Take advantage of SF Fire Credit Union promotions, bonuses, and offers here!

Update 2/5/25: The $300 checking bonus has been extended through 6/30/25.

About SF Fire Credit Union Promotions

San Francisco Fire Credit Union is headquartered in San Francisco and is the 38th largest credit union in the state of California. It is also the 254th largest credit union in the nation. It was established in 1959 and as of December of 2022, it had grown to 191 employees and 77,486 members at 3 locations. San Francisco Fire Credit Union’s CD rates are 3X the national average, and it has a B health rating.

| Eligibility: Membership in San Francisco Fire Credit Union is open to those who live, work, or attend school in San Mateo, San Francisco, or Marin Counties in California, active or retired fire fighters in San Mateo, San Francisco, or Marin County Fire Fighters, or members of the California State Firefighters’ Association. See current membership details |

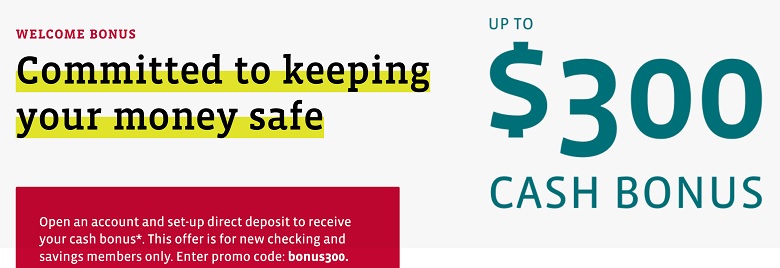

SF Fire Credit Union $300 Checking Bonus

Earn a $300 bonus when opening a checking or savings account with qualifying activity.

- What you’ll get: $300 bonus

- Account Type: Checking

- Availability: CA. Must live, work, or attend school in San Francisco, San Mateo, or Marin County (Locator)

- Direct Deposit Requirement: Yes, $5000+ (see what works)

- Credit Inquiry: Soft Pull

- ChexSystem: Unknown

- Credit Card Funding: Up to $495

- Monthly Fees: None

- Early Account Termination Fee: Not listed

- Household limit: None listed

(Expires 06/30/2025)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- Open a new checking account and enter promo code: bonus300.

- Set up direct deposits of at least $1,000 or more within the first 30 days of account opening. Maintain direct deposit for at least three consecutive 30-day cycles (90 days) after first direct deposit transaction.

- $1,000 – $4,999.99 Monthly Direct Deposit Totals for $100 cash bonus

- $5,000 or more Monthly Direct Deposit Totals for $300 cash bonus

- Once the qualifying direct deposits have been received, you’ll be eligible to receive a cash bonus of up to $300!

- Eligibility Requirements:

- This offer is for new checking account holders only.

- You are not eligible for this offer if:

- You are a current checking and/or savings account holder.

- You have previously received a bonus for enrolling in direct deposit.

- Bonus Payment:

- Once the 90-day qualification period has elapsed, we will determine if you have met the offer requirements and will deposit any earned bonus into your new checking account within 15 days.

- You are responsible for any federal, state, or local taxes due on the bonus and we will report as income to the tax authorities if required by applicable law. Consult your tax advisor.

- Offer expires June 30, 2025. The expiration date is the last day that someone can open a new checking account to be eligible for the bonus. Meaning qualifying accounts will receive bonus up to 3 months following the end of the promotion. However, offer may be discontinued or changed at any time prior to the expiration date without notice.

How To Waive Monthly Fee

- Free Checking: No monthly fee

- Savings: No monthly fee

|

|

Bottom Line

If you live near a SF Fire Credit Union location, you have the opportunity to earn generous bonuses. To earn these bonuses, simply open the eligible accounts and follow the procedures and the bonuses shall be granted!

Although you can earn a generous bonus from SF Fire Credit Union, check out our list of bank promotions for more offers. With fantastic offers such as Money Market and CD rates, you are able to get the most out of your banking experience!

Compare SF Fire Credit Union Promotions with other bank bonuses from banks like U.S. Bank, Citi, Huntington, HSBC, Chase, TD Bank, Discover Bank, Aspiration, Axos Bank, PNC Bank, BMO Harris, SoFi, and more!

Leave a Reply