Find an updated list of APG Federal Credit Union Bank promotions, bonuses, and offers here.

Update 6/6/25: The $300 checking bonus is back through 6/30/25.

About APG Federal Credit Union Promotions

APG Federal Credit Union is headquartered in Edgewood, Maryland. This Credit Union was established in 1938 and has over 132,000 members at 14 locations.

| Eligibility: Membership in APG Federal Credit Union is open to those who reside, work, attend school, worship, or volunteer in Cecil or Hartford Counties, or select areas of Middle River, Maryland. Immediate family and household members may also be eligible. See current membership details |

Next, I will be reviewing APG Federal Credit Union promotions below.

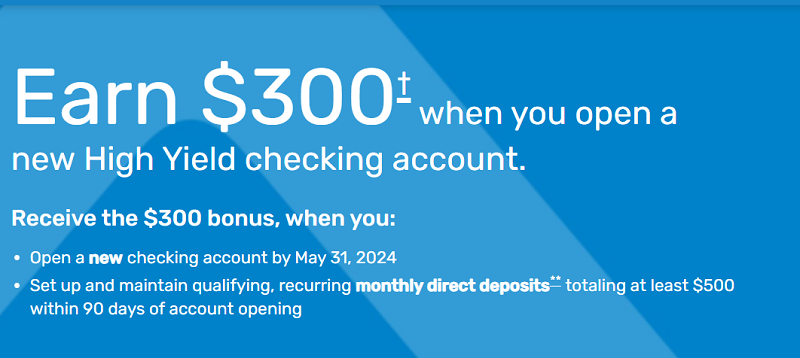

APG Federal Credit Union Bank $300 Checking Savings Bonus

- What you’ll get: $300 bonus

- Account Type: High Yield Checking account

- Availability: MD (Bank Locator)

- Direct Deposit Requirement: Yes, $500+ (see what works)

- Credit Inquiry: Unknown

- ChexSystems: Unknown

- Credit Card Funding: Unknown

- Monthly Fees: None

- Early Account Termination Fee: $15, 60 days

- Household Limit: One

(Expires 06/30/2025)

Editor’s Note: Here’s an alternative link to the offer (alternative link #3)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- Open a new checking account by June 30, 2025

- Set up and maintain qualifying monthly recurring direct deposits totaling at least $500 within 90 days of account opening

- If you meet all the terms of this offer, the bonus will be credited to your checking account on the first business day following the end of the 90-day Qualification Period.

- Offer is for new and existing members age 13 and older without a checking account only. Account owner may not have closed a checking account with APGFCU at any time on or after May 1, 2024, to qualify for this promotion. New High Yield Checking, Member Protect Checking, and Standard Checking accounts opened on or after May 1, 2025, and on or before June 30, 2025, may qualify for a $300 cash bonus if the account meets the following qualification: within 90 days of opening the checking account (“Qualification Period”), receive into the checking account qualifying monthly recurring direct deposits** of at least $500.

- Offer cannot be combined with any other offers and does not apply to second or multiple checking accounts. If you meet all the terms of this offer, the bonus will be credited to your checking account on the first business day following the end of the 90-day Qualification Period. Limit one bonus per member. Fees may apply for early closure of the checking account. Offer may be extended, modified, or discontinued at any time without prior notice at the credit union’s discretion. Any applicable taxes are the responsibility of the recipient. The checking account must remain open for a minimum of 90 days and all accounts associated with the membership must be in good standing (see “All About Your Accounts” agreement) to receive the bonus. Offer expires June 30, 2025.

APG Federal Credit Union $50 Referral Bonus

APG Federal Credit Union $50 Referral Bonus

APG Federal Credit Union will give you up to a $50 bonus when you refer new members to the credit union.

- What you’ll get: $50 bonus

- Account Type: Personal or Business Share Savings Account

- Availability: MD

- Direct Deposit Requirement: No

- Credit Inquiry: Unknown

- ChexSystems: Unknown

- Credit Card Funding: Unknown

- Monthly Fees: None

- Early Account Termination Fee: $15, 60 days

- Household Limit: One

(Limited time offer)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | HSBC Premier Checking (Up to $3,000 Cash Bonus), |

How To Earn Bonus

- Refer a friend or family member to open a new personal or business share savings account, and you’ll both be eligible for a $50 bonus

- $5 minimum to open and maintain a share savings or business share savings account for new member-owners.

- Refer-a-Friend new membership share savings and business share savings accounts must be opened through the online account opening process, through the mail or at an APGFCU branch.

- This offer is subject to change at the credit union’s discretion.

- Only one bonus offer payment will be paid to a new member-owner during the promotional period and this offer may not be combined with any other share savings offers.

- Referral email must be included with new membership application to receive the bonus.

- We may report to the IRS the value of any cash received and any applicable taxes are the responsibility of the recipient.

- Referrer must be in good standing to obtain the bonus.

- Membership eligibility applies.

- Other restrictions may apply.

- Officers, directors, volunteers and employees of APGFCU and members of their immediate families (spouse, parent, child and sibling) and persons residing in their households (whether related or not) are not eligible to participate.

How To Waive Monthly Fees

- Member Protect Checking: $6 monthly fee, waived if you have direct deposit of $200 or more into your Member Protect Checking account, opt out of receiving paper statements, make 20 or more debit card point-of-sale purchases per month

- High Yield Checking: None

|

|

Bottom Line

APG Federal Credit Union is offering a $300 bonus when you meet all the requirements above. For this bonus, you have to be an educator or faculty for a school. Even if you don’t qualify, you may know someone who does so let them know about this offer!

If you have experience banking with APG Federal Credit Union please leave us a comment below letting us know how it went. Also, let us know if we missed anything.

APG Federal Credit Union doesn’t have great rates for CDs and Savings. You may want to check out our full list of Bank Rates and CD Rates.

*Compare APG Federal Credit Union Promotions with other bank bonuses from banks like Citi, Huntington, HSBC, Chase, TD, Discover Bank, Aspiration, Axos Bank, PNC Bank, BMO Harris, SoFi, Fifth Third Bank, Bank of America, Wells Fargo, US Bank, and more!*

*Check back at this page for updated APG Federal Credit Union promotions, bonuses and offers.

Leave a Reply