Find an updated list of Laurel Road promotions, bonuses, and offers here. Current offers include $540, $200, $300 and $400 checking, savings bonuses and referral.

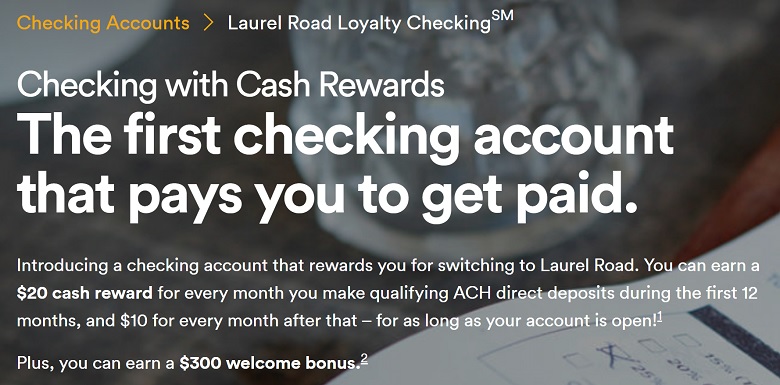

Laurel Road offers $300 checking bonus with a new checking account and set up direct deposit. You can also earn a $20 bonus each month for the first year (second statement cycle through 13th and $10 each month thereafter) when you make one or more direct deposits totaling at least $2,500 within 60 days after account opening.

Update 6/11/24: The $200 savings bonus is available until 6/30/25.

About Laurel Road

Laurel Road is a digital banking platform and brand of KeyBank that provides tailored solutions to support the financial well being of healthcare and business professionals.

Laurel Road High Yield Savings $200 Bonus

Earn up to a $200 bonus with a Laurel Road High Yield Savings account.

How to earn it:

- Open a High Yield Savings account before 6/30/2025

- Deposit at least $1 in the first 20 days of account open

- Have at least $5,000 in your account by day 90 after open

- Bonus tiers:

- $50 bonus – Deposit total between $5,000–$14,999.99

- $100 bonus – Deposit total between $15,000–$29,999.99

- $200 bonus – Deposit total more than $30,000+

- Terms:

- Must deposit a minimum of $1 within the first 20 days and must have the relevant tiered account balance on the 90th day.

- Referred cannot be an existing or prior Laurel Road member in the last twelve (12) months.

- Referrer and Referred must be U.S. citizen(s) and/or permanent resident(s).

(FDIC Insured)

Laurel Road Up to $540 Checking Bonus (Expired)

- What You’ll Get: $300 + $20/mo. for 1st Year (Up To $540)

- Account Type: Checking Account

- Availability: Nationwide

- Direct Deposit Requirement: Yes, $2,500+ within 60 days (see what works)

- Credit Inquiry: Soft Pull

- ChexSystem: Unknown, sensitive

- Credit Card Funding: Unknown

- Monthly Fees: None

- Early Account Termination Fee: $25 is closed within 180 days

- Household Limit: None listed

(Expires 10/15/2024)

Editor’s Note: There is an alternative link to earn the bonus bonus for nurses.

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | HSBC Premier Checking (Up to $3,000 Cash Bonus), |

How to Earn Bonus

- For a limited time, you can earn a $300 bonus when you make qualifying ACH direct deposits totaling $2,500 or more within 60 days of opening your new Laurel Road Loyalty Checking account.

- Receive up to an additional $240: You can earn a $20 cash reward for every month you make qualifying ACH direct deposits during the first 12 months, and $10 for every month after that – for as long as your account is open!

