Bank of the West promotions, bonuses, and offers can be found updated here.

Currently, they are offering a $25 Referral checking bonus when you meet the qualifications below. You can receive up to 40 referral bonus deposits (totaling $1,000) per calendar year.

Typical checking account bonuses range from $150, $200 and $300 with investment services offers from $200 up to $2,500.

About Bank of the West Promotions

In 1874, Bank of the West opened its doors on the California frontier as Farmers National Gold Bank. One of just 10 banks nationwide authorized to issue paper currency backed by gold reserves, the San Jose bank helped people build homes, finance farms, and grow their businesses. In 1979, they changed their name to Bank of the West.

Today, they have branches and commercial banking offices across the West Coast, the Southwest, the Midwest, and the Rocky Mountain states.

I’ll review the Bank of the West Promotions below.

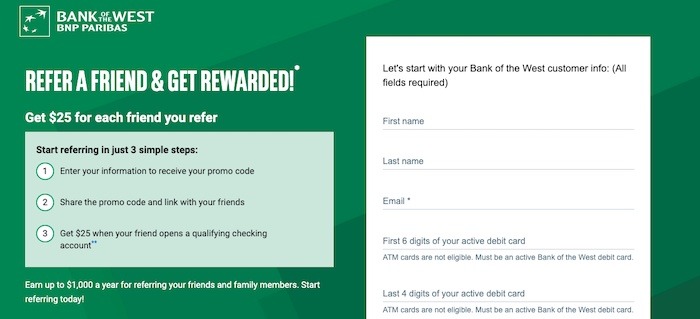

Bank of the West $25 Referral Bonus

Refer a friend & get rewarded!

Bank of the West is offering a $25 referral bonus when you refer a friend or family member to open a new qualifying checking account and complete certain requirements.

- What you’ll get: $25 bonus

- Account Type: Personal Checking Account

- Availability: AZ, CA, CO, ID, IA, KS, MN, MO, NE, NV, NM, ND, OK, OR, SD, UT, WA, WI, WY (Bank Locator)

- Direct Deposit Requirement: No

- Credit Inquiry: Soft Pull

- ChexSystem: Yes

- Credit Card Funding: $500 max, VISA/MC only

- Monthly Fees: $0-$25; waivable

- Early Account Termination Fee: None Listed

- Household Limit: Unknown

(Expires December 31, 2022)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- Enter your information into the referral form to receive your promo code

- Share your promo code and link with your friends

- Get $25 when your friend opens a qualifying checking account

- By participating in this program, each party consents that Bank of the West is permitted to share information regarding the customer relationship status to both the program referring customer and to the referred friend or family member for the purposes of confirming Refer-a-Friend eligibility.

- Confidential account and personal information will not be shared to the program referring customer or referred friend or family member.

- To receive the $25 Refer-a-Friend bonus: 1) Refer your family members and friends to open a new Bank of the West personal checking account with qualifying activities through the referral site or visit a local branch; 2) Referred candidate must be a new Bank of the West customer and open a new eligible personal checking account using the corresponding promo code to apply in branch or through the Refer-a-Friend offer page link; 3) After your referred friend or family member has opened a new Bank of the West personal checking account and has fulfilled the qualifying activities, the $25 referral bonus will be deposited to your primary Bank of the West checking account within 120 days.

- Your checking account must be in open status and have a positive balance (greater than $0 balance) in order to receive the bonus.

- You can receive up to 40 referral bonus deposits (totaling $1,000) per calendar year.

Bank of the West $250 Checking Bonus *Expired*

$250 Checking Bonus

Bank of the West is offering a $250 checking bonus with any deposit checking and meet certain requirements.

- What you’ll get: $250 bonus

- Account Type: Checking Account

- Availability: AZ, CA, CO, ID, IA, KS, MN, MO, NE, NV, NM, ND, OK, OR, SD, UT, WA, WI, WY (Bank Locator)

- Direct Deposit Requirement: Yes, $1000+ for the first three months

- Credit Inquiry: Soft Pull

- ChexSystem: Yes

- Credit Card Funding: $500 max, VISA/MC only. *Recent data points may be coding as cash advance*

- Monthly Fees: $10, avoidable

- Early Account Termination Fee: $25 fee if closed within 91 days

- Household Limit: One

(Offer expires September 30, 2022)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | HSBC Premier Checking (Up to $3,000 Cash Bonus), |

How To Earn Bonus

- Open an account by September 30, 2022

- Make direct deposits of $1,000 or more for 3 months in a row

- Apply for a new, qualifying consumer checking account with a promotion code between 07/11/2022 and 9/30/2022—the account must be opened by 10/14/2022. Account must be opened online at www.bankofthewest.com/checkingbonus or in a branch. Qualifying checking accounts are consumer checking accounts, excluding UCB Student Checking and Bank of the West Premier Checking accounts.

