Find an updated list of Delta Community Credit Union promotions, bonuses and offers here.

Update 4/2/25: The $250 bonus for checking & savings has been extended through 6/30/25. There’s also a $200 checking bonus available through 5/31/25.

About Delta Community Credit Union Promotions

Being the largest credit union in Georgia, Delta Community Credit Union offers convenient access through 25 branches. If you are not located near a branch, you can see all nationwide bank bonuses for more suitable offers.

I’ll review the offers below.

Delta Community Credit Union $200 Checking & Savings Bonus

- What you’ll get: $200 bonus

- Account Type: Checking & Savings

- Availability: GA (Bank Locator)

- Direct Deposit Requirement: Yes (see what works)

- Credit Inquiry: Hard Pull or Soft Pull? Let us know.

- ChexSystems: Unknown

- Credit Card Funding: Unknown

- Monthly Fees: None

- Early Account Termination fee: Not listed

- Household Limit: Not listed

(Expires 05/31/2025)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- New members who open a Savings and Checking Account between March 1 and May 31, 2025 can earn a $200 bonus!

- Simply establish and complete Direct Deposits totaling $1,000 to your new Checking Account and

- Make at least 10 Visa® Debit Card purchases within the first 90 days of account opening.

- Once the requirements are met, the bonus will be deposited into your new account within 60 days.

- To get started, you can apply online, and a special promotion code will be added to your application. Prefer to apply in person? Visit your nearest Delta Community branch and mention promo code “CHECKING200” when opening your new account.

- Open a consumer membership with a Savings Account and Checking Account simultaneously between March 1 and May 31, 2025 and provide the promo code CHECKING200, and within 90 days of account opening (1) set up and receive qualifying Direct Deposits totaling $1,000 or more and (2) make 10 Visa® Debit Card purchases.

- The qualifying Direct Deposits must be deposited from the member’s employer via ACH transfer.

- Deposits that do not originate from an employer and/or are not sent by ACH (including check deposits, P2P transfers such as Venmo, Zelle® or Paypal, bank ACH transfers not from an employer, and merchant transactions such as Square or Stripe) are not eligible as qualifying Direct Deposits in this promotion.

- ATM transactions do not qualify as Debit Card purchases for this promotion.

- Debit Card transactions must post and clear the account with in the 90-day period. Accounts must be opened either online or in a branch.

- Offer not valid unless all requirements are met.

- Savings Account must have a minimum deposit of $5.

- Accounts of applicant must remain in good standing, with deposit balances above zero dollars, any applicable loan payments current, and all accounts in compliance with any other terms, conditions and governing requirements until bonus is paid. Bonuses earned through this promotional offer are subject to IRS reporting.

- The bonus will be deposited to the Checking Account within 60 days after deposit and transaction requirements are met.

- This offer is valid for the first-time Delta Community members only and cannot be combined with other offers.

- Applicant must be eligible to qualify for membership.

- As of March 1, 2025, the Annual Percentage Yield (APY) for Savings is 0.25%, for Free Checking is 0.00% and Interest Checking is 0.10%.

- Rates subject to change.

- Delta Community Credit Union reserves the right in our sole discretion to prohibit a bonus payment to non-eligible individuals for any offers claimed via third party websites and promotional materials with no affiliation or prior authorization from the Credit Union.

Delta Community Credit Union $250 Checking & Savings Bonus (Select Employer Group)

Delta Community Credit Union is offering a $250 bonus when you open a new qualifying checking & savings account.

- What you’ll get: $250 bonus

- Account Type: Checking & Savings

- Availability: GA (Bank Locator)

- Direct Deposit Requirement: Yes (see what works)

- Credit Inquiry: Hard Pull or Soft Pull? Let us know.

- ChexSystems: Unknown

- Credit Card Funding: Unknown

- Monthly Fees: None

- Early Account Termination fee: Not listed

- Household Limit: Not listed

(Expires 03/31/2025)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- Open a new Savings and Checking Account between now and June 30, 2025, and get a $250 Bonus!

- To earn the bonus, set up and receive a qualifying direct deposit totaling $1,000 and make at least 10 Visa Debit Card transactions within the first 90 days of account opening.

