Find the latest Hancock Whitney Bank promotions, bonuses, and offers here!

Update 5/15/25: There’s currently a $200 personal checking bonus available through 6/30/25.

About Hancock Whitney Bank Promotions

With almost 200 locations in LA, MS, FL, AL, and TX, Hancock Whitney Bank provides a variety of services and features in all aspects of banking to make sure your financial needs are taken care of!

I will review the Hancock Whitney Bank Promotions below.

Hancock Whitney Bank $200 Checking Bonus

- What you’ll get: $200 bonus

- Account Type: FreeStyle Personal Checking Account

- Availability: AL, FL, LA, MS, TX (Bank Locator)

- Direct Deposit Requirement: Yes, $300+ (see what works)

- Credit Inquiry: Soft Pull

- ChexSystems: No

- Credit Card Funding: None

- Monthly Fee: $10, waivable

- Household Limit: One

- Closing Account Fee: $20, if closed within 180 days, then bonus is forfeit.

(Expires 06/30/2025)

Editor’s Note: You can waive the $10 monthly service fee by making at least one client-initiated debit or credit transaction per month or including scheduled, automated payments, like your cellphone bill.

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | |

How to Earn Bonus

- Complete the form and they’ll send you your promo code to your email address.

- Open your account online or at one of our local Financial Centers.

- Set up and receive qualifying monthly direct deposits totaling at least $300 each month by 8/31/2025.

- If you meet the qualifying activities you’ll receive your $200 checking bonus by 10/31/2025. Your account will need to stay open and active through 10/31/2025 to receive your bonus.

- Your promo code must be included when your account is opened and your email has to be the same one you included on the form.

- Important details and required qualifying activities for the $200 Freestyle Checking offer: Use the promo code referenced above when opening your new checking account with money not currently on deposit at Hancock Whitney Bank by the offer expiration date of 3/31/2025. Set up and receive qualifying direct deposits totaling at least $300 each month by 5/31/2025. Your account and direct deposits must remain open and active during the entire promotional period which includes up to when the bonus is paid by 7/31/2025. If you meet all requirements, we will deposit the earned bonus into your new personal checking account by 7/31/2025.

- Promotion requirements for the Freestyle Checking offer: The email given at account opening must match the email address submitted to get the offer promo code and the promo code is required to be included in the account opening. All account applications are subject to approval.

- A qualifying direct deposit is a recurring electronic deposit, including a salary, pension, Social Security, other government benefit or other recurring, monthly income amount, made by your employer or outside agency. Account transfers, mobile deposits, payments from Zelle, PayPal, Cash App or other similar providers, tax refunds or deposit made at a branch or ATM are not qualifying direct deposits.

- The Bank may change or discontinue the offer at any time and without notice. This offer is non-transferable and cannot be combined with other offers. Only the person to whom this offer is addressed is eligible for this offer. Limit of one consumer checking-related bonus per household every 2 calendar years. Bonuses may be considered interest and may be reported on IRS Form 1099.

Hancock Whitney Bank $200 Business Checking Bonus (Expired)

- What you’ll get: $200 bonus

- Account Type: Business Checking Account

- Availability: AL, FL, LA, MS, TX (Bank Locator)

- Direct Deposit Requirement: No

- Credit Inquiry: Soft Pull

- ChexSystems: No

- Credit Card Funding: None

- Monthly Fee: $0 – $25, waivable

- Household Limit: None listed

- Closing Account Fee: Account must be opened for 180 days, or bonus will be deducted.

(Expires 03/31/2025)

| Chase Business Checking ($300 or $500 Bonus) | Bank of America Business Checking ($200 bonus offer) |

| Axos Business Premium Savings ($375 Bonus) | Axos Bank Basic Business Checking ($400 Bonus) |

| Axos Bank Business Interest Checking ($400 Bonus) | Huntington Unlimited Plus Business Checking ($1,000 Bonus) |

| Huntington Unlimited Business Checking ($400 Bonus) | Bluevine Business Checking ($300 Bonus) |

| U.S. Bank Business Checking ( $500 or $900 Bonus) | |

How to Earn Bonus

- Open a Preferred Business Checking, Interest Business Checking or Essential Business Checking account with promo code.

- Account must be opened by 3/31/2025 and remain active through 5/31/2025.

- The following criteria must be met by 5/31/2025: enroll in Business Online Banking, then make $2,500 or more in total qualifying deposits.

- Note: A promo code is required at account opening to qualify for this offer. In addition, the email address provided at account opening must match the email address you provide to receive your promo code.

