Find the latest Old National Bank promotions, bonuses, and offers here.

Update 6/13/25: There is now a $650 checking bonus good through 10/31/25 and a $500 business checking bonus good through 9/30/25.

About Old National Bank Promotions

Old National is a top 100 US bank that serves clients and communities in Iowa, Indiana, Kentucky, Michigan, Minnesota and Wisconsin. They provide extensive services in retail and commercial banking, investments, brokerage and wealth management where you’ll find great bank bonuses, CD rates and bank rates.

We will review the current Old National Bank promotions below.

Old National Bank $650 Checking Bonus

Old National bank is offering a $300 up to $650 bonus when you open a new checking account and meet certain requirements.

- What you’ll get: $300 or $650 bonus

- Account Type: Checking Account

- Availability: IA, IL, IN, KY, MI, WI (Bank Locator)

- Direct Deposit Requirement: Yes (see what works)

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Credit Card Funding: Up to $500, can fund with American Express, Visa & Mastercard

- Monthly Fees: $6.95-$15, avoidable

- Early Account Termination Fee: $25 if closed within 180 days

- Household Limit: None listed

(Expires 10/31/2025

Editor’s Note: Here’s an alternative link to the offer.

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

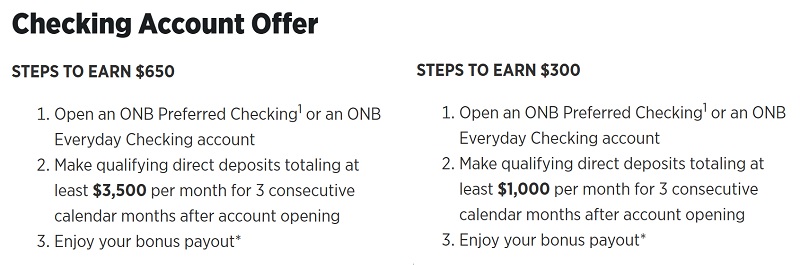

To qualify for the $650 cash bonus:

- Open an ONB Preferred Checking or an ONB Everyday Checking account

- Make qualifying direct deposits totaling at least $3,500 per month for 3 consecutive calendar months after account opening

- Enjoy your bonus payout

To qualify for the $300 cash bonus:

- Open an ONB Preferred Checking or an ONB Everyday Checking account

- Make qualifying direct deposits totaling at least $1,000 per month for 3 consecutive calendar months after account opening

- Enjoy your bonus payout

- TO QUALIFY FOR THE CONSUMER CHECKING CASH BONUS OF UP TO $650: To earn the checking account bonus, new to personal checking customer must complete each of the following requirements. Open an ONB Everyday or Preferred Checking account with a minimum deposit of $50 between 2/1/2025 and 10/31/2025 online or at any Old National banking center and complete the following:

- TO QUALIFY FOR $650 CASH BONUS: Make qualifying direct deposits totaling at least $3,500 per month to the new account for 3 consecutive calendar months.

- TO QUALIFY FOR $300 CASH BONUS: Make qualifying direct deposits totaling at least $1,000 per month to the new account for 3 consecutive calendar months.

- The qualifying minimum direct deposits must be made to the new account for 3 consecutive calendar months beginning in the calendar month following the calendar month in which the new account was opened (“Qualification Period”). Qualifying ACH direct deposit includes electronic direct deposits of a paycheck, pension payment, social security payment or other government benefits payment deposited into the checking account from an employer, a government agency, or other similar third-party organization. Deposits made by teller/ATM/mobile deposits, wire transfers, debit card transfers, transfers between Old National accounts, external transfers from other accounts at other financial institutions, or Peer to Peer (i.e. Zelle, Venmo) transfers do not qualify.

- Limit one cash bonus per customer [Taxpayer Identification Number (TIN)/Social Security Number (SSN)] regardless of the number of checking accounts opened. Recipient(s) (customer TIN/SSN) of cash bonus shall not be eligible to receive a cash bonus on any other personal checking account.

- The new ONB Everyday, or Preferred Checking account must be open with a balance greater than $0 and in good standing at the time the cash bonus is paid into the account, within 130 days after account opening.

- Bonus may be reported on IRS Form 1099-MISC. Offers are not available for customers with an existing Old National personal checking account (including owners on joint accounts), personal checking accounts closed within the last 12 months, has been paid an ONB personal checking promotional bonus in the past 12 months or Old National employees. Old National reserves the right to discontinue offer at any time. Not valid with any other Old National offer.

