Chase is simplifying things by creating Chase Pay Service which will allow you to pay without physically having your card. Instead, your accounts and card information will be available to you at the touch of your fingertips.

Chase is simplifying things by creating Chase Pay Service which will allow you to pay without physically having your card. Instead, your accounts and card information will be available to you at the touch of your fingertips.

Also, you’ll able to be confident about using Chase Pay because all of your credit card information will not be shared and will be protected. This isn’t only a means to pay, but you’ll also receive access to great features such as loyalty rewards and coupons.

You’re even able to use this tool to pay while you’re in other apps and select online retailers! Plus Chase Pay is already accepted at thousands of places such as WalMart and BestBuy. So if you are interested in learning more then keep reading!

| PROMOTIONAL LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up to $700 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

How it Works

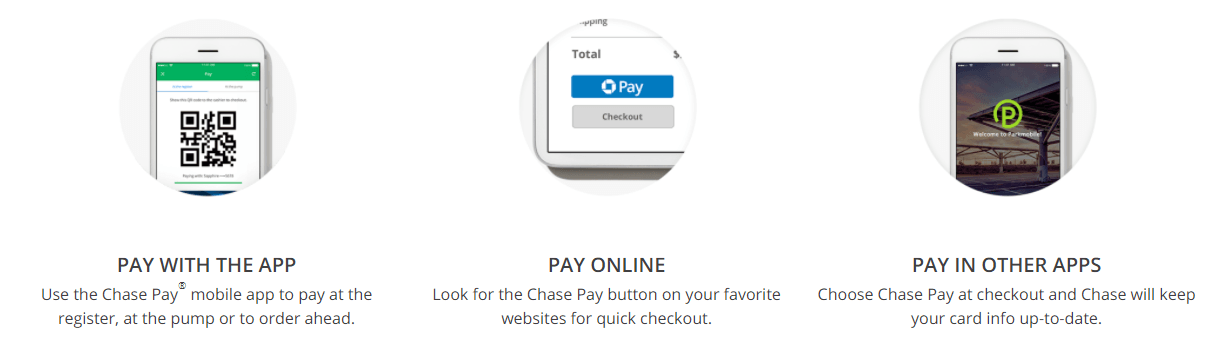

If you are wondering how Chase Pay Service works exactly then you’re at the right place. First you’ll need to download the app, sign in with your Chase ID and password, and then you’re ready to use it! Best of all, there is no usage fee.

You are able to use Chase Pay if you have any Chase Visa consumer credit cards, Chase Liquid, and if you have an existing checking account, you can use your Chase debit card as well (Check out our in-depth reviews on Chase Total Checking® & Chase Premier Plus CheckingSM accounts to learn more.

However, at the moment Chase Pay doesn’t accept business credit cards, business debit cards or Mastercard cards. Security is a crucial importance to Chase, therefore when you use Chase pay, the merchant will receive your payment token instead of your account number. So you can rest assured knowing that your Chase username, password, credit card number, or account number will not be shared.

Take advantage of special discounts and offers that you can only get when you use Chase Pay. Also, don’t forget to redeem Chase Ultimate Rewards points with the Chase Pay app and button. You can even use this app at checkouts for other apps such as when you are buying coffee, movie tickets, and parking!

Even at the pump you are able to utilize this tool and you’ll be able to pay for gas at a station near you without leaving your car. For a bonus, join the fuel loyalty program to automatically earn and redeem fuel rewards every time you get gas.

Chase Pay Merchants

Mobile payments are growing fast and with that comes thousands of places where you can optimize your Chase Pay account and pay for your purchases! Chase is constantly updating the list of merchants that accepts the form of Chase Pay as a payment option for consumers. To name a few see the top retailers/restaurants below:

- Best Buy (In Store)

- Walmart (Online)

- Atom Tickets App

- La Madeleine French Bakery & Cafe (Chase Pay App)

- Parkmobile App

- ShopRite (In Store/Online)

- 1-800 Flowers.com (Online)

- 1-800 Baskets.com (Online)

- Cheryl’s (Online)

- Harry & David (Online)

- And Much More!

Additional Chase Bank Features

Chase offers a multitude of features to further assist you in reaching all of your financial aspirations and goals. With Chase Credit Journey, you will be able to identify and better your credit score. They offer many tools and services to provide you the necessary assistance in improving your credit score. There are many factors they may affect your credit score.