- Customer must make qualifying direct deposits of $1,000 or more, monthly for three consecutive calendar months within the corresponding qualification period, detailed below. All direct deposits must go to the new checking account. One or more separate direct deposits in a single calendar month that add up to $1,000 qualify. Fulfillment of the offer requirements is based on calendar months which may not coincide with statement cycles. For example, for accounts opened in July, three months of sequential direct deposits made in July, August and September; August, September and October; September, October and November; or October, November and December would each qualify.

- A qualifying direct deposit must be payroll, Social Security, pension or other government benefits. Non-qualifying direct deposits include transfers from Bank of the West or Bank of the West affiliate accounts, credits from Bank of the West, ACH bank-to-bank transfers, person-to-person transfers using a mobile payments service such as Zelle®, or deposits made at a branch or ATM. Qualifying direct deposits must be funds new to the Bank.

Bank of the West $600 Checking Savings Bonus *Expired*

Earn a $600 Checking Savings Bonus

Open a Premier Checking account or both a Premier Checking and Choice Money Market Savings account to earn a generous $600 bonus.

- What you’ll get: $600 bonus

- Account Type: Checking, Savings Account

- Availability: AZ, CA, CO, ID, IA, KS, MN, MO, NE, NV, NM, ND, OK, OR, SD, UT, WA, WI, WY

(Expires 08/06/2021)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How to Earn Bonus

- $500 Bonus:

- You’ll earn $500 when you open a Premier Checking account by 8/06/21, deposit at least $25,000 the same month, and maintain a $25,000 average monthly balance for three full calendar months.

- $100 Bonus:

- Earn an additional $100 when you open a Choice Money Market Savings account with a new Premier Checking account by 8/06/21.

- Deposit at least $10,000 the same month and maintain a $10,000 average monthly balance for three full calendar months

- Offer end date and availability subject to approval and change without prior notice.

- All accounts are subject to the Bank’s standard terms and conditions and Schedule of Fees and Charges.

- Offer is not available to existing Bank customers with an open consumer deposit account as of 05/31/21.

- Offer available only to one individual residing at this address that received the mail piece with this checking offer.

- If opening your new account(s) at a branch, bring the mailer containing the promo code with you.

- If redeeming this offer online, you must apply through the dedicated offer webpage at bankofthewest.com/premierbonus.

- Applications submitted through other pages on our website will not qualify for this offer.

- Bank of the West Premier Checking and Choice Money Market Savings balance requirements below must be strictly adhered to in order to receive the bonus.

Bank Of The West $150 Business Checking Bonus *Expired*

- What you’ll get: Up to $150

- Account Type: Checking

- Where it’s available: AZ, CA, CO, IA, ID, KS, MN, MO, ND, NE, NM, NV, OK, OR, SD, UT, WA, WI, WY

| Chase Business Checking ($300 or $500 Bonus) | Bank of America Business Checking ($200 bonus offer) |

| Axos Business Premium Savings ($375 Bonus) | Axos Bank Basic Business Checking ($400 Bonus) |

| Axos Bank Business Interest Checking ($400 Bonus) | Huntington Unlimited Plus Business Checking ($1,000 Bonus) |

| Huntington Unlimited Business Checking ($400 Bonus) | Bluevine Business Checking ($300 Bonus) |

| U.S. Bank Business Checking ( $500 or $900 Bonus) | |

How To Earn Bonus

Open Any Deposit Checking for Business account and earn a $25 bonus each month you make any deposit for up to six months.

- $100 minimum opening deposit required between September 1, 2020 and September ?30, 2020 and make any deposit within the same calendar month in which the account was opened.

- $25 bonus will be credited to the account by the end of the month immediately following the calendar month in which the account was opened.

- If customer does not make the first deposit in the same calendar month in which the account was opened, the customer will not be eligible for the initial $25 bonus or any of the additional $25 bonuses.

- Requirements to receive up to five (5) additional $25 bonuses: Make any qualifying deposit into the Any Deposit Checking for Business account in each of the five (5) consecutive calendar months immediately following the month of account opening.

- For each of the five (5) consecutive months that a deposit is made, a $25 bonus will be credited to the account by the end of the month immediately following the calendar month that the deposit was made.

- NOTE: Bonuses earned from qualifying deposits made in November will be paid out in January.

- If a deposit is not made in any one of the subsequent five (5) calendar months following the month in which the account was opened, the customer will not be eligible for the $25 for the month that the deposit was missed AND they will not be eligible for any additional $25 monthly bonuses after that missed month.

- Bonus Limitations: Offer not available to existing Bank of the West customers with an open business checking account as of August 31, 2020.