Old National Bank $500 Business Checking Bonus

- What you’ll get: $500 bonus

- Account Type: Business Checking Account

- Availability: IL, IN, KY, MI, WI (Bank Locator)

- Direct Deposit Requirement: Yes

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Credit Card Funding: Up to $500, can fund with American Express, Visa & Mastercard

- Monthly Fees: $0-$20

- Early Account Termination Fee: Unknown

- Household Limit: None listed

(Expires 09/30/2025)

| Chase Business Checking ($300 or $500 Bonus) | Bank of America Business Checking ($200 bonus offer) |

| Axos Business Premium Savings ($375 Bonus) | Axos Bank Basic Business Checking ($400 Bonus) |

| Axos Bank Business Interest Checking ($400 Bonus) | Huntington Unlimited Plus Business Checking ($1,000 Bonus) |

| Huntington Unlimited Business Checking ($400 Bonus) | Bluevine Business Checking ($300 Bonus) |

| U.S. Bank Business Checking ( $500 or $900 Bonus) | |

How To Earn Bonus

- Open an Access Business Banking Checking account or Pro Access Business Banking Checking account with a minimum deposit of $100 at any Old National banking center and complete the following:

- Deposit $7,000 or more within 30 days of account opening.

- Maintain a minimum balance of at least $7,000 for days 31-90 of account opening.

- Enroll in Small Business Digital Banking and log in within 30 calendar days of account opening.

- Account must remain open with a balance greater than $0 and in good standing at the time the cash bonus is paid into the account, within 120 days after opening.

- TO QUALIFY FOR THE SMALL BUSINESS CHECKING CASH BONUS OF $500:

- To earn the checking account bonus, new to business deposit customer must complete each of the following requirements:

- Open an Access Business Banking Checking account or Pro Access Business Banking Checking account with a minimum deposit of $100 between 4/28/2025 and 9/30/2025, at any Old National banking center and complete the following:

- Deposit $7,000 or more within 30 days of account opening.

- Maintain a minimum balance of at least $7,000 for days 31-90 of account opening.

- Enroll in Small Business Digital Banking and log in within 30 calendar days of account opening.

- Account must remain open with a balance greater than $0 and in good standing at the time the cash bonus is paid into the account, within 120 days after opening.

- The qualifying minimum deposit must be made to the new account within 30 calendar days of account opening (“Qualification Period”). On day 30 of account opening, we will check for the required deposit balance. If your day 30 falls on a non-business day, we will review the account on the first business day after day 30 of account opening. Qualifying deposits include teller/ATM/mobile deposits, wires, external transfers from other accounts at other financial institutions. Deposits made by transfers between Old National accounts, do not qualify.

- The qualifying required balance must be maintained during days 31-90 of account opening (“Maintenance Period”). During days 31-90 of account opening, we will check daily for the minimum required balance.

- The qualifying enrollment and login into Small Business Digital Banking platform must be made to the new account within 30 calendar days of account opening (“Qualification Period”). Enrollment and login into Consumer Digital Banking, OnPoint Essentials, and OnPoint Treasury does not qualify.

- Limit one cash bonus per customer [Taxpayer Identification Number (TIN)/Social Security Number (SSN)] regardless of the number of checking accounts opened. The new Access Business Banking account or Pro Access Business Banking account must be open with a balance greater than $0 and in good standing at the time the cash bonus is paid into the account. The cash bonus will be credited to the Old National business checking account approximately within 120 days from account opening. Recipient(s) (customer TIN/SSN) of cash bonus shall not be eligible to receive a cash bonus on any other business checking account. Bonus may be reported on IRS Form 1099-MISC.

Old National Bank $50 Referral Bonus (Up to $500)

Earn up to $500 when you refer someone to open an account with Old National Bank.

- What you’ll get: $50 bonus

- Account Type: Checking Account

- Availability: IL, IN, KY, MI, WI

(Limited time offer)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | HSBC Premier Checking (Up to $3,000 Cash Bonus), |

How To Earn Bonus

- Get a $50 Visa Reward Card when your friend opens a new, eligible Old National checking account AND completes the following within 60 days of account opening:

- Completes ten (10) debit card transactions (ATM withdrawals excluded) AND

- Has one (1) or more direct deposits totaling at least $500

- Once your friend completes the program requirements, you will BOTH receive a $50 Visa Reward Card!

- Account must be open and in good standing at the time of qualification to receive the Reward Card.

- Referrers may earn up to ten (10) Reward Cards ($500 value) within a calendar year by registering and referring their friends or family.

- Within 4 to 6 weeks of the Referee completing all requirements, Reward Cards will be mailed to both the Referrer and Referee.

- Bonus may be reported on IRS Form 1099-INT.

- Old National reserves the right to discontinue this offer at any time.

Old National Bank Up to $700 Business Checking Bonus (Expired)

Old National bank is offering up to $700 business checking bonus when you meet certain requirements.

