Here you will always find an updated list of Ally Bank promotions, bonuses, and offers.

Update 8/7/24: Ally Bank is offering a $100 bonus when you open an eligible Ally Bank account (checking, savings or self-directed trading). Valid through 12/31/24.

About Ally Bank

Ally Bank has been in existence for 100 years but has since evolved and expanded nationwide by converting to an online bank. However, being an online bank does have its limitations.

Ally Bank $100 Checking Bonus

Earn a $100 bonus when you open a new Ally Bank Spending account and complete qualifying activities.

How to earn it:

- Enroll by 12/31/2024 and open a new, eligible Ally Bank Spending Account within 30 days of enrollment and fund within 30 days of opening your new account.

- Set up and receive a qualifying direct deposit within 60 days of account opening.

- Your $100 welcome bonus will be deposited within 30 days of receiving your qualifying direct deposit.

(Expires 12/31/2024)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

Ally Bank $100 Savings Bonus

Ally Bank is currently offering a $100 bonus when you open an Ally Bank Savings account.

How to earn it:

- Enroll and open a new Ally Bank Savings Account by 12/31/2024.

- Open a new Ally Bank Savings Account within 30 days of enrollment.

- Set up (within your new account) and start a qualifying monthly automated recurring transfer within 30 days of account opening.

- Complete at least 3 back-to-back monthly automated recurring transfers.

- Your $100 welcome bonus will be deposited within 30 days of receiving your 3rd recurring transfer.

(Expires 12/31/2024)

Ally Bank $100 Self-Directed Trading Bonus

Earn a $100 bonus when you open a new Ally Invest Self-Directed Trading account and complete qualifying activities.

How to earn it:

- Enroll by 12/31/2024 and open a new Ally Invest Self-Directed Trading account within 30 days of enrollment.

- Transfer a minimum of $1,000 within 60 days of opening your account. Note: you can make multiple transfers to reach the minimum requirement of $1,000.

- Your $100 welcome bonus will be deposited within 30 days of your account reaching $1,000.

(Expires 12/31/2024)

| J.P. Morgan Self-Directed Investing (Up to $700 Cash) | TradeStation ($150 Cash) |

| M1 High-Yield Cash Account (4.00% APY) | E*TRADE (Up to $6,000 Cash) |

| WeBull (Free Stocks) | |

Ally Bank $250 Checking Bonus (Ally Auto Customers)

Earn a $250 bonus when you open a Ally Bank Spending Account and meet the requirements.

- What you’ll get: $250 bonus

- Account Type: Ally Spending Account

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Opening Deposit: None

- Credit Card Funding: None

- Direct Deposit Requirement: Yes (see what works)

- Monthly Fee: None

- Household Limit: Unknown

- Closing Account Fee: Unknown

(Expires 12/31/2023)

How To Earn Bonus

- Open a new Ally Bank Spending Account or Savings Account by 12/31/23, with offer code ALLYAUTO1, and fund your new account within 30 days. You must be an Ally Auto customer at the time of account opening.

- Note: On the initial step of the application, be sure to select I’m not an existing Ally Bank customer.

- Set up and receive at least 1 qualifying direct deposit within 60 days of opening your new account.

- Keep your account open and in good standing and we’ll deposit your $250 within 30 days of receiving your first direct deposit.

- No minimum balance is required to open an Ally Bank Spending or Savings Account. Annual Percentage Yield (APY) is subject to change, and is accurate as of 11/10/2023. Fees may reduce earnings.

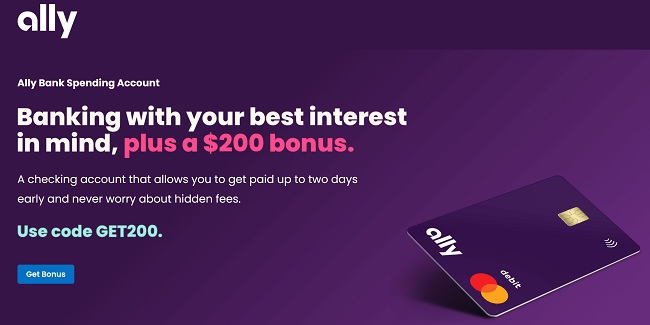

Ally Bank $200 Checking Bonus (Expired)

Earn a $200 bonus when you open a Ally Bank Spending Account and meet the requirements.

- What you’ll get: $200 bonus

- Account Type: Ally Spending Account

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Opening Deposit: None

- Credit Card Funding: None

- Direct Deposit Requirement: Yes (see what works)

- Monthly Fee: None

- Household Limit: Unknown

- Closing Account Fee: Unknown

(Expires 10/13/2023)

How To Earn Bonus

- Open your first Spending Account. Use code GET200 by Oct. 13, 2023. Make sure to fund your account within 30 days of opening it.

- Set up one or more direct deposits. Make sure they total at least $1,500 within 90 days.

- Get your $200. Ally Bank will send your bonus within 30 days of your account receiving $1,500 in qualified direct deposits.

