Get the latest 1st Source Bank promotions, bonuses, and offers here.

Get the latest 1st Source Bank promotions, bonuses, and offers here.

Residents of Indiana and Michigan can take advantage of the $100 and $150 checking bonuses when you open a new Checking Account and meet the requirements.

About 1st Source Bank Promotions

1st Source Bank was founded in 1863 in South Bend, Indiana. Since opening, it has expanded to over 17 counties and 80 locations throughout Indiana and Michigan. 1st Source has offered clients a convenient and friendly way to bank for over 155 years.

I’ll review the 1st Source Bank Promotions below.

1st Source Bank $100 Checking Bonus *Perks for Employees* *Expired*

Earn a $100 Bonus with 1st Source Bank

Participating employers can earn a $100 bonus with a new Checking Account. Simply meet the requirements below to qualify.

- What you’ll get: $100 bonus

- Account Type: Easy Banking or Cubs 1st Club Checking Account

- Availability: IN, MI (Bank Locator)

- Direct Deposit Requirement: Yes

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Credit Card Funding: None

- Monthly Fees: $10, avoidable

- Early Account Termination Fee: $25, 180 days

- Household Limit: One

(No expiration date listed)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | HSBC Premier Checking (Up to $3,000 Cash Bonus), |

How To Earn Bonus

- Just open a 1st Source Easy Banking Club Checking Account

- Receive a direct deposit and use your debit card.

- Obtain the official coupon from your company Human Resources contact.

- All accounts and Resource® Plus debit cards are subject to credit approval.

- For specific account details, please consult our Truth in Savings Disclosure.

- The $100 MasterCard® Gift Card offer is available with an original coupon.

- The specific requirements to earn the gift card are available on the coupon and at

www.1stsource.com/data/uploads/APYInfoEBCPerks.pdf. - See www.1stsource.com/disclosures.aspx for more account and annual percentage yield details.

1st Source Bank $150 Checking Bonus *Expired*

Earn a $150 bonus with 1st Source Bank.

1st Source Bank is offering a $150 bonus when you open a new qualifying checking account and complete certain requirements. To be eligible for this offer, you must be an Allied Physician.

- What you’ll get: $150 bonus

- Account Type: Easy Banking or Cubs 1st Club Checking Account

- Availability: IN, MI

- Direct Deposit Requirement: Yes

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Credit Card Funding: None

- Monthly Fees: $10, avoidable

- Early Account Termination Fee: $25, 180 days

- Household Limit: One

(Offer expires December 31, 2020)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

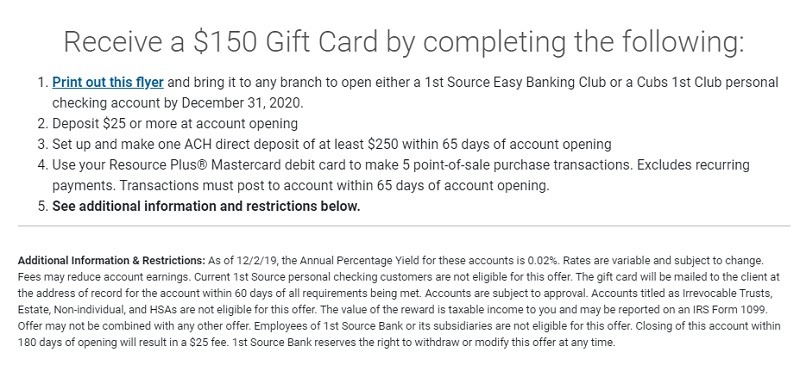

How To Earn Bonus

- Print out this flyer and bring it to any branch to open either a 1st Source Easy Banking Club or a Cubs 1st Club personal checking account by December 31, 2020.

- Deposit $25 or more at account opening

- Set up and make one ACH direct deposit of at least $250 within 65 days of account opening

- Use your Resource Plus® Mastercard debit card to make 5 point-of-sale purchase transactions. Excludes recurring payments. Transactions must post to account within 65 days of account opening.

- Current 1st Source personal checking customers are not eligible for this offer.

- The gift card will be mailed to the client at the address of record for the account within 60 days of all requirements being met.

- Accounts are subject to approval.

- The value of the reward is taxable income to you and maybe reported on an IRS Form 1099.

- Offer may not be combined with any other offer.

- Employees of 1st Source Bank or its subsidiaries are not eligible for this offer.

- Closing of this account within 180 days of opening will result in a $25 fee.

- 1st Source Bank reserves the right to withdraw or modify this offer at any time.

How to Waive Monthly Fees

- Easy Banking Club: $10.00 monthly can be waived with direct deposits totaling $250 or more per month.

- Cubs 1st Club: $10.00 monthly can be waived with direct deposits totaling $250 or more per month.

- 1st Checking: $7.00 monthly can be waived with minimum daily balance of $500.

- E-student Checking: No monthly fees

- Portfolio Checking: $25.00 monthly can be waived with a minimum balance of $5,000.

- Business Value Checking: $5.00 monthly can be waived if $1,000 minimum daily balance is maintained.

- Business Checking: $20.00 monthly can be waived if $20,000 minimum daily balance is maintained.

- Business Checking with Interest: $20.00 monthly

- Business Analysis Checking: $20.00 monthly

- Community Not-for-Profit Checking: No monthly fees

|

|

Bottom Line

The current promotion from 1st Source Bank is great for those who qualify! If you are interested, I would visit a local branch to see if you qualify for this promotion. However, there are still better offers out there so check them out here on HMB!

While they have generous checking bonuses, 1st Source Bank doesn’t have great rates for CDs and Savings. You may want to check out our full list of Bank Rates and CD Rates.

*Compare 1st Source Bank Promotions with other bank bonuses from banks like Citi, Huntington, HSBC, Chase, TD, Discover Bank, Aspiration, Axos Bank, PNC Bank, BMO Harris, SoFi, Fifth Third Bank, Bank of America, Wells Fargo, US Bank, and more!

*Check back at this page for updated 1st Source Bank promotions, bonuses and offers.

Leave a Reply