Find the most updated Chase Bank promotions, bonuses, and offers here. Get the latest Chase Coupons here.

Chase has offers for business checking, consumer checking, and savings accounts, so you’re bound to find the right offer.

The Chase Bank cash bonuses & promotions range from 100, $300, $325, $350, $400, $500, $700, $1000, $3000+.

Update 4/3/25:

- The business checking offer has been improved with a bonus offer of up to $500 valid through 7/17/25.

- The J.P. Morgan Self-Directed Investing offer has been extended through 7/22/2025.

- The Chase Total Checking®, Chase Secure BankingSM, Chase Private Client CheckingSM and Chase College CheckingSM offers have been extended through 7/16/2025.

- Some of the best Chase Checking offers you’ll find on the web. We recommend the $300 business checking bonus and the $300 Total Checking bonus.

| PROMOTIONAL LINK | OFFER | REVIEW |

| Chase Business Complete Checking® | $300 or $500 Cash | Review |

| Chase Private Client | $3,000 Cash | Review |

| Chase Total Checking® | $300 Cash | Review |

| J.P. Morgan Self-Directed Investing | Up to $700 Cash | Review |

| Chase College CheckingSM | $100 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

About Chase Bank Promotions

Chase Bank is one of the largest banks in the U.S. with access to more than 4,700 physical branches, 16,000 ATMs, and a high-rated mobile app.

Chase offers an array of financial products from credit cards, home and auto loans, personal accounts, business and commercial products, and investment products.

Even though their rates aren’t the best, you will have all your banking products conveniently bank all at one place.

There is no doubt Chase has some of the best bank bonuses and coupon codes out there. The bank is constantly trying to attract new customers with sign-up bonuses and promotional offers.

I’ll go over the Chase bank bonuses below.

Chase Private Client Checking $3,000 Bonus Offer Code

Chase Private Client CheckingSM – Chase is offering up to a $3,000 bonus when join Chase Private Client.

- What you’ll get: Up to $3,000 bonus

- Eligible account: Chase Private Client Checking

- Where it’s available: AZ, CA, CO, CT, DC, DE, FL, GA, IA, ID, IL, IN, KY, LA, MA, MD, MI, MS, NH, NJ, NM, NV, NY, OH, OK, OR, PA, RI, TN, TX, UT, VA, WA, WI, WV.

- How to earn it:

- Enjoy up to a $3,000 bonus when you open a new Chase Private Client CheckingSM account with qualifying activities.

- Within 45 days of coupon enrollment, transfer qualifying new money or securities to a combination of eligible checking, savings and/or J.P. Morgan Wealth Management non-retirement accounts (excludes Chase Personal and Business CDs, Chase business checking and savings accounts, any J.P. Morgan Self-Directed Investing & Automated Investing, J.P. Morgan Personal Advisors Accounts, and J.P. Morgan Wealth Management retirement accounts).

- Your bonus will be determined on day 45. Maintain your new money for 90 days from coupon enrollment and enjoy your bonus. We’ll add it to your account within 40 days.

- Monthly fee: There are no Chase membership fees, but you must maintain a minimum relationship balance of $250,000.

(Expires 07/16/2025)

This Chase Bank promotion is very hard to earn especially with the high deposit requirement. Sign up now and experience a banking relationship that brings you more.

Chase Business Complete Checking® $300 or $500 Bonus Offer Code

Chase Business Checking Account – Chase is offering $300 or $500 bonus when you open a new Chase Business Complete Checking® account. To earn the bonus, simply request a bonus coupon by e-mail then open it online or take it in branch to open a Chase Business Checking Account. After you have completed that, complete the specified requirements and you will be able to enjoy the bonus as well as great account features.

- What you’ll get: $300 or $500 bonus

- Eligible account: Chase Business Complete Checking®

- Where it’s available: Nationwide. Apply online or in-branch.

- How to earn it:

- Enter your email address to request an offer code from the offer page. You can open the account online or bring this offer code to your local branch when opening a new account.

- Open a new Chase Business Complete Checking® account.

- Fund: Deposit a total of $2,000 or more in new money into your new qualifying checking account within 30 days from offer enrollment. The new money cannot be existing deposits at Chase or its affiliates.