- Only New Customers who open and fund an Eligible Account using promo code GET200 are eligible to participate. The offer is limited to one (1) bonus per customer (even if you open more than one Eligible Account, you can only earn one $200 bonus). A joint owner on the same Eligible Account will not receive a separate, additional bonus.

- You must open your Eligible Account within the Account Opening & Funding Period. Note: it’s common for QDD transactions to take longer than thirty (30) days after account opening to be setup successfully (some may not take effect until two (2) payroll cycles), so you may need to fund your account with any amount from another source to ensure your account remains open (also note that trial deposits do not count as a funding transaction).

- To be eligible for the bonus, your Eligible Account must receive a minimum total of $1,500 of QDD payments within ninety (90) days from when you open your new Eligible Account (Direct Deposit Requirement). If you haven’t yet met the $1,500 minimum, any QDD payments that are still pending or in process after ninety (90) days from when you open your new Eligible Account do not qualify for the bonus.

- Your Eligible Account must be open and in good standing at the time of the bonus payout to receive your bonus. If you’ve followed the eligibility requirements, we’ll pay your bonus to your Eligible Account within thirty (30) days of satisfying all applicable terms of this offer. At the time of the bonus payout, if you have more than one Eligible Account, we’ll pick an account to fulfill. Remember, even if you open more than one Eligible Account, you can only earn one $200 bonus.

- We won’t pay your bonus by check or by transfer to another financial institution. We reserve the right to refuse to open an account or pay out a bonus at any time and for any reason. This Spending Account Acquisition Offer is subject to change and may be cancelled at any time without notice. Any disputes relating to these Terms & Conditions must be made within 150 days after the end of the Account Opening & Funding Period.

- By participating in this offer, we reserve the right to consider you ineligible for other offers that involve opening an Ally Bank Spending Account and/or Savings Account, and/or other offers that involve establishing direct deposit payments, that Ally Bank may have in market, both present day or in the future through December 31, 2024. If you participate in more than one offer at the same time, the first offer for which you meet the requirements will be the one that we fulfill. If we believe you’re trying to game or abuse this offer or any other offers, we reserve the right to revoke your eligibility for this offer and any other offers.

- This is an online offer only—there are no in-person, mail-in, call-in, or other offline methods to participate.

- We’ll treat the bonus as interest for tax reporting purposes. You should talk to your tax advisor about potential impacts to your tax liability.

Ally Bank Up To $500 Bonus + 2.25% APY Online Savings Account (Expired)

Earn up to $500 bonus with Ally Bank Online Savings Account plus 2.25% APY.

- Get things started by opening an account with offer code GETPAID by November 21, 2022.

- Move at least $1,000 from another financial institution to a new or existing eligible Ally Bank account by November 31, 2022. Remember, transfers can take up to three business days.

- Your new money must remain in your eligible Ally Bank account through January 15, 2023. Keep in mind, any withdrawals made during this time may reduce your bonus.

- Get a 1% bonus on the money you moved, up to $500 by February 15, 2023

- Open an Online Savings account from Ally Bank.

- Maintain any balance amount and earn the 2.25% APY rate.

| Balance Requirement | APY Rate |

| $0.01+ | 2.25% APY |

- Clients can deposit checks remotely via Ally eCheck Deposit

- Interest compounds daily (great for accounts with large balances)

- Deposits are insured by the FDIC

- Allows transfers between other Ally Bank accounts and external accounts

- Transfers can be scheduled a year in advance

- Six transactions per statement cycle as required by federal law. Clients that make more than six transactions incur a $10 fee per additional occurrence.

- Interest is compounded daily

- FDIC insured up to $250,000

- No minimum to open

- Earn 2.25% APY rate on any balance

Up To $3,000 Ally Invest Bonus (Expired)

When you fund your Ally Invest account, you can earn up to a $3,000 bonus as well as free trading.

- Account Type: Ally Invest

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Opening Deposit: Unknown

- Credit Card Funding: None

- Direct Deposit Requirement: Optional

- Monthly Fee: None

- Household Limit: Unknown

- Closing Account Fee: Unknown

(Expired)

How To Earn Up To $3,000 Bonus and Free Trades

- Cash Bonus:

- Funding – Accounts must be opened by the expiration date and funded within 60 days of account opening.

- The qualifying deposit to open the new account must be from outside Ally Invest.

- The new account must be funded with a minimum qualifying deposit of $10,000 or more to receive the Minimum Cash Bonus

- The minimum qualifying funds to receive bonus offer must remain in the account (minus any trading losses) for a minimum of 90 days from the date of funding.

- Accounts will receive the specified credit, depending on the initial deposit amount, deposited into the account within ten (10) days of meeting the qualifying requirements.

- Once the account is credited, the bonus and initial qualifying deposit is not available for withdrawal for 300 days after the requirements have been met.

- If the qualifying deposit(s) are removed the bonus payout may be revoked.