- Checking Promotion Requirement: Use the promo code referenced above when opening a Preferred Business Checking, Interest Business Checking or Essential Business Checking account with new money not currently held by Hancock Whitney Bank. Account must be opened by 3/31/2025 and remain active through 5/31/2025.

- The promo code is required at account opening.

- The following criteria must be met by 5/31/2025: enroll in Business Online Banking, then make $2,500 or more in total qualifying deposits.

- If you meet all requirements, we will deposit the earned bonus into your new Business Checking account by 7/31/2025.

- Bonuses may be considered interest and may be reported on IRS form 1099.

- Qualifying deposits do not include transfers from any existing Hancock Whitney Bank accounts.

- Minimum opening deposit of $50 is required.

- Monthly service charges range from $0 to $25, depending on product.

- A $20 service charge will be assessed if the account is closed within the first 360 days after the account is opened.

- Transaction limits may apply.

- Please refer to a banker and the Business Services Information Disclosure Schedule of Fees for other applicable fees and information.

- Limit of one new business checking offer redemption per business and/or address per 2 calendar years.

- Offer not available to former or existing Hancock Whitney Bank clients.

- New clients only. If your account is closed within 180 days after opening, we reserve the right to deduct the bonus amount from your account’s closing balance.

- The Bank may change or discontinue the offer at any time and without notice.

- This offer is nontransferable and cannot be combined with other offers.

- The email given at account opening must match the email address submitted to get the offer promo code.

Hancock Whitney Bank $300 Checking Bonus (Expired)

- What you’ll get: $300 bonus

- Account Type: Checking Account

- Availability: AL, FL, LA, MS, TX (Bank Locator)

- Direct Deposit Requirement: Yes, $300+ (see what works)

- Credit Inquiry: Soft Pull

- ChexSystems: No

- Credit Card Funding: None

- Monthly Fee: $12 or $20, waivable

- Household Limit: One personal checking bonus per household every 2 calendar years.

- Closing Account Fee: $20, if closed within 180 days, then bonus is forfeit.

(Expires 12/31/2024)

Editor’s Note: If you open the Priority Checking for the $300 bonus which has a $20 monthly fee. To waive the monthly fee, you must have a minimum daily collected balance of $5,000 or more; or $7,500 in combined deposits (excluding CDs and IRAs) or consumer loans (excluding mortgages) or credit card balances.

It may be better to open the $200 bonus with the Freestyle checking in order to waive the monthly fee more easily.

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How to Earn Bonus

- Complete the form and they’ll send you your promo code to your email address.

- Open your account online or at one of our local financial centers by 12/31/2024.

- Set up and receive qualifying monthly direct deposits by 2/28/2025.

- If you meet the qualifying activities you’ll receive your checking bonus of up to $300 by 4/30/2025. Your account will need to stay open and active to receive your bonus.

- Important details and required qualifying activities for the Up to $300 Any Checking offer:

- Use the promo code referenced above when opening your new checking account with money not currently on deposit at Hancock Whitney Bank by the offer expiration date of 12/31/2024. You must set up and receive qualifying direct deposits by 2/28/2025.

- For Freestyle Checking you must set up and receive qualifying direct deposits totaling at least $300 each month; for Priority Checking you must set up and receive qualifying direct deposits totaling at least $1,000 each month; and for Assure Checking you must set up and receive qualifying direct deposits totaling at least $50 each month.

- Your account and direct deposits must remain open and active during the entire promotional period which includes up to when the bonus is paid by 4/30/2025. If you meet all requirements, we will deposit the earned bonus into your new personal checking account by 4/30/2025. The earned bonus for Freestyle Checking is $200, for Priority Checking it is $300 and for Assure Checking it is $50.

- Promotion Requirements for the Any Checking Up to $300 offer: The email given at account opening must match the email address submitted to get the offer promo code and the promo code is required to be included in the account opening. All account applications are subject to approval.

- A qualifying direct deposit is a recurring electronic deposit, including a salary, pension, social security, other government benefit or other recurring, monthly income amount, made by your employer or outside agency. Transfers from one account to another do not qualify. Qualifying direct deposit does not include payments received from apps such as PayPal or Cash App, and other similar payment providers. Tax refunds and Stimulus Checks are not qualifying direct deposits. Deposits made at a financial center, via ATM, online transfer, mobile device, debit card/prepaid card number or the mail do not qualify.

- The Bank may change or discontinue the offer at any time and without notice. This offer is non-transferable and cannot be combined with other offers. Only the person to whom this offer is addressed is eligible for this offer. Limit of one consumer checking-related bonus per household every 2 calendar years. Bonuses may be considered interest and may be reported on IRS Form 1099.