- Get started now or visit any of our 29 metro Atlanta branches to open an account. You will need to mention your company’s exclusive promo code “SEG250_85” when applying in the branch

- Applicant must be eligible and qualify for membership. To obtain the $250 bonus, applicant must complete the following:

(1) Between April 1 and June 30, 2025 become a member of Delta Community Credit Union by opening a consumer Savings Account with a minimum deposit of $5 and a consumer Checking Account; exclusive Invitation Code must be applied online or in a branch at account opening. - Offer not valid if not redeemed by one of these two methods.

- (2) Set up and receive qualifying direct deposits totaling $1,000 or more within 90 calendar days of opening Checking Account.

- The qualifying direct deposit must be deposited from member’s employer via ACH transfer. Deposits that do not originate from an employer (such as check deposits; P2P transfers such as Venmo or PayPal; bank ACH transfers not from an employer; and merchant transactions such as Square or Stripe) are not eligible as a qualifying direct deposit for this promotion.

- (3) Complete a minimum of 10 (ten) Visa® Debit Card purchases which post and clear the account within 90 calendar days of opening Checking Account. ATM transactions will not be considered for bonus.

- To receive bonus, account must remain in good standing, with deposit balances above zero dollars, any applicable loan payments current, and all accounts in compliance with any other terms, conditions and governing requirements until bonus is paid.

- Bonuses earned through this promotion are subject to IRS reporting.

- The Annual Percentage Yield for Savings is 0.25% as of April 1, 2025.

- The Annual Percentage Yield for Interest Checking is 0.10% as of April 1, 2025. Rates are subject to change.

- Free Checking and SpendSafe Checking® do not pay dividends.

- The bonus will be deposited to the Checking Account within 60 calendar days after qualifying direct deposit and transaction requirements are met.

- Offer is valid for first-time Delta Community members only, is not transferable, and cannot be combined with other offers.

- Offer may only be redeemed once per member. Business accounts are not eligible for this promotion.

- Delta Community Credit Union reserves the right in our sole discretion to prohibit a bonus payment to non-eligible individuals for any offers claimed via third-party websites and promotional materials with no affiliation or prior authorization from the Credit Union.

- Branch personnel please enter SEG250_85 in the invitation code field at account opening or use PROMO.CODE if necessary.

Delta Community Credit Union $50 Referral Bonus

Earn a $50 Bonus when you refer a friend to Delta Community Credit Union

- What you’ll get: $50 bonus

- Account Type: Checking Account

- Availability: GA

(No expiration date listed)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- Are You a Referrer (Existing Member)?

- Create a Delta Community Refer-A-Friend account.

- Send eligible friends a referral by email or social message.

- Let your friends claim the offer and open an account with Delta Community Credit Union.

- Monitor the status of your referrals in the Refer-A-Friend Program site.

- Are You a Referee (New or Prospective Member)?

- Claim your referral offer from a Delta Community member within 14 days by creating an account on our Refer-A-Friend site.

- Open a Delta Community Checking Account with Debit Card by applying online.

- Make a $50 deposit to your new Checking Account.

- Lastly, be sure to use your new Delta Community Debit Card at least 5 times within a 60-day period.

- Refer-A-Friend bonus cannot be combined with other promotions and is not valid for previous offers or orders.

- Bonus payments are made within 60 days of program requirements being met.

- Referrer must be Primary Account Holder with Delta Community.

- Bonuses earned through this promotion are subject to IRS reporting.

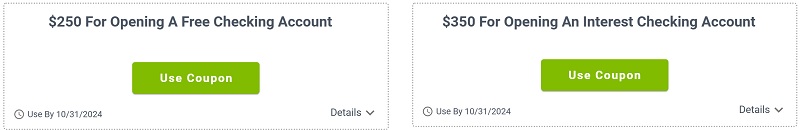

Delta Community Credit Union $350 Checking Bonus (Expired)

- What you’ll get: $350 bonus

- Account Type: Checking

- Availability: GA (Bank Locator)

- Direct Deposit Requirement: Yes (see what works)

- Credit Inquiry: Hard Pull or Soft Pull? Let us know.

- ChexSystems: Unknown

- Credit Card Funding: Unknown

- Monthly Fees: None

- Early Account Termination fee: Not listed

- Household Limit: Not listed

(Expires 10/31/2024)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- Open a Free Checking Account and receive a $250 bonus just by depositing $500 and completing 10 Visa Debit Card transactions within the first 60 days.