- If the customer received or may receive any other business checking bonus from Bank of the West between September 28, 2018 and September 30, 2020, then the customer is not eligible for this bonus offer.

- Limit one (1) business checking bonus per customer.

- Account must be in open status with a balance greater than $0 at the end of each calendar month of the six-month period to qualify for any bonuses.

- Offer dates, terms, and conditions subject to change without notice. Bank will classify bonus as interest paid to the checking account.

- Any applicable taxes associated with this offer are the responsibility of the account holder.

- To the extent required by law, Bank will report value of each monthly bonus to the IRS on form 1099 for the applicable year in which the bonus was paid.

- All accounts are subject to Bank’s standard terms and conditions and Schedule of Fees and Charges. Maximum of six (6) $25 bonuses for a maximum total bonus of $150.

- Qualifying deposit for receiving bonus may be for any amount and includes direct deposit, mobile deposit, ATM deposit, or in-branch deposit (but does not include fund transfers between Bank of the West accounts or any credit from Bank of the West).

How To Waive Monthly Fees

- Any Deposit Checking: None

- Performance Money Market: None

- Any Deposit Checking: $10 monthly fee waived with one deposit of any amount ($0.01 or more) each statement cycle or if any account owner is under 25 years of age.

- 1% for the Planet Checking: $10 monthly fee waived with one deposit of any amount ($0.01 or more) each statement cycle or if any account owner is under 25 years of age.

- Premier Checking: $25 monthly service charge waived with minimum combined average balance of at least $25,000 in Eligible Accounts.

- Classic Savings: $5 monthly fee waived with any of the following:

- Maintain an average monthly balance of $300 ($50 in Minnesota)

- Use Auto-Save to set up recurring monthly transfers of $25 or more from any Bank of the West personal checking account to your Classic Savings account

- If the primary account holder is 18 years old or younger

- Choice Money Market: $15 monthly fee waived with any of the following:

- Maintain an average monthly balance of $5,000

- Use Auto-Save to set up a recurring monthly transfer of $75 or more from any Bank of the West personal checking account to your Choice Money Market Savings account

- Maintain a Bank of the West Premier Checking Account. Refer to the Bank of the West Premier Program disclosure for details.

- Any Deposit Checking for Business: $10 monthly service charge will be waived when you make any deposit each month.

- Classic Business Checking: $25 monthly service charge will be waived with any of the following:

- Maintain a minimum daily balance of at least $5,000

- Maintain an average monthly combined balance of $15,000 in linked Business Money Market, Savings, or CD accounts

- Have a Bank of the West Merchant Services account8 linked to your Classic Business Checking account

- Have a Bank of the West Business Credit Card account with the same primary owner as your Classic Business Checking account

- Choice Business Checking: $40 monthly service charge will be waived with any of the following:

- Maintain a minimum daily balance of at least $25,000

- Maintain an average monthly combined balance of $50,000 in linked Business Money Market, Savings, or CD accounts

- Classic Business Savings: $5 monthly service charge waived with any of the following:

- Set up Auto-Save with an automatic recurring monthly transfer of $100 or more from any Bank of the West business checking account

- Maintain an average monthly balance of $500 or more

- Business Money Market Advantage: $10 monthly service charge will be waived when you maintain a minimum daily balance of $1,000.

- Business Money Market Advantage: $15 monthly service charge will be waived when you maintain an average monthly balance of $10,000 or more.

|

|

Bottom Line

Bank of the West is currently offering a wide variety of bonuses, promotions, and offers as well as great account features to help you in any situation.

However, this bonus is only available for a limited time, so I would recommend you act soon if this sounds like something you are interested in. Your feedback is highly appreciated and makes our site even better!

While they have generous checking bonuses, Bank of the West doesn’t have great rates for CDs and Savings. You may want to check out our full list of Bank Rates and CD Rates.

*Compare Bank of the West Promotions to more bank bonuses from Citi, Huntington, HSBC, Chase, TD, Discover Bank, Aspiration, Axos Bank, PNC Bank, BMO Harris, SoFi, Fifth Third Bank, Bank of America, Wells Fargo, US Bank, and more!

*Check back at this page for updated Bank of the West promotions, bonuses, and offers.

Forgot to mention: I tried multiple ways of putting money into other people’s accounts. Only the business account payroll service ($10/mo) got coded as a DD. Interestingly, my initial simple ACH transfers from my business account (sole proprietor) to my new personal checking at BotW the first month (before I was able t get the payroll service set up) seemed to have counted! The experimental ones to another person went AWOL for a few days and seem to have been manually credited as…a “Credit”, not a DD, so they didn’t count. It was quite a learning experience.

Opened account online Dec 2020. Made External Transfers (ACH/DD) and payroll service (DD) from business account at another bank. Got the $250 bonus in April.