- Your new money deposit amount will be determined in the following manner at 30 days from offer enrollment:

- $300 when you fund with $2,000 – $9,999

- $500 when you fund with $10,000 or more

- Your new money deposit amount will be determined in the following manner at 30 days from offer enrollment:

- Maintain: Maintain the new money (at least $2,000 for the $300 offer OR at least $10,000 for the $500 offer) in the new checking account for at least 60 days from the offer enrollment. If new money deposit amount decreases below the threshold during the 60-day period, your offer amount may change or your checking account may no longer qualify for the offer.

- Complete 5 qualifying transactions within 90 days of offer enrollment. Qualifying transactions are: debit card purchases, accepting credit and debit card payments with QuickAccept®, Chase QuickDepositSM, ACH (Credits), wires (Credits and Debits), Chase OnlineSM Bill Pay. The following are not considered qualifying transactions: ACH (Debits), Person to Person payments, Zelle® and online transfers to Chase credit card(s).

- After you have completed all the above checking requirements, we’ll deposit the offer amount in your new account within 15 days.

(Expires 07/17/2025)

This business Chase Bank promotion is valuable to business owners. You can bank easy knowing that there are thousands of Chase branches and ATMs located throughout the U.S. Plus, you have the ability to use advanced online and mobile banking options.

Chase also offers financial products and services that let you bank when and how you want. Chase for Business helps you control your finances so when change happens, you’re ready.

J.P. Morgan Self-Directed Investing Bonus Coupon

- Get up to $700 when you open and fund a J.P. Morgan Self-Directed Investing account with qualifying new money.

- $700 when you fund with $250,000 or more

- $325 when you fund with $100,000-$249,999

- $150 when you fund with $25,000-$99,999

- $50 when you fund with $5,000-$24,999

- Get unlimited commission-free online stock, ETF, fixed income, and options trades when you open an account.

- $0 Online Commission trades

- Choose an account that’s right for you: General Investing, Traditional IRA or Roth IRA.

- Access our secure, easy-to-use trading experience online or through the Chase Mobile® app.

- Our powerful tools and resources are built to help you take control of your investments.

(Expires 07/22/2025)

INVESTMENT AND INSURANCE PRODUCTS ARE: NOT A DEPOSIT • NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

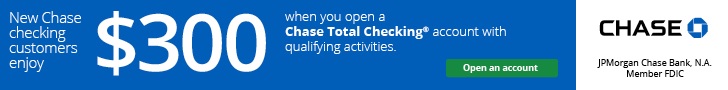

Chase Total Checking® $300 Bonus Coupon

Chase Total Checking®– Chase Bank is offering a $300 bonus when you open a new Chase Total Checking® Account with qualifying activities. You can directly apply online for a new Chase Total Checking® account. You could also enter your email to receive a Total Checking® Coupon that you can take to your local Chase branch.

- What you’ll get: $300 bonus

- Eligible account: Chase Total Checking®

- Where it’s available: Available online nationwide except in Alaska, Hawaii and Puerto Rico. For branch locations, visit locator.chase.com.

- How to earn it:

- Apply directly online or in-branch using your personalized coupon generated from the offer page.

- Open a Chase Total Checking® account.

- Make direct deposits totaling $500 or more within 90 days of coupon enrollment.

- Receive your bonus within 15 days.

- Monthly fee: $12 or $0 with one of the following, each monthly statement period:

- Electronic deposits made into this account totaling $500 or more, such as payments from payroll providers or government benefit providers, by using (i) the ACH network, (ii) the Real Time Payment or FedNowSM network, (iii) third party services that facilitate payments to your debit card using the Visa® or Mastercard® network,

- OR a balance at the beginning of each day of $1,500 or more in this account,

- OR an average beginning day balance of $5,000 or more in any combination of this account and linked qualifying Chase checking, savings, and other balances.

(Expires 07/16/2025)

With Chase Total Checking®, you get access to Chase ATMs and branches. Some features include free debit card, free online banking & bill pay, and mobile banking. This is simply another great Chase bank promotion. Chase QuickDepositSM lets you deposit checks almost anytime, anywhere with the ease of taking a picture.

With Chase Overdraft AssistSM, we won’t charge an Insufficient Funds Fee if you’re overdrawn by $50 or less at the end of the business day OR if you’re overdrawn by more than $50 and you bring your account balance to overdrawn by $50 or less at the end of the next business day (you have until 11 PM ET (8 PM PT) to make a deposit or transfer). Chase Overdraft Assist does not require enrollment and comes with eligible Chase checking accounts.

Chase College Checking $100 Bonus Coupon

Chase College CheckingSM– Open a new Chase College CheckingSM account to earn a $100 bonus. Make sure to enter your email to receive a Chase College Checking Coupon from Chase Bank to take it to your local Chase branch. Then simply enroll in paperless statements and complete 10 qualifying transactions to earn your bonus.