Or, if you prefer to earn even more, our Interest Checking Account offers a $350 bonus when you deposit $1,500 and make 10 Visa Debit Card transactions within the same period. - Use promo code SEP24_VP_77 at your neighborhood branch.

- Looking for a rewarding way to start your financial journey? Open a new checking account with Delta Community Credit Union between September 1 and October 31, 2024, and take advantage of an exclusive opportunity to reward yourself!

- Open a Free Checking Account and receive a $250 bonus just by depositing $500 and completing 10 Visa Debit Card transactions within the first 60 days.

- Or, if you prefer to earn even more, our Interest Checking Account offers a $350 bonus when you deposit $1,500 and make 10 Visa Debit Card transactions within the same period.

- These are more than just checking accounts.

- They’re your gateway to better financial management, lower fees, and the personal service you deserve from Atlanta’s trusted credit union, proudly serving the community since 1940.

- But that’s not all! As a member of Delta Community Credit Union, you’ll benefit from a variety of exclusive services tailored to help you succeed financially, from competitive loan rates to financial planning tools.

- This limited-time offer is specially designed for select individuals who receive a direct communication from Delta Community, meaning it’s not available to the general public.

- If you’re a first-time member, this is your chance to join a credit union that genuinely cares about your financial well-being.

- Take control of your finances and earn valuable rewards with Delta Community Credit Union – where your money works harder for you! Offer valid between September 1 and October 31, 2024.

- Hurry up to visit our website or get started in your nearest branch today!

Delta Community Credit Union $150 Checking & Savings Bonus (Expired)

Delta Community Credit Union is offering a $150 bonus when you open a new qualifying checking account.

- What you’ll get: $150 bonus

- Account Type: Checking

- Availability: GA (Bank Locator)

- Direct Deposit Requirement: No (see what works)

- Credit Inquiry: Hard Pull or Soft Pull? Let us know.

- ChexSystems: Unknown

- Credit Card Funding: Unknown

- Monthly Fees: None

- Early Account Termination fee: Not listed

- Household Limit: Not listed

(Expires 08/31/2023)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- Open a new Savings and Checking Account and get a $150 bonus!

- To earn the bonus, simply deposit $500 to your new Checking Account and make at least 10 Visa® Debit Card purchases within the first 60 days of account opening.

- Applicant must be eligible and qualify for membership.

- To obtain the $150 bonus, applicant must complete the following: (1) Between June 1 and July 31, 2023 become a member of Delta Community Credit Union by opening a consumer Savings Account with a minimum deposit of $5 and a consumer Checking Account; exclusive invitation code must be applied online or in a branch at account opening.

- Offer not valid if not redeemed by one of these two methods; (2) make deposits totaling $500 to Checking Account and a minimum of 10 (ten) Visa® Debit Card purchases which post and clear the account within 60 days of opening Checking Account.

- ATM transactions will not be considered for bonus.

- To receive bonus, account must remain in good standing, with deposit balances above zero dollars, any applicable loan payments current, and all accounts in compliance with any other terms, conditions and governing requirements until bonus is paid.

- Bonuses earned through this promotion are subject to IRS reporting.

- The Annual Percentage Yield for Savings is 0.20% as of May 1, 2023.

- The Annual Percentage Yield for Checking is 0.00% for balances less than $5,000 as of May 1, 2023.

- Rates are subject to change.

- The bonus will be deposited to the Checking Account within 60 days after deposit and transaction requirements are met.

- Offer is valid for first-time Delta Community members only, is not transferable, and cannot be combined with other offers.

- Offer may only be redeemed once per member. Business accounts are not eligible for this promotion.

Delta Community Credit Union $100 Youth Savings Bonus (Expired)

Delta Community Credit Union is offering a $100 bonus when you open a new qualifying youth savings account.

- What you’ll get: $100 bonus

- Account Type: Youth Savings

- Availability: GA (Bank Locator)

- Direct Deposit Requirement: No (see what works)

- Credit Inquiry: Hard Pull or Soft Pull? Let us know.

