Find all the latest Hometown Bank (bankHometown) promotions, bonuses, and offers here.

Currently, Hometown Bank has many checking offers where you can earn a $100, $200, or $300 bonus.

About Hometown Bank (bankHometown) Promotions

Since 1889, Hometown Bank has been providing banking services to residents of Central Massachusetts and Northeast Connecticut.

I’ll review the HomeStreet Bank Promotions below.

Hometown Bank $300 Checking Bonus

- What you’ll get: $300 bonus

- Account Type: Checking Account

- Availability: CT, MA, RI, NH (Bank Locator)

- Direct Deposit Requirement: Yes, optional (see what works)

- Credit Inquiry: Unknown

- ChexSystems: Unknown

- Credit Card Funding: None

- Monthly Fees: None

- Early Account Termination Fee: $10 fee if closed within 180 days

- Household Limit: One

(Limited time offer)

Editor’s Note: Here’s a $300 Grand Opening bonus at their Worcester location.

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | HSBC Premier Checking (Up to $3,000 Cash Bonus), |

How To Earn Bonus

- $200 promotional offer is for opening a personal checking account and activating direct deposit (of at least $25) or signing up for online banking and conducting 5 debit card transactions using your debit card within the first 60 days of account opening

- $50 promotional offer is for making 5 bill payments using online banking and enrolling in eStatements within 60 days of account opening

- $50 loyalty bonus will be paid after the account has been open for 12 months

- $200.00 promotional offer is for opening a personal checking account and activating direct deposit (of at least $25.00) or signing up for online banking and conducting 5 debit card transactions using your debit card within the first 60 days of account opening ($100.00 will be credited to the account by the last day of the statement cycle following the 60th day the account has been open).

- $50.00 promotional offer is for making 5 bill payments using online banking and enrolling in eStatements within 60 days of account opening ($50.00 will be credited to the account by the last day of the statement cycle following the 60th day the account has been open).

- $50.00 loyalty bonus will be paid after the account has been open for 12 months ($50.00 will be credited to the account by the last day of the statement cycle following the 365th day the account has been open).

- $10 minimum to open Get Real Checking or Basic Checking accounts. $100 minimum to open Premier Checking account.

- Bonuses for new checking account customers and limited to one account per customer.

- In accordance with applicable regulations bonus payouts may be 1099 reportable.

- Account must be in good standing and have a positive balance at the time the bonus is paid.

- May not be combined with other promotional offers. This is a limited time offer and subject to change without notice.

Hometown Bank $200 Checking Bonus

Earn a $200 bonus at Hometown Bank.

Hometown Bank is offering a $200 bonus when you meet all the requirements below.

- What you’ll get: $200 bonus

- Account Type: Checking Account

- Availability: CT, MA (Bank Locator)

- Direct Deposit Requirement: Yes, optional (see what works)

- Credit Inquiry: Unknown

- ChexSystems: Unknown

- Credit Card Funding: None

- Monthly Fees: None

- Early Account Termination Fee: $10, 180 days

- Household Limit: One

(Limited time offer)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- Open a personal checking account from Hometown Bank. and activate direct deposit of at least $25 or sign up for online banking and conducting 5 debit card transactions using your debit card within the first 60 days of account opening.

- $100.00 will be credited to the account by the last day of the statement cycle following the 60th day the account has been open

- Make 5 bill payments using online banking and enrolling in eStatements within 60 days of account opening

- $50.00 will be credited to the account by the last day of the statement cycle following the 60th day the account has been open

- $50.00 loyalty bonus will be paid after the account has been open for 12 months.

- Fees could reduce earnings on accounts.

- Rates offered are subject to change without notice.

- $10 minimum to open Get Real Checking or Basic Checking accounts.

- $100 minimum to open Premier Checking account.

- Bonuses for new checking account customers and limited to one account per customer.

- In accordance with applicable regulations bonus payouts may be 1099 reportable.

- Account must be in good standing and have a positive balance at the time the bonus is paid.

- May not be combined with other promotional offers.

- This is a limited time offer and subject to change without notice.

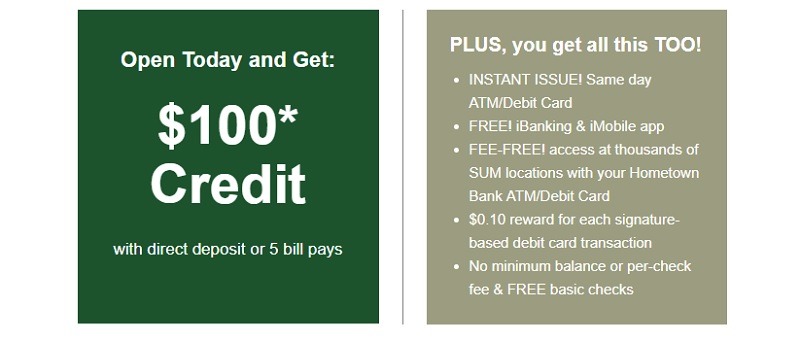

Hometown Bank $100 Checking Bonus

Earn a $100 bonus at Hometown Bank.

Hometown Bank is offering a $100 bonus when you meet all the requirements below.

- What you’ll get: $100 bonus

- Account Type: Checking Account

- Availability: CT, MA

- Direct Deposit Requirement: Yes, optional (see what works)

- Credit Inquiry: Unknown

- ChexSystems: Unknown

- Credit Card Funding: None

- Monthly Fees: None

- Early Account Termination Fee: $10, 180 days

- Household Limit: One

(Limited time offer)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- Open a personal checking account from Hometown Bank. and activate direct deposit of at least $25 or sign up for online banking and conducting 5 debit card transactions using your debit card within the first 60 days of account opening.

- $100.00 will be credited to the account by the last day of the statement cycle following the 60th day the account has been open

- $100 Promotional offer is for new checking account customers only for (a) activating direct deposit within 60 days of account opening ($100.00 will be credited to the account after a minimum first direct deposit of $25.00 is made) or (b) making 5 bill payments using Hometown ePay within 60 days of account opening ($100.00 will be credited to the account after the fifth bill payment posts to the account).

- Bonuses are reportable for tax purposes.

- The Annual Percentage Yield (APY) of .02% is accurate as of April 18, 2016.

- Minimum balance to obtain the APY is $10.00.

- Minimum balance required to obtain promotional offer is $10.00.

- This is a variable rate account and the rate may change after account opening.

- May not be combined with other promotional offers. This is a limited time offer subject to change at any time without notice.

Hometown Bank $100 Business Referral Bonus

Hometown Bank $100 Business Referral Bonus

Hometown Bank is offering a $100 Business Referral Bonus when you meet all the requirements below.

- What you’ll get: $100 bonus

- Account Type: Business Checking Account

- Availability: CT, MA

- Direct Deposit Requirement: No

- Credit Inquiry: Unknown

- ChexSystems: Unknown

- Credit Card Funding: None

- Monthly Fees: None

- Early Account Termination Fee: $10, 180 days

- Household Limit: None

(No expiration date listed)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | HSBC Premier Checking (Up to $3,000 Cash Bonus), |

How To Earn Bonus

- Download and print out the referral card or obtain them from your local branch.

- Write your name on this handout and give it to the business you are referring.

- When a new business checking account is opened with your referral handout, you’ll receive $100.

- $100 will be credited to your business account after the business you refer opens a new bankHometown business checking account and provides your business name at account opening.

- The business you refer must be a new bankHometown business checking customer.

- $100 will be paid into your business account by the last day of the statement cycle following the 60th day the account was opened.

- By participating, each business may be aware that the other is a customer of bankHometown.

- The referring person must have a business checking account at bankHometown and be authorized to

transact on behalf of the referring business. - This is a limited time offer and subject to change anytime without notice.

- In accordance with applicable regulations, bonus payouts may be 1099 reportable.

Hometown Bank $50 Referral Bonus *Expired*

Hometown Bank is offering a $50 Referral Bonus when you meet all the requirements below.

- What you’ll get: $50 bonus

- Account Type: Checking Account

- Availability: CT, MA

- Direct Deposit Requirement: No

- Credit Inquiry: Unknown

- ChexSystems: Unknown

- Credit Card Funding: None

- Monthly Fees: None

- Early Account Termination Fee: $10, 180 days

- Household Limit: None

(No expiration date listed)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- Download and print our Refer-A-Friend card or obtain them from your local branch.

- Write your name on the cards and give them to your friends and family.

- When your friends and family open a new checking account with your referral card and one of the following: Online Banking and a bankHometown Debit Card or Direct Deposit with a bankHometown Debit Card

- You will receive $50.

- $50.00 will be credited to your account after someone you refer opens a bankHometown Personal Checking account and provides your name at account opening.

- The person you refer must be a new bankHometown checking customer and open the account with a Direct Deposit (of at least $25) or sign up for Online Banking and conduct 5 debit card transactions using the debit card in the first 60 days of account opening.

- If achieved, the $50 will be paid into your account by the last day of the statement cycle following the 60th day the account was opened.

- By participating, each party may be aware that the other is a customer of bankHometown.

- The referring person must have a checking account at bankHometown.

- This is a limited time offer and subject to change anytime without notice.

- In accordance with applicable regulations, bonus payouts may be 1099 reportable.

How To Waive Monthly Fees

- Premier Checking: None

- Basic Checking: None

- Basic Business Checking: None

- Premier Business Checking: None

|

|

Bottom Line

Of the two Hometown Bank promotions, the $200 bonus if the more worthwhile. When switching over to this new account you can essentially be getting paid for responsibilities you already had to do as compared to the $100 bonus. Best part of this is that you can earn this bonus without a direct deposit.

If you have experience banking with Hometown Bank please leave a comment below letting us know how it was. When you give us feedback, you help make this site better for other readers.

Hometown Bank offers are exclusively Checking Accounts but we still recommend you compare their Savings and CD rates to those out our full list of Bank Rates and CD Rates.

*Compare Hometown Bank Promotions with other bank bonuses from banks like Citi, Huntington, HSBC, Chase, TD, Discover Bank, Aspiration, Axos Bank, PNC Bank, BMO Harris, SoFi, Fifth Third Bank, Bank of America, Wells Fargo, US Bank, and more!*

*Check back at this page for updated Hometown Bank promotions, bonuses and offers.