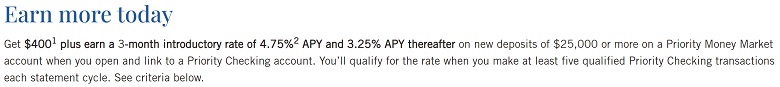

Hancock Whitney Bank $400 Checking & Money Market Bonus *Expired*

- What you’ll get: $400 bonus

- Account Type: Checking Account

- Availability: AL, FL, LA, MS, TX (Bank Locator)

- Direct Deposit Requirement: Yes, $1000+ (see what works)

- Credit Inquiry: Soft Pull

- ChexSystems: No

- Credit Card Funding: None

- Monthly Fee: $21 checking; $25 money market, waivable

- Household Limit: One

- Closing Account Fee: $20, 180 days

(Expires 09/30/2023)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How to Earn Bonus

- Open a Priority Checking account and get $400.

- Enter your email address on the form, and we’ll send you a promo code.

- Use your promo code to apply online or bring the promo code to your nearest financial center by September 30, 2023.

- The following criteria must be met by 11/30/2023: Set up and receive a qualifying monthly direct deposits totaling at least $1,000.

- Then, call your nearest financial center for an appointment to open your Priority Money Market account.

- Checking Promotion Requirements: Use the promo code referenced above when opening a new Priority Checking account with money not currently on deposit at Hancock Whitney Bank by the offer expiration date of 9/30/2023.

- The promo code is required at account opening.

- The following criteria must be met by 11/30/2023: Set up and receive a qualifying monthly direct deposits totaling at least $1,000.

- A qualifying direct deposit is a recurring electronic deposit, including a salary, pension, social security, other government benefit or other recurring, monthly income amount made by your employer or outside agency.

- Transfers from one account to another do not qualify.

- Qualifying direct deposits do not include payments received from apps such as PayPal or Cash App, and other similar payment providers.

- Tax refunds and Stimulus Checks are not qualifying direct deposits.

- Deposits made at a financial center, via ATM, online transfer, mobile device, debit card/prepaid card number or the mail do not qualify.

- The bank may change or discontinue the offer at any time and without notice.

- This offer is non-transferable and cannot be combined with other offers.

- Only the person to whom this offer is addressed is eligible for this offer.

- Limit of one consumer checking related bonus per household per calendar year.

How To Waive Monthly Fees

- Access Checking: $10, $250 minimum balance to waive fees.

- Connect Checking: $12, $1,500 minimum balance to waive fees.

- Priority Checking: $21, $10,000 minimum balance to waive fees.

- Essential Business Checking: None

- Preferred Business Checking: $18 monthly service charge waived with any of the following: $5,000 min. daily balance, Combined balances of loans and deposits of $25,000, $2,000 in monthly business credit card transactions, Active Merchant Services Account

- Interest Business Checking: $25 monthly service charge waived with any of the following: $25,000 min. daily balance, Combined balances of loans and deposits of $50,000

- Priority Money Market Account: The monthly service charge of $25 can be waived if you maintain a minimum daily balance of $25,000 or more.

|

|

Bottom Line

Hancock Whitney Bank is now offering attractive bonuses! If you live in the area definitely take advantage of these fantastic promotions, all three trigger soft pulls and provide extensive banking expertise. Therefore I would highly recommend this deal since it will not affect your credit score!

Additionally, let us know how your experience went, as your feedbacks make our sites better!

Hancock Whitney Bank can offer you fantastic resources to better your banking experience, however, they do not provide very competitive Savings and CD rates. Take advantage of our full list of Bank Rates and CD Rates to get the best deal for you!

Compare Hancock Whitney Bank Promotions with other bank bonuses from banks like Citi, Huntington, HSBC, Chase, TD, Discover Bank, Aspiration, Axos Bank, PNC Bank, BMO, SoFi, Fifth Third Bank, Bank of America, Wells Fargo, US Bank, and more!

*Check back at this page for more Hancock Whitney Bank promotions, bonuses, and offers.

Hancock Whitney Bank $300.00 promotional code to open Freestyle checking account. Me – too lazy to drive a couple of hours along the Gulf 🙂

Hancock Whitney Bank $300.00 promotional code to open checking account

This a really great deal

Don’t be a greedy troll, that behavior is both obnoxious and shows the kind of integrity you have. This is why banks are beginning to terminate account relationships because of people like this who continue to game this system, smh!

In my experience, this institution fails to honor their promotions and cannot understand their own fine print. Use caution interacting with them.

Don’t be greedy.

I got a bonus from this bank early this year, then recently closed it. If I open another account during the last week of this year, and make several debit cad purchase in January, could I get another bonus in early 2018?