- ChexSystems: Unknown

- Credit Card Funding: Unknown

- Monthly Fees: None

- Early Account Termination fee: Not listed

- Household Limit: Not listed

(Expires 04/30/2023)

| AlumniFi Credit Union Savings (4.75% APY) | SoFi Checking & Savings ($325 Bonus + 3.80% APY) |

| Upgrade Premier Savings (4.15% APY) | Discover® Bank Savings (Up to $200 Bonus + 3.70% APY) |

| CIT Bank Platinum Savings (4.00% APY) | Harborstone Credit Union Money Market (4.30% APY) |

| FVCbank Advantage Direct Savings (4.55% APY) | Live Oak Bank Savings (4.10% APY) |

How To Earn Bonus

- Parents/Guardians complete the Youth Savings Account application and send it via secure messaging on the Mobile App or Online Banking, mail it, fax it, or bring it to a Delta Community branch.

- Once your new Youth Savings Account is opened, make a deposit! We will match that initial deposit up to $100 by July 15, 2023.

- Parents/Guardians complete the Youth Savings Account application and send it via secure messaging on the Mobile App or Online Banking, mail it, fax it, or bring it to a Delta Community branch. Once your new Youth Savings Account is opened, make a deposit! We will match that initial deposit up to $100 by July 15, 2023.

- Only new Youth Savings Accounts opened between March 1, 2023 and April 30, 2023 are eligible.

- Any child, grandchild, sister, brother, niece, nephew or cousin (natural, legally adopted or step) 12 years of age and under can have Youth Savings Account, as long as they have a Joint Owner. The child, grandchild, sister, brother, niece, nephew or cousin (natural, legally adopted or step) does not have to reside within Delta Community Credit Union’s eligible counties.

Delta Community Credit Union $100 Student Checking Bonus (Expired)

Delta Community Credit Union is offering a $100 bonus when you open a new Savings and Checking Account account.

- What you’ll get: $100 bonus

- Account Type: Savings and Checking Account

- Availability: GA

(Offer Expires June 30, 2022)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- Apply online and a special promotion code GRAD22 will be added to your application

- To qualify for $100, simply open a new Savings and Checking Account between May 15 and June 30 and deposit $100.

- Offer is valid for new Delta Community members between the ages of 17 and 25 and cannot be combined with any other offer.

- Applicant must qualify and open membership and Checking Account between May 15 and June 30, 2022.

- Existing members ages 17 to 25 without a Delta Community Checking Account are also eligible.

- Bonus of up to $100 will be paid equal to the deposits made to account (up to $100) which remain in the account through June 30, 2022, excluding dividends.

- The annual Percentage Yield for Savings is 0.08% as of May 1, 2022.

- The Annual Percentage Yield for Checking is 0.00% for balances less than $5,000 as of May 1, 2022.

- Rates are subject to change.

- The bonus will be deposited to the Checking Account within 60 days after deposit requirements are met.

- To receive bonus, all accounts must remain in good standing, including all loan payments current.

How To Waive Monthly Fees

- Personal Checking: None

- Business Value Checking: $5 monthly fee, waivable with $500 average daily balance, $5,000 deposit balance or combined deposit and/or loan relationship totaling $10,000

- Business Checking: $10 monthly fee, waivable with $750 average daily balance, $10,000 deposit balance or combined deposit and/or loan relationship totaling $20,000

|

|

Bottom Line

Make sure to check out Delta Community Credit Union to learn more about the bonus promotions. With easy to meet requirements build atop the foundation of a better financial future, I would definitely recommend taking advantage of this promotion!

While they have generous bonuses, Delta Community Credit Union doesn’t have great rates for CDs and Savings. You may want to check out our full list of Bank Rates and CD Rates.

*Compare Delta Community Credit Union Promotions with other bank bonuses from Chase, Huntington, HSBC, CIT, TD, Discover, Bank of America, Citi, Ally Bank, & more!*

We highly appreciate your feedback as they make our site even better!

*Check back at this page for updated Delta Community Credit Union promotions, bonuses and offers.

https://refer.deltacommunitycu.com/yierx-3

1. Click on the referral link to be taken to the referral page. Insert your name, email, and birthdate to confirm so a unique promo code will be generated for you.

2. Open a savings account and a checking account using the unique promo code at the time of applying, either online or in branch. Just check both accounts, and apply promo code.

3. Savings account minimum deposit is $5 to open. Within 60 days of opening the new checking account, deposit a minimum of $50 into the checking account and complete at least 10 Debit Card purchases.

4. Receive $50 bonus.

There are no fees and no minimum balance requirement. Make sure to keep at least $0.01 in the checking account until bonus is received.