- What you’ll get: $100 bonus

- Eligible account: Chase College CheckingSM

- Where it’s available: Nationwide

- How to earn it: Open a Chase College CheckingSM account and complete 10 qualifying transactions within 60 days of account opening. Qualifying transactions include: debit card purchases, online bill payments, checks paid, Chase QuickDepositSM, Chase QuickPay®, or direct deposits.

- When you’ll receive it: Bonus will be deposited into your account within 15 business days, once all requirements have been completed and the 10 qualifying transactions have posted to your account.

- Monthly fee: $12 monthly service fee.

- $0 Monthly Service Fee for students 17 to 24 years old at account opening, enrolled in college or a vocational, technical or trade school, up to the graduation date provided at account opening (five years maximum) or $12 Monthly Service Fee

- The Monthly Service Fee after expected graduation date is $12 or $0 when you do at least one of the following each statement period:

- Option #1: Have electronic deposits made into this account totaling $500 or more, such as payments from payroll providers or government benefit providers, by using (i) the ACH network, (ii) the Real Time Payment or FedNowSM network, or (iii) third party services that facilitate payment to your debit card using the Visa® or Mastercard® network; OR,

- Option #2: Keep an average ending day balance of $1,500 or more in your checking account.

(Expires 07/16/2025)

College students can experience great services with this Chase Bank offer. You will be able to manage your Chase College Checking account on campus, at home, or anywhere else.

*With Chase Overdraft AssistSM, we won’t charge an Overdraft Fee if you’re overdrawn by $50 or less at the end of the business day OR if you’re overdrawn by more than $50 and you bring your account balance to overdrawn by $50 or less at the end of the next business day (you have until 11 PM ET (8 PM PT) to make a deposit or transfer). Chase Overdraft Assist does not require enrollment and comes with eligible Chase checking accounts.

Chase High School Checking $100 Bonus Coupon

If you are a high school student, you can now open a Chase High School CheckingSM in-branch and qualify for a $100 bonus.

- What you’ll get: $100 bonus

- Eligible account: Chase High School CheckingSM

- Where it’s available: Nationwide

- How to earn it:

- The parent/guardian is the co-owner of the account and needs to have an eligible Chase checking account and be present at account opening. Account is subject to approval.

- Open the High School Checking account in branch with your 13-17 year old by 07/16/2025. To open the account, your teen will need to bring two acceptable forms of ID. You must be present at account opening. Account is subject to approval.

- Your teen needs to complete 5 qualifying transactions within 60 days of coupon enrollment. Qualifying transactions include:

- Debit card purchases

- Zelle®

- ACH Credits

- Chase QuickDepositSM

- Online bill payments

- Check your teen’s account for the $100 bonus. The bonus will appear in your teen’s account within 15 days of completing qualifying transactions.

- Monthly fee: $0

(Expires 07/16/2025)

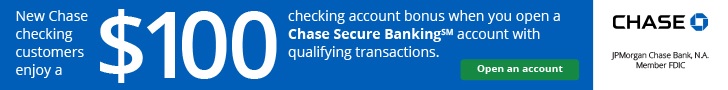

Chase Secure BankingSM $100 Bonus Coupon

Chase Secure BankingSM – New Chase checking customers can open a new Chase Secure BankingSM account online or enter your email address to get your coupon and bring it to a Chase branch to open an account to earn $100 bonus. Then complete 10 qualifying transactions within 60 days of coupon enrollment.

- What you’ll get: $100 bonus

- Eligible account: Chase Secure BankingSM

- Where it’s available: Nationwide online.

- How to earn it: New Chase checking customers enjoy a $100 checking account bonus when you open a Chase Secure BankingSM account with qualifying transactions. Open online or at any Chase branch.

- Monthly fee: $4.95 or $0; Avoid the monthly service fee when you have electronic deposits made into the account totaling $250 or more during each monthly statement period.

(Expires 07/16/2025)

J.P. Morgan Personal Advisors Summary

- Connect with a J.P. Morgan team member to schedule a free financial planning session. Call 833-930-4515 or fill out our contact form and we’ll be in touch.

- Work with a team of fiduciary advisors who will create a personalized financial plan, match you to expert built portfolios and provide ongoing advice via video or phone.

- Get matched to expert-built portfolios, and receive ongoing advice and annual check-ins to ensure your plan is on track.