You’ll be surprised about credit score influences such as how many accounts you have open, how old those accounts are, how much credit you have available any many more. With Chase Credit Journey, you will be able to manage your credit with ease all without any charges! So, why not take advantage of this free service and see the many ways you can better your credit score.

Investing and knowing where your money is going is important in reaching your financial aspirations. Chase Private Client Service allows you to personalize your goals fit for all of your needs. Planning your future shouldn’t be difficult and the service offered by Chase allows you to bank and invest with ease for any financial goals.

Whether it is to save up for retirement or save up for college funding for your child’s education, Chase’s investment plans offers guidance in making sound financial decisions to better your wealth. You can get your foot in the door by opening up a Chase SavingsSM account and taking a hold of your financial investments today!

Buying a car is stressful as it is. You will have to worry about the liability of owning a car and on top of that, how you are going to pay for it. With Chase Auto Direct, buying a car could have never been easier! They offer wide array of services to offer you the best rates on the market whether it is to obtain a car loan or to refinance a car.

With Chase, you will get guaranteed savings in getting the car you want. There are many services to take advantage of especially when you are looking for ways to pay for a car and help you to make car buying process simplified!

Card Options

The Ink Business Preferred® Credit Card offers 90,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $900 cash back or $1,125 toward travel when redeemed through Chase TravelSM. You'll earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year; 1 point per $1 on all other purchases - with no limit to the amount you can earn. Furthermore, points are worth 25% more when you redeem for travel through Chase TravelSM. This card does come with a $95 annual fee but does not have any foreign transaction fees. |

The Chase Freedom Unlimited® Card offers a $200 bonus after spending $500 on purchases in your first 3 months from account opening. Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers. In addition, you can earn: • 6.5% cash back on travel purchased through Chase TravelSM, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more • 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service • 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase TravelSM, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases. There is no minimum to redeem for cash back & your cash back rewards do not expire as long as your account is open. This card comes with no annual fee and you'll get a free credit score that is updated weekly with Credit JourneySM. Member FDIC |

The Ink Business Cash® Credit Card offers $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening. You'll earn: • 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year • 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year • 1% cash back on all other card purchases with no limit to the amount you can earn. This card comes with no annual fee. You'll be able to take advantage of employee cards at no additional cost. |

The Chase Freedom FlexSM offers a $200 bonus after spending $500 on purchases in your first 3 months from account opening. 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR. You'll earn: • Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter! • 5% cash back on travel purchased through Chase Travel?, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more • 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service • Unlimited 1% cash back on all other purchases You cash back rewards do not expire as long as your account is open and there is no minimum to redeem for cash back. This card has no annual fee. |

The Ink Business Unlimited® Credit Card offers $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. You'll earn an unlimited 1.5% cash back on every purchase made for your business and you'll receive employee cards at no additional cost. This card carries no annual fee. |

The Chase Sapphire Preferred® Card offers 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. You'll earn: • 5x on travel purchased through Chase TravelSM • 3x on dining, select streaming services and online groceries • 2x on all other travel purchases • 1x on all other purchases • $50 Annual Chase Travel Hotel Credit • Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027. Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase TravelSM This card carries a $95 annual fee. |

Bottom Line

Chase offers a variety of great services that are designed specifically for the customers and paying has never been easier once you start utilizing Chase Pay Service. You’re not just able to pay by using your mobile app, but you’ll also be able to earn loyalty points for everyday items such as gas!

Best of all, your information will stay secured and you can rest easy knowing that your personal information will not be shared once you make a transaction. Lastly, don’t forget to check out our Chase Bank Promotions & the Best Chase Credit Card Deals to learn more about what chase has to offer to provide you with quality banking services!

| BMO Bank Checking: Open a new BMO Smart Money Checking Account and get a $400 cash bonus* when you have a total of at least $4,000 in qualifying direct deposits within the first 90 days. Learn More---BMO Checking Review *Conditions Apply. Accounts are subject to approval and available in the U.S. by BMO Bank N.A. Member FDIC. $4,000 in qualifying direct deposits within 90 days of account opening. |

| Chase Ink Business Unlimited® Credit Card: New cardholders can enjoy a welcome offer of $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. Click here to learn how to apply--- Review |

Leave a Reply