- What you’ll get: $700 bonus

- Account Type: Business Checking Account

- Availability: IL, IN, KY, MI, WI (Bank Locator)

- Direct Deposit Requirement: No

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Credit Card Funding: Up to $500, can fund with American Express, Visa & Mastercard

- Monthly Fees: $0-$20

- Early Account Termination Fee: Unknown

- Household Limit: None listed

(Expires 12/30/2022)

| Chase Business Checking ($300 or $500 Bonus) | Bank of America Business Checking ($200 bonus offer) |

| Axos Business Premium Savings ($375 Bonus) | Axos Bank Basic Business Checking ($400 Bonus) |

| Axos Bank Business Interest Checking ($400 Bonus) | Huntington Unlimited Plus Business Checking ($1,000 Bonus) |

| Huntington Unlimited Business Checking ($400 Bonus) | Bluevine Business Checking ($300 Bonus) |

| U.S. Bank Business Checking ( $500 or $900 Bonus) | |

How To Earn Bonus

To qualify for the checking account bonus:

- Open a Small Business Checking or Business Partner Interest Checking with a minimum deposit of $50 on or before Dec. 30, 2022. Offer available to accounts opened at any Old National banking center, accounts opened online are not eligible, AND

- Deposit minimum balance requirement by end of 30th calendar day following the account opening date and maintain current daily balance requirement for days 31-90.

- To earn the $200 bonus, deposit and maintain $5,000 – $14,999.99;

- To earn the $350 bonus, deposit and maintain $15,000-$24,999.99;

- To earn the $500 bonus, deposit and maintain $25,000 or more.

- Current Balance will be based on the end of the 30th calendar day the account is open; and for the next 60 calendar days (days 31-90); and will be determined using Old National’s Funds Availability Policy

To qualify for additional $100 Cash Bonuses (up to an additional $200), client must qualify for checking account bonus AND within 90 days of account opening:

- $100 Merchant Services Bonus: execute a signed service agreement for Merchant Services and complete at least one merchant deposit into the business checking account. Monthly and transaction fees for Merchant Services apply; credit- and debit-card acceptance service is subject to credit approval by Elavon, a third-party service provider.

- $100 Credit Card Bonus: be approved for a new Small Business or Commercial Credit Card. Small Business and Commercial credit cards, subject to credit approval, are issued by First Bankcard ®, a division of First National Bank of Omaha, pursuant to a license from Visa U.S.A., Inc. VISA is a registered trademark of Visa International Service Association and used under license. New credit card owners Tax Identification Number (TIN) must match TIN/SSN on new checking account to qualify.

- Offer is not available for clients with an existing Old National business checking account, business checking accounts closed on or after June 1, 2021, or clients that have previously received a business checking bonus payout.

- Additional bonuses available for new services and cards only.

- Other restrictions may apply, see bank for details.

- Limit one bonus per category per TIN/SSN. Account must be open and in good standing at the time the incentive is paid.

- The qualifying bonus(es) will be credited to your Old National business checking account within 165 days from account opening.

- Bonus may be reported on IRS Form 1099-MISC.

- Old National reserves the right to discontinue offer at any time.

- Not valid with any other Old National offer.

How To Waive Monthly Fees

- ONB Preferred Checking: $15 monthly fee waived when you:

- Maintain a minimum daily balance of $5,000 or

- Maintain a combined balance of $25,000 in checking, savings, money market accounts, CDs, lines of credit or loans

- ONB Everyday Checking: $6.95 monthly fee waived when you:

- Have a total of $500 in direct deposits each month or Maintain a minimum daily balance of $750 or

- Maintain a combined balance of $1,500 in checking, savings or money market accounts or

- Are an active member of the US Military

- ONB Classic Checking: $7.95 monthly fee waived when you:

- Maintain a minimum daily balance of $750 or

- Maintain a combined balance of $5,000 in checking, savings or money market accounts

- ONB Student Checking: No monthly fee

- Free Business Checking: No monthly fee

- Small Business Checking: Daily balance requirement is $5,000. Otherwise, a $20 monthly service charge applies.

- Business Partner Interest Checking: Maintain $10,000 average balance in key account or $20,000 in combined checking, savings, or money market. Otherwise, a $20 monthly service charge applies.

- Non-Profit Business Checking: No monthly fee

|

|

Bottom Line

Make sure you check out Old National Bank to learn more about their bonus promotions. This is a great and easy bonus for you to earn, and with a few requirements there’s no reason why you shouldn’t go for it!

Compare Old National Bank Promotions with other bank bonuses from banks like Citi, Huntington, HSBC, Chase, TD, Discover Bank, Aspiration, Axos Bank, PNC Bank, BMO, SoFi, Fifth Third Bank, Bank of America, Wells Fargo, US Bank, and more!

Feel free comment below and let us know about how it went. We value your feedback and will continue to keep you posted on the latest bank offers nationwide.

*Check back on this page for updated Old National Bank promotions, bonuses, and offers.*

The $200 offer is only available to the list of individuals who were sent a mail piece. Says it right in the disclosure – “In order to receive this offer, address on mailer must match primary address on new account at time of account opening.”

Good news all! I can confirm that this is indeed a soft pull!

You can fund the account up to $500 with a credit card! I know they accept American Express, Visa & Mastercard.

The Barclaycard Arrival Plus, Chase Southwest Plus, Citi American Airlines Business or Double cash all goes through as a purchases!

Up to $500 CC Funding (Citi Double Cash coded as Mortgages/Institutions). Don’t forget to elect e-statements once you can access your account online or it is a $3 fee.