- Our team of advisors act as fiduciaries so you can be confident that any advisor you work with has your best interest at heart.

- Manage all of your banking, investing and borrowing, and conveniently transfer money online and on the Chase Mobile® app.

- Once we understand your financial picture, risk tolerance and time horizon, we’ll recommend a professionally designed investment portfolio that meets your needs and automatically rebalances as the market shifts.

- Partner with an advisor to build a personalized financial plan based on what’s important to you—whether that’s paying off debt, opening a business or saving for a big purchase.

Chase Savings $200 Bonus

Chase SavingsSM– Open a new Chase SavingsSM account to earn a $200 bonus when you deposit a total of $15,000 or more in new money within 30 days of coupon enrollment, and maintain a $15,000 balance for 90 days. Chase SavingsSM, their most popular savings account, makes it easy to start saving with online banking and mobile banking tools.

- What you’ll get: $200 bonus

- Eligible account: Chase SavingsSM

- Where it’s available: Available online nationwide except in Alaska, Hawaii and Puerto Rico.

- How to earn it: Open a new Chase SavingsSM account and deposit $15,000 or more in new money within 30 days of coupon enrollment, and maintain a $15,000 balance for 90 days.

- Monthly fee: Avoid the $5 monthly fee when you do at least one of the following each statement period:

- Option 1: A balance at the beginning of each day of $300 or more in this account, OR

- Option 2: $25 or more in total Autosave or other repeating automatic transfers from your personal Chase checking account or Chase Liquid® Card (available only through chase.com or Chase Mobile®), OR

- Option 3: A Chase College CheckingSM account linked to this account for Overdraft Protection, OR

- Option 4: An account owner who is an individual younger than 18, OR

- Option 5: A linked Chase Better Banking® Checking, Chase Premier CheckingSM, Chase Premium Plus CheckingSM, Chase SapphireSM Checking, or Chase Private Client CheckingSM account

As a Chase Savings account holder, you’ll enjoy account alerts and automatic monthly transfers from checking to savings. You will also have online access to your accounts 24/7 and the ability to make transfers to your savings at any Chase ATM. Additionally, 24-hour customer support is just a phone call away.

(Expires 07/24/2023)

The information for the Chase SavingsSM account has been collected independently by HustlerMoneyBlog. The product details on this page have not been reviewed or provided by the bank.

Chase Bank Credit Card Promotions

Personal Chase Credit Cards

The Chase Sapphire Preferred® Card offers 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. You'll earn: • 5x on travel purchased through Chase TravelSM • 3x on dining, select streaming services and online groceries • 2x on all other travel purchases • 1x on all other purchases • $50 Annual Chase Travel Hotel Credit • Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027. Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase TravelSM This card carries a $95 annual fee. |

The Chase Sapphire Reserve offers 100,000 points + $500 Chase Travel promo credit after you spend $5,000 in purchases in the first 3 months from account opening. You'll earn • 8x points on all purchases through Chase Travel, including The Edit • 4x points on flights?booked direct • 4x points on hotels?booked direct • 3x points on dining worldwide • 1x points on all other purchases This card does carry a $795 annual fee and there are no foreign transaction fees. However, you're able to earn a $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year & up to $120 application fee credit for Global Entry or TSA Pre?®, and more annual value from perks and benefits. Member FDIC |

The Chase Freedom FlexSM offers a $200 bonus after spending $500 on purchases in your first 3 months from account opening. 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR. You'll earn: • Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter! • 5% cash back on travel purchased through Chase Travel?, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more • 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service • Unlimited 1% cash back on all other purchases You cash back rewards do not expire as long as your account is open and there is no minimum to redeem for cash back. This card has no annual fee. |

The Chase Freedom Unlimited® Card offers a $200 bonus after spending $500 on purchases in your first 3 months from account opening. Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers. In addition, you can earn: • 6.5% cash back on travel purchased through Chase TravelSM, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more • 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service • 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase TravelSM, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases. There is no minimum to redeem for cash back & your cash back rewards do not expire as long as your account is open. This card comes with no annual fee and you'll get a free credit score that is updated weekly with Credit JourneySM. Member FDIC |

The Chase Slate Edge Card offers 0% Intro APR for 18 months from account opening on purchases and balance transfers. You'll be able to lower your interest rate by 2% each year and automatically be considered for an APR reduction when you pay on time, and spend at least $1000 on your card by your next account anniversary. On top of that, you can raise your credit limit. Get an automatic, one-time review for a higher credit limit when you pay on time, and spend $500 in your first six months. Keep tabs on your credit health - Chase Credit Journey helps you monitor your credit with free access to your latest score, real-time alerts, and more. This card comes with no annual fee. Member FDIC |