- See the table below for the deposit required for each bonus amount.

| Bonus Amount | Deposit or Transfer Amount |

| $3,000 | $2M+ |

| $2,000 | $1M – $1.99M |

| $1,200 | $500k – $999.9k |

| $600 | $250k – $499.9k |

| $300 | $100k – $249.9k |

| $250 | $25k – $99.9k |

| $100 | $10k – $24.9k |

- Commission-Free Trades:

- $0 commissions- They offer commission free trading on all U.S exchange-listed stock, ETF, and option trades.

- Competitive options pricing- They also lowered our fee for option trades to just $0.50 per contract.

- $150 Transfer Fee Credit:

- Must complete a first-time ACATS account transfer of $2,500 or more to receive a Transfer Fee Credit of up $150 to cover the outgoing transfer fee from your current brokerage firm.

- ACAT forms must be received within 15 days of opening new account.

- Credit will be deposited to your account within 30 days of receipt of evidence of charge.

- This transfer reimbursement offer does not apply to Termination Fees or Maintenance Fees.

- Not valid for any retirement or ERISA qualified accounts.

- Offer is not transferable.

- Open to US residents only.

- Excludes current Ally Invest Securities, LLC account holders.

- Excludes former Ally Invest Securities, LLC (formerly TradeKing Securities LLC) account holders who have closed their accounts within the past 90 days.

Ally Bank Customers: Get $100 or $250 Bonus w/ Ally Invest Account (Targeted)

Get $100 or $250 Bonus w/ Ally Invest Account (Targeted)

Ally Bank is targeting certain customers with a chance to earn $100 or $250 Bonus w/ Ally Invest Account.

Editor’s Note: Keep in mind that there is no direct link to this targeted offer. To take advantage of this promotion, be sure to check your email for <subject: Limited Time: Get $250 for opening an Ally Invest account>

- Account Type: Ally Invest

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Opening Deposit: $500

- Credit Card Funding: None

- Direct Deposit Requirement: Optional

- Monthly Fee: None

- Household Limit: Unknown

- Closing Account Fee: Unknown

How To Earn $100 or $250 Bonus

- To participate in this cash bonus offer, click here to access the Ally Invest online application. You must open your eligible account between 2/23/2022 and 3/24/2022 AND deposit a minimum of $500 or more by 4/8/2022.

- Keep your new Ally Invest account open and in good standing for us to add your bonus to your account. We’ll pay your bonus by 5/8/2022.

- This unique offer is only available to select Ally Bank and Auto customers. You are only eligible for this bonus if you received the email offer. We’re all about playing fair, so if we believe you’re trying to game or abuse this offer, you won’t be allowed to participate in this offer or any future offers.

Compare to Other Banks

- Ally Bank vs Bank of America

- Ally Bank vs Chase

- Ally Bank vs Wealthfront

- Ally Bank vs Capital One

- Ally Bank vs Marcus by Goldman Sachs

- Ally Bank vs Axos Bank

- Ally Bank vs CIT Bank

- Ally Bank vs Discover Bank

- TD Bank vs Ally Bank

|

|

Bottom Line

Ally Bank understands you have needs and they have solutions! Therefore trade and invest how you want with access to a variety of investment choices. Furthermore, you can select from equities, bonds & CDs, options, non-proprietary mutual funds, forex trading and more to diversify your portfolio. Once you become their client, you can enjoy fair, straightforward pricing. No hidden fees or complicated pricing structures!

While Ally Bank is offering an incredible rate on their Online Savings Account, I recommend comparing it with some from our full list of Bank Rates and CD Rates.

Compare Ally Bank Promotions to other banking offers from institutions like Chase Bank, Huntington Bank, HSBC, Discover Bank, TD Bank, Bank of America, CIT Bank, & Citi.

With their online savings account, you can enjoy earning a higher rate than traditional savings accounts, you can deposit checks remotely with Ally eCheck Deposit, grow your money faster with interest compounded daily, and FDIC insured up to $250K. You get the service you need when you need it.

Make sure you check out the promotions and choose the right account for you. If you want to check up on the internet’s most complete list of Brokerage Promotions and Best Bank Rates, then keep coming back to HMB for more!

Check back here to always find an updated list of Ally Bank promotions.*

Helpful Tips

- How To Open an Ally Bank Account

- What Are Ally Bank’s Hours?

- How To Find and Use Your Ally Bank Login

- Ally Bank Routing Number

Great post! I love seeing these promotions from Ally Bank. The $100 bonuses for checking and savings accounts are a nice incentive, especially with the added benefit of self-directed trading. Definitely considering taking advantage of these offers before they end! Thanks for sharing the details!

Great offer from Ally Bank! I’ve been eyeing their promotions for a while now, and this $125 savings bonus is definitely worth looking into. As a long-time customer, I appreciate the incentives they provide to keep my business. Thanks for sharing this post!

Don’t do this! Ally’s customer service is terrible, first and foremost! Secondly, I was supposed to receive my opening bonus of $150 by 7/15 and have now been told I will receive it 8/5. They told me several times that I hadn’t had a qualifying direct deposit when that was setup immediately. My advice, stay away from this company!