monthly fee. Maintain daily balance of $200.00 or average daily balance of $500.00

- Business Advantage Checking: $20 monthly fee. Maintain daily balance of $2,500.00 or average daily balance of $5,000.00 or if you have a business loan of at least $250,000.00

- Business Analysis Checking: $25 monthly fee. Maintain average daily balance of $10,000.00 or consolidated balance of $25,000.00

- Business Interest Checking: $15 monthly fee. Maintain daily balance of $200.00 or average daily balance of $500.00

|

|

Bottom Line

Consequently, while the bonuses at WaterStone Bank sounds enticing, bear in mind most of them require you to have direct deposit to receive the full bonus. Additionally, to online banking like most financial institutions, they offer access to internet cafes so you can use their technology.

However, WaterStone Bank doesn’t have great rates for CDs and Savings. Instead, you may want to check out our full list of Bank Rates and CD Rates.

Compare WaterStone Bank Promotions with other bank bonuses from banks like Huntington, HSBC, Chase, TD, Bank of America, Citi, BMO Harris, and more!

*Check back at this page for updated WaterStone Bank promotions, bonuses and offers.

Leave a Reply