TD Bank is located on the East Coast with 1,300 locations offering low minimum balance requirements as well as extending banking hours with a 24/7 customer service by phone.

They offer different types of banking services depending on your needs – from personal checking to investment options like CDs.

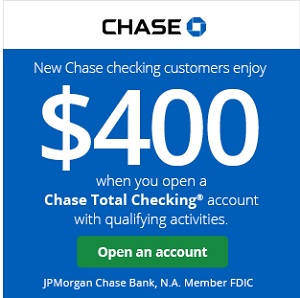

While Chase, one of the biggest banks in the Unites States, offers full service banking from personal banking to mortgages to loans, as well as a popular range of credit cards.

Not to mention, they offer more checking options compared to other competitors.

Continue reading below to see a side-by-side comparison between TD Bank and Chase Bank, so you can see which one offers the services you need the most.

| PROMOTIONAL LINK | OFFER | REVIEW |

| TD Bank Beyond Checking | $300 Cash | Review |

| TD Bank Convenience CheckingSM | $200 Cash | Review |

|

|

|

| TD Bank | Ally Bank | |

| Locations | 1300 locations along the east cost (Locator) | Online Only |

| ATMs | 1,300 ATMs throughout the Northeast, Mid-Atlantic, Metro D.C., the Carolinas and Florida | Over 43,000 no-fee Allpoint ATMs |

| Savings | 3/5 | 4/5 |

| CD | 3.5/5 | |

| Checking | 4.5/5 | 4/5 |

| Money Market | 3.5/5 | 4/5 |

| Customer Service | 5/5 | 5/5 |

| Mobile App | 4.5/5 | 5/5 |

| Pros | -Extended banking hours -Low requirements to waive monthly fees -No foreign transaction fees |

-CD options -No account minimums -Good customer service |

| Cons | -No free checking -Low APY -Only on East Coast |

-Low Checking APY for lower balance customers |

| Bottom Line | TD Bank offers a variety of banking services that includes saving, checking, and CDs. | Ally Bank is an online only based banking that offers full service with the most competitive rates. |

TD Bank Promotions

With the TD Convenience CheckingSM Account: • Earn $200 when you receive direct deposits totaling $500 or more within 60 days • Low minimum daily balance of $100 waives the $15 monthly fee. • Students and young adults ages 17 through 23 get additional perks like no minimum balance requirements and no monthly maintenance fee. • Instantly replace a lost, stolen, or damaged debit card by visiting a TD Bank location near you • Access accounts via Online Banking with Bill Pay, Online Statements, Send Money with Zelle and TD Bank Mobile Deposit. Plus, get 24/7 cash access at TD ATMs in the U.S. and Canada and around-the-clock Live Customer Service. • TD checking accounts come with an instant-issue debit card - and, you can pay with confidence with contactless technology Visa Zero Liability protection and 24/7 fraud monitoring. • Get a 0.25% discount on TD Bank Home Equity and Personal Loans. |

Chase Bank Promotions

Bottom Line

Which Bank is Better: TD Bank or Chase?

In summary:

- If you live in the near the East Coast, take advantage of the many accounts that TD Bank has to offer as well as the extended customer hours and easy online banking.

- Chase is a good choice if you’re looking for a bank with full range of services, physical locations, lots of ATMS, and good mobile banking.

For more variety of options, see our list of the best bank account bonuses & savings account offers

Leave a Reply