American Bank of the North (ABoN) has pretty good account options with reasonable requirements. To find out if American Bank of the North is right for you, continue reading the review below.

Hailing from Nashwauk, Minnesota, American Bank of the North now serves more than 13 branches in Minnesota and is a full-service bank that provides convenience to their customers with easy to manage requirements and fees.

They also have an All American Rewards Checking account that has no monthly fees nor minimum balance requirements to worry about! Not only that, but it also bears competitive interest rates.

Checking Account Options

Basic Checking has a great selection of checking accounts that all offer pretty good benefits.

This is a rewards checking account and you will need $50 to open it.

There are no monthly fees nor minimum balance requirements.

You can earn interest on this checking account when you enroll in online banking, ePay or make 15 debit card transactions.

This checking account is for those who are 50 and older and requires a $50 opening deposit.

This account also bears interest and there are no minimum balance requirements nor monthly fees.

This is another interest bearing account and you can open it with $50.

If you maintain a daily balance of $1,000, you can waive the $7.50 monthly fee.

You will earn tiered interest rates as long as you have $1,000 in your account.

Compare Checking Accounts

Savings Account Options

American Bank of the North has a small variety of savings accounts, but they have low minimum opening deposit and low requirements.

You need at least a $50 deposit to open this account.

There is a $10 monthly fee, but you only need to maintain a minimum daily balance of $50.

You can earn interest on all balances.

This account also comes with a Visa® ATM Debit card, all access to online and mobile banking and access to American Bank of the North ATMs.

this is technically a holiday savings account offered by American Bank of the North.

You only need a small minimum opening deposit of $5 and you can start earning interest daily.

There are no monthly fees to worry about and no specific balance requirement.

Compare Savings Accounts

CD Account Options

American Bank of the North offers CDs with competitive rates. These CD terms range from 3 months to 5 years and each of them requires $1,000 to open.

The interest is paid no less than annually, and maturity lasts up to 10 years.

To find more about their CDs, click here.

The CDs will automatically renew upon maturity.

Compare CD Accounts

• Available nationwide online, Discover® offers CDs with some of the highest & most competitive rates! with select terms as short as 3 months up to 120 months • Rates ranging from 2.00% APY up to 4.05% APY. • Opening a Discover Bank Certificate of Deposit is extremely quick and easy. • Funds on deposit are FDIC-insured up to the maximum allowed by law. • Get started and open a Discover CD in 3 easy steps. |

Reasons to Bank with American Bank of the North

- They have relatively low minimum balance requirements.

- Have a pretty good selection of checking and savings accounts.

- They have a Rewards Checking account.

- They have a senior citizen checking account.

- There are no out of network ATMs.

- Have easily waiveable monthly fees and most can be waived through eStatements.

- Conduct all your banking online (recommended) or through the American Bank of the North mobile app.

Reasons Not to Bank with American Bank of the North

- They are only located in Minnesota and there are 13 total branches.

- Their customer service is not 24 hours.

- They could have higher interest rates on certain accounts.

- They don’t have a youth savings account.

- Even though they have a senior citizen checking account, they don’t have a senior savings account to correspond.

- They don’t offer relationship checking.

- If you prefer opening accounts at a physical branch, then you will have to pay the opening deposit requirements.

- They have a low variety of savings accounts compared to their checking accounts.

American Bank of the North Routing Number

The routing number for American Bank of the North is 111321063.

Contact Customer Service

You can reach American Bank of the North’s customer service at 1-877-888-6800.

You can also fill out a question form on American Bank of the North’s website.

How American Bank of the North Compares

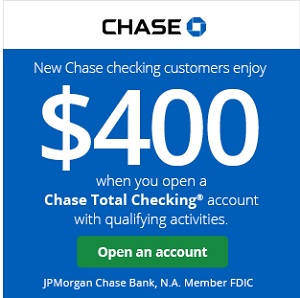

- Chase Bank: Chase is one of the biggest banks in the U.S and offers just about almost everything. Compared to its other competitors, Chase offers much more checking account options.

- Discover Bank: Discover Bank is also an online nationwide bank that offers bonuses for their checking and savings accounts! You can earn cash back rewards when you open a checking account and generous bonuses for opening a savings one.

- PNC Bank: PNC Bank offers free access to PNC Bank ATMs, free mobile/online banking, reimbursement of PNC fees for use of non-PNC ATMs, and many other features that can be found on their website. They have several account options.

Bottom Line

Those who don’t live in Minnesota may not be particularly interested in banking with American Bank of the North, but you can always do your banking online.

However, their website is not very user-friendly and can be hard to navigate.

Their account options are pretty standard, but they do have a Rewards Checking account to consider.

However, keep in mind that when you look for a checking or savings account be sure to look into all the fees charged. Don’t focus on the interest rate alone, but on what the account will cost you overall.

If you’re interested in banking with American Bank of the North, then apply today! For more options from a variety of banks, see our list of the best bank promotions!

Leave a Reply