The Southwest Rapid Rewards® Plus Credit Card offers 50,000 bonus points after you spend $1,000 on purchases in the first 3 months from account opening. You'll also earn 3,000 bonus points after your Cardmember anniversary each year. You'll earn: • Earn 2X points on Southwest® purchases. • Earn 2X points on local transit and commuting, including rideshare. • Earn 2X points on internet, cable, phone services, and select streaming. You're able to redeem your your points for flights, hotel stays, gift cards, access to events & more! This card does carry a $69 annual fee. |

The Southwest Rapid Rewards® Premier Credit Card offers 50,000 bonus points after you spend $1,000 on purchases in the first 3 months from account opening. In addition, you'll earn 6,000 bonus points after your Cardmember anniversary each year. You'll earn: • Earn 3X points on Southwest purchases. • Earn 2X points on local transit and commuting, including rideshare. • Earn 2X points on internet, cable, phone services, and select streaming. You're able to redeem your points for flights, hotel stays, gift cards, access to events and more. This card does carry a $99 annual fee, but there are no foreign transaction fee. |

The United Explorer Card offers 60,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open. You'll earn: • 2x miles on United® purchases, dining, and hotel stays. • 1x mile on all other purchases Perks of this card include: • Enjoy priority boarding privileges and visit the United Club with 2 one-time passes each year for your anniversary • Free first checked bag - a savings of up to $160 per roundtrip. Terms Apply. • Up to $120 Global Entry, TSA PreCheck or NEXUS fee credit • 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Explorer Card There is a $0 introductory annual fee for the first year, then $95. Member FDIC |

The United GatewaySM Card offers 30,000 bonus miles after you spend $1,000 on purchases in the first 3 months your account is open. With this card, you'll earn: • 2x miles on United® purchases, at gas stations, and on local transit and commuting. • 1x mile on all other purchases. This card comes with no annual fee. |

The IHG One Rewards Traveler Credit Card offers 80,000 Bonus Points after spending $2,000 on purchases within the first 3 months of account opening. You'll earn: • Up to 17 total points per $1 spent when you stay at IHG Hotels & Resorts • 3 points per $1 spent on purchases on monthly bills, at gas stations, and restaurants. • 2 points per $1 spent on all other purchases This card has no annual fee or foreign transaction fees. Member FDIC |

The Southwest Rapid Rewards® Priority Credit Card offers 50,000 bonus points after you spend $1,000 on purchases in the first 3 months from account opening. In addition, you'll earn 7,500 bonus points after your Cardmember anniversary each year. You'll earn: • Earn 3X points on Southwest® purchases. • Earn 2X points on local transit and commuting, including rideshare. • Earn 2X points on internet, cable, phone services, and select streaming. Some perks include $75 Southwest travel credit each year., receiving 4 Upgraded Boardings per year when available, savings of 25% back on in-flight drinks and WiFi, and more! This card carries a $149 annual fee and no foreign transaction fees. |

The British Airways Visa Signature® Card offers 75,000 Avios after you spend $5,000 on purchases within the first three months of account opening. You'll earn: • 3 Avios per $1 spent on purchases with British Airways, Aer Lingus, Iberia, and LEVEL. • 2 Avios per $1 spent on hotel accommodations when purchased directly with the hotel. • 1 Avios per $1 spent on all other purchases. This card comes with a $95 annual fee and no foreign transaction fees. You'll be able to get 10% off British Airways flights starting in the US when you book through the website provided in your welcome materials. In addition, every calendar year you make $30,000 in purchases on your British Airways Visa card, you'll earn a Travel Together Ticket good for two years. |

The Marriott Bonvoy Boundless® Credit Card offers 5 Free Nights (each night valued up to 50,000 points) after spending $5,000 on eligible purchases within 3 months of account opening. You'll earn: • Up to 17X total points per $1 spent at over 7,000 hotels participating in Marriott Bonvoy • 3X points per $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. • 2X points for every $1 spent on all other purchase • 1 Elite Night Credit towards Elite Status for every $5,000 you spend. You gain an automatic Silver Elite Status each account anniversary year. Path to Gold Status when you spend $35,000 on purchases each account year. You'll receive 15 Elite Night Credits each calendar year & an additional Free Night Award (valued up to 35,000 points) every year after account anniversary. This card does carry a $95 fee; there are no foreign transaction fees. |