Friends opened accounts online in Dec 2020 also. One family had trouble–questions, delays getting account open–possibly due to Resident Alien status (1 person), not funding account at time of opening (1 person). I tried to do DD’s for all from my business account, but there were snafus galore on my end. When I was finally able to get it fixed to do the DD’s properly, they were slow to post at BotW and missed the deadline of starting DDs within 60 days. I continued with the 3 consecutive monthly DDs, but they did not get the bonus. We may appeal, but I was told by Customer Service it won’t help.

Bank of the West has some weird practices compared to other banks: External Transfers (ACH) to your own checking account at another bank cost $3 instead of being free, but Bill Pay checks are still free and so is Zelle. Zelle worked almost instantly to move money back out. Some banks pull the money the night a Bill Pay check gets cut, so the funds are guaranteed; BotW treats it as a regular check, so if the funds aren’t there when the check clears, it will bounce and you get a NSF fee.

This bank is CLEARLY hoodwinking folk out of their personal info!! And if you have not had a personal relationship with this bank prior, you will be automatically declined through their on line application — GUARANTEED! They will tell you that you have to go to one of their brick & mortar branches once you call their 800#, after your application has been declined online — even if it’s 400 miles away to apply!

DO NOT — I Repeat, “DO NOT” waste your time and energy allowing them to even “soft pull” your credit profile from the major bureaus AND Chex Systems(consumer credit reporting agency), it’s a way of simply obtaining your personal info for this bank to do God knows what with!!

The application process was very “suspect” while I was filling it out online — Never at any time, was I asked to upload ANY documents to “validate my identity” — UNLIKE EVERY OTHER BANK OR FINANCIAL INSTITUTION that takes online applications!!

I copied & pasted their reason for the decline of my application:

Thank you for applying for a(n) Premier Checking account. At this time, your online application has been declined because we were unable to verify your identity or other personal information. Still interested in opening an account? Please apply in person with your government-issued ID.visit your local branch We hope to see you soon!

*Really?? — When I called the rep, she said, my application was “exclusively” declined because they had no definitive way of identifying me, and had nothing to do with any “other personal info” on my application.

Just a few days ago, I was approved online by “both JP Morgan Chase Bank(America’s biggest bank) & Navy Federal Credit Union(America’s biggest Credit Union) with the same info that I furnished this application with, except — as I said, “Bank of West” didn’t even require me to upload documents validating my identity or address.” Why? — They had no intent to approve applicants online — but to simply scam folk, driven by the enticing allure of a healthy cash bonus promo! SMDH (? ?° ??? ?°)? … and now I am hearing comments from other people on other forums about NEVER receiving their bonuses more than 5 calendar months from opening their accts, though they fulfilled all required actions to receive it?!!!!!!!!!

Beware, they do not pay out. I fulfilled all the requirements of the bonus offer, they were supposed to deposit the bonus by 1/29, but I got nothing. Sent a message to customer service and got no response.

Hi I opened account aug2020 I was told recieve 120 days it is now Jan 23 2021. No one seems to know anything told didn’t have positive balance that was not disclosed an did it in branch

I got the mailer, opened & funded accounts with $25K by 10/31/20 (as required.) However, I received a $300 bonus back in January, 2020 so not sure if I will receive the new bonus.

I received an invitation in the mail and came to your site (and BoW’s) for more info. You say there’s a direct deposit required for the $600 offer, but I don’t see that in BoW’s info… but you do need to keep a full $25,000 in to avoid monthly fees which will eat much of the reward. So for the $600 offer, it seems to be, monthly fees = yes, direct deposit = no. Or am I missing something?

Also, since the deal ends on a specific date, it seems opening your account in October and funding at the end of October, will allow you to keep the $25K in, the least amount of time.

Third time’s a charm. Denied a third time. They want the perfect people.

The $600 promo is only available to specific people that received the mailer.

Are you saying they do some kind of credit check?!

The fine print for the latest promotion is that the deadline for entry is August 2nd followed by 3 consecutive months of qualifying deposits with the payout not coming until December or by December 31st. Perhaps your bonus is still processing!

Does a bank transfer from another bank that’s not affiliated qualify as a deposit for this promotion?

Was told I need a promo code in order to get the bonus when opening a checking acct. How do I get it???

I opened a Bank of West account on October 1, 2018 and followed all the rules for the promotion and it is now January 6, 2019 no sign of the $150 bonus.

Applied. Denied. Record time. Part 2.

Hi Roy,

Thanks for reaching out to us. We have updated the Bank of the West Logo accordingly. Please let me know if you have any other concerns or issues.

Vicky

can you pls update the bank of the west logo.

it shows up on google search for bank of the west.

Applied. Denied. Record time.