- $540 can be earned by qualifying for up to $240 in rewards your first year combined with the $300 welcome bonus. Primary account holder is eligible to earn monthly rewards of $20/month from the second through thirteenth statement periods, which is considered your “first year.” From the fourteenth statement period onward, the eligible reward will be $10/month for as long as the Laurel Road Loyalty Checking account (“Account”) is open. To earn monthly rewards, you must make qualifying Automated Clearing House (ACH) direct deposits into the Account totaling at least $2,500 during the statement period. If you were the primary owner on another Laurel Road checking account at any time within the prior 24 months of Account opening, rewards are limited to $10 per statement period during the life of the Account. For the $300 welcome bonus, you must open the Account by 10/15/2024 at 11:59 p.m. (ET) and make one or more qualifying direct deposits via an Automated Clearing House (ACH) transaction into the Account totaling at least $2,500 within 60 calendar days after account opening to receive the $300, which will be deposited into the Account within 60 calendar days of meeting requirements. You are not eligible for the bonus if you were the primary owner on any Laurel Road checking account within the prior 24 months before Account opening. Qualifying Direct Deposits – A pre-arranged electronic direct deposit through the Automated Clearing House (“ACH”) Network from most employer payrolls, payroll provider (excluding third-party advance payroll service providers), benefits payer such as Social Security or Military Pay, or pension. Non-Qualifying Deposits – Including but not limited to: Point-of-sale (POS) and internet-initiated mobile entry (WEB) ACH transactions; incoming Person-to-Person (P2P) payments made via the ACH Network such as Zelle, PayPal, Cash App, or Venmo (including payroll-related transactions made via P2P providers); mobile check deposits; wire transfers; cash deposits; one-time direct deposits such as tax refunds and corporate reimbursements; internal transfers between Laurel Road or KeyBank accounts; external transfers from another financial institution; and insurance payments and other similar transactions. Laurel Road, in its sole discretion, reserves the right to deem any deposit either a qualifying or non-qualifying direct deposit, as applicable. Only one Loyalty Checking account per primary account holder. Account must be in good standing and cannot be closed at the time of bonus payments. All bonus and monthly rewards values may be reported to the IRS on Form 1099-INT. Offers are subject to cancellation or change without notice and cannot be combined with other checking bonus, reward, or rate discount offers. Laurel Road is not responsible for, and will not honor, promotional offers that appear on third-party websites that are not authorized by Laurel Road. Normal account service charges and miscellaneous charges may apply, which may reduce earnings. Applications are subject to approval and processing times. Click here for current Laurel Road Loyalty Checking Rates.

Laurel Road $200 Student Loan Refinance

For residents, Laurel Road is offering you an opportunity to earn $200 bonus!

- Account Type: Student Loan Refinance

- Availability: Nationwide

- Direct Deposit Requirement: None

- Monthly Fee: None

(No Expiration Date)

Editor’s Note: You can also get a $200 bonus with a personal loan.

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How to Earn Bonus

- The referred borrower must refinance his/her student loan(s) with Laurel Road into a new loan.

- A referral cannot be made for existing Laurel Road members or applicants. We must be made aware of the referral by either the referred borrower or the referrer during the application process.

- Referrals made after the loan has closed are ineligible for reward.

- Referred borrowers can only be referred by one person.

- Limited time offers are subject to additional terms and conditions. Laurel Road can change or eliminate any offer at any time, for any reason and without notice. Laurel Road is not responsible for, and will not honor, promotional offers that appear on third-party websites that are not authorized by Laurel Road.

- Referrals are not eligible for any additional bonus split. All payouts will be made to the referrer.

- Maximum bonus limit of $4,000 per calendar year for all referrals.

- Unless explicitly stated, special campaign offers cannot be combined with any other existing offer.

Laurel Road Referral Program: Up To $400 Bonus

For each friend you refer, you can earn $400 per referral when they refinance a student loan, finance a personal loan, or get a credit card.

Max 10 referrals per year for $4,000 total. You have the capability to split the referral bonus with the new applicant E.G you’ll each get $200 bonus from the $400.

See the Laurel Road referral program page here.

|

|

Bottom Line

Laurel Road is offering tons of promotions like checking bonuses. The steps to follow are easy and fast, so be sure to take advantage today while you can. If you have student loans, refinancing with Laurel Road might be your best option, but be sure to compare rates to other lenders.

Compare Laurel Road with the promotions available from SoFi here.

*Compare Laurel Road Promotions with other bank bonuses from banks like Citi, Huntington, HSBC, Chase, TD, Discover Bank, Aspiration, Axos Bank, PNC Bank, BMO Harris, SoFi, Fifth Third Bank, Bank of America, Wells Fargo, US Bank, and more!*

Additionally, leave a comment below informing us about your experience with the Laurel Road. See our best bank promotions page to learn more.

Just got my new account denied. Laurel Road said it was due to ChexSystems. Looks like the “Unknown” should be changed to “Yes”.

Thanks my dude. Saved me some time

Please note:

This bonus is ONLY available with a student loan refi.

Martha,

If you want a screenshot of chat conversation, please email me directly. Thank you. -AJ