Business Credit Cards

The Ink Business Unlimited® Credit Card offers $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. You'll earn an unlimited 1.5% cash back on every purchase made for your business and you'll receive employee cards at no additional cost. This card carries no annual fee. |

The Ink Business Cash® Credit Card offers $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening. You'll earn: • 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year • 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year • 1% cash back on all other card purchases with no limit to the amount you can earn. This card comes with no annual fee. You'll be able to take advantage of employee cards at no additional cost. |

The Ink Business Preferred® Credit Card offers 90,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $900 cash back or $1,125 toward travel when redeemed through Chase TravelSM. You'll earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year; 1 point per $1 on all other purchases - with no limit to the amount you can earn. Furthermore, points are worth 25% more when you redeem for travel through Chase TravelSM. This card does come with a $95 annual fee but does not have any foreign transaction fees. |

The Southwest® Rapid Rewards® Premier Business Credit Card offers 60,000 points after you spend $3,000 on purchases in the first 3 months from account opening. You'll earn • Earn 3X points on Southwest Airlines purchases. • Earn 2X points on Rapid Rewards hotel and car partners. • Earn 2X points on rideshare. • 1 point per $1 spent on all other purchases. This card does carry a $99 annual fee and there are no foreign transaction fees. Member FDIC |

The Southwest® Rapid Rewards® Performance Business Credit Card offers 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening. This card earns • Earn 4X points on Southwest purchases. • Earn 3X points on Rapid Rewards hotel and car partners. • Earn 2X points on rideshare. • Earn 2X points on social media and search engine advertising, internet, cable, and phone services and 1X points on all other purchases. In addition, you can score 9,000 bonus points after your Cardmember anniversary, get 4 upgraded boarding passes per year, and more! Member FDIC |

The United? Business Card offers 75,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open. You can also receive 5,000-mile better-together anniversary bonus when you have the United Business Card and a personal United credit card. You'll earn: • 2x miles on United® purchases, dining including eligible delivery services, at gas stations, office supply stores, and on local transit and commuting. • 1x mile on all other purchases. The card does carry a $99 annual fee ($0 intro annual fee for the first year, then $99). You're able to save up to $160 per round-trip with a free checked bag (terms apply). In addition, you can enjoy priority boarding privileges and have the opportunity for two one-time United ClubSM passes each year — Over $100 in value per year. Also, enjoy $100 annual United travel credit after 7 United flight purchases of $100 or more. Member FDIC |

Chase Bank $500 Referral Promotions

Chase Referral – Earn up to $500 in referral bonuses when you tell your friends and family to open a new Total Checking or Chase Savings at Chase. All you have to do is find your personal referral form via the Chase homepage or after logging out of your Chase online account. So tell your friends and family about all the great Chase bank promotions on this page.

You are able to make up to 10 referrals which will let you earn up to a $500 bonus and as for the new customer, they are able to earn up to $350 bonus! If you are interested in what Chase has to offer, then check this promotion out and share it with your friends and family.

Bottom Line

Chase Bank bonuses & promotions are available across the country, so find a checking account would fit your needs. As long as you you can meeting the bonus requirements, I recommend to apply online to earn your cash reward.

Feel free to visit our list of the Best Bank Promotions today!

Bookmark this page and come back to see all the latest Chase Bank promotions, bonuses, and offers.

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, airlines or hotel chain.

how do i open $2000 bonus checking account

It good services

GOOD SERVICES

Hello,

I’m a newbie to this so sorry if my question sounds not interesting for a lot of you. I’ve just opened a Chase checking account online, using the bonus link. Now the account is set up, I need to know how to set a direct deposit with BlueBird and Chase. I went to Chase’s link ‘set up a direct deposit” in my account but the form seems to be only for direct deposit with paychecks. How do you set up a direct deposit with BlueBird for Chase? What is the best approach? Thank you in advance. I’d appreciate if someone could show me the steps.

How do I get the $200.00 bonus for business gel in account ?? I did not receive that offer via email

I opened a personal checking and now want to open a business checking. Are there any $500 coupons for opening a business account with Chase available? Thanks.

Hey Jo, you can only apply the Premier Checking online:

https://www.hustlermoneyblog.com/Chase-Premier-Plus-Checking-L

Anthony, I tried all links you have on chase bonus checking, they all said have to apply in person at the bank. You have any direct link that I can apply online as your article stated above